Apple is stepping deeper into the enterprise AI race with a new set of tools designed to give businesses more control over how their employees use artificial intelligence.

With software updates scheduled for release in September, Apple is introducing a key option for IT administrators: the ability to configure access to an enterprise version of OpenAI’s ChatGPT.

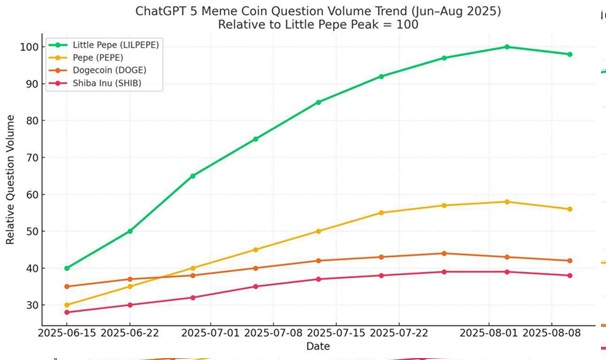

The timing is notable because ChatGPT for Enterprise, launched by OpenAI in 2023, has quickly grown to over 5 million business customers, according to the company. Corporations utilize the service to connect with internal datasets and deploy AI agents for customer support, workflow automation, and research purposes. That growth has signaled the mainstreaming of generative AI in the workplace — a development Apple is now aligning itself with.

But Apple’s move is not limited to OpenAI. Support documents show that administrators will be able to restrict or allow any “external” AI provider, not just ChatGPT. This framework keeps Apple flexible in a fast-moving sector, leaving the door open to future enterprise partnerships with other major AI players such as Anthropic, Cohere, or Google DeepMind without needing to re-engineer the system at its core.

The new integration builds on Apple’s dual strategy of promoting its own Apple Intelligence features for end users — such as writing tools, email drafting, and image understanding — while ensuring IT departments retain granular control. Apple’s Private Cloud Compute architecture underscores its promise of security and on-device processing, but the company acknowledges that many enterprises will prefer to make their own decisions on data handling. That’s why Apple is allowing organizations to decide whether employee AI requests should be processed locally or sent to cloud-based services like ChatGPT.

This flexibility also explains how Apple has positioned its ChatGPT integration across iOS, macOS, and iPadOS. Requests are routed either through Apple’s own servers or ChatGPT, but never both. This makes it simpler for businesses to enable or disable ChatGPT without affecting Apple’s core intelligence features — even if the business has no direct contract with OpenAI.

Beyond AI, Apple is layering in new enterprise features. An API for Apple Business Manager will allow the service’s capabilities — like provisioning, inventory tracking, and security enforcement — to integrate directly with third-party IT tools such as mobile device management (MDM) systems and help desk software. A streamlined device migration process is being introduced for organizations undergoing mergers and acquisitions, a common pain point for IT leaders.

Apple is also enhancing its Return to Service tool, which helps reset corporate devices for redeployment. The update will allow apps to remain installed after a reset, reducing downtime and bandwidth usage. For the first time, this service will also extend to Apple’s Vision Pro headset, signaling that the company wants its spatial computing device to play a role in corporate workflows.

Security and identity management are also being reinforced. On shared Macs, authenticated Guest Mode will let employees sign in with credentials from an identity provider, with all personal data wiped on logout. Businesses will also be able to add NFC readers to Macs, enabling employees to log in simply by tapping an Apple Watch or iPhone.

These features come at a moment when AI infrastructure is becoming the next big battleground in tech. Cloud providers, chipmakers, and AI labs are spending heavily to build the backbone for generative AI. OpenAI, for instance, is investing billions — backed by Microsoft — to expand supercomputing capacity and data centers that power its enterprise-grade models. Analysts describe such spending as a bet on AI’s permanence in enterprise operations, where generative tools are expected to become as standard as email or spreadsheets.

Apple’s approach is to sit at the intersection of this shift: integrating best-in-class external AI while strengthening its own device and software ecosystem to ensure enterprise customers can adopt AI on their own terms.