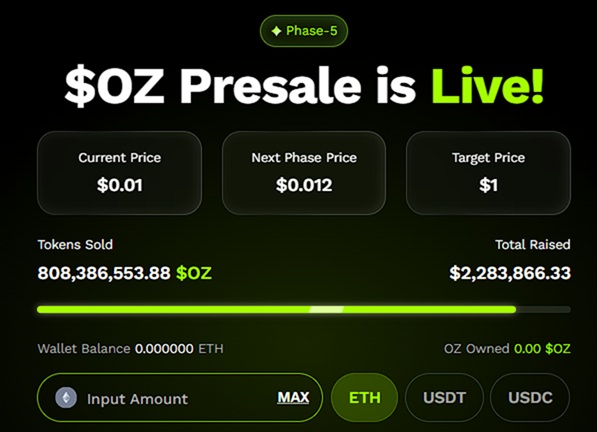

Ozak AI is swiftly gaining a reputation as one of the most promising AI-powered cryptocurrency projects in 2025. With the continued fifth presale level, the mission has effectively raised over $2.28 million and bought more than 800 million $OZ tokens, demonstrating strong network guidance and investor self-assurance.

Completing each Certik and internal audit and listing on CoinGecko and CoinMarketCap, Ozak AI has solidified its credibility, positioning itself as a contender capable of tough pinnacle altcoins, which include Ethereum ($4,344), Solana ($185), Cardano ($0.85), and XRP ($2.81).

Ozak AI Presale Momentum Highlights Growth Potential

The ongoing 5th presale has proven extraordinary investor interest, with investors taking benefit of a low access point. Raising over $2.28 million at this level displays sturdy confidence in Ozak AI’s potential, mainly because the wider crypto marketplace enjoys a $4 trillion bull run. Early adoption and presale momentum frequently predict future overall market performance, making Ozak AI a high-upside opportunity for buyers in search of exponential growth.

Comparing Ozak AI With Top Altcoins

While installed cryptocurrencies like Bitcoin ($113,045.72), Ethereum ($4,344), and Solana ($185) provide market balance and liquidity, their increase capability is constrained through excessive circulating components and market saturation. XRP ($2.81) and Cardano ($0.85) also face limitations because of adoption charges and demanding scalability situations.

Ozak AI, priced at $0.01 per token, gives early buyers the capability for 100x–200x returns, combining low entry cost with excessive utility. Its AI-powered functions, which encompass actual-time buying and selling insights, predictive analytics, and automatic choice-making, make it more than a speculative asset, setting it apart from other altcoins with confined functional use.

AI Integration: The Next Frontier

Artificial intelligence is remodeling crypto trading and blockchain innovation. Ozak AI leverages AI to offer rapid, statistics-driven marketplace signals, allowing customers to make knowledgeable selections and execute trades with unparalleled pace. This integration no longer handily adds tangible application but also aligns with the growing demand for intelligent, self-reliant structures in decentralized finance. By combining blockchain with AI, Ozak AI stands on the intersection of high-boom generation sectors.

Price Predictions and Upside Potential

While analysts predict Ethereum could reach $8,000 and Solana $500 in the coming months, Ozak AI’s early-stage pricing offers potentially larger relative gains. A $1 target for Ozak AI would represent a 100x return from its current $0.01 presale price, making it an attractive option for investors seeking high ROI while diversifying beyond traditional layer-1 holdings.

Credibility and Security

Ozak AI’s commitment to transparency is evident through its Certik and internal audits. Security is a critical consideration in crypto investing, and Ozak AI’s audits ensure that both token mechanics and smart contracts are thoroughly vetted.

Additionally, listings on CoinGecko and CoinMarketCap provide investors with reliable metrics for tracking market performance and liquidity. These factors enhance investor confidence and establish Ozak AI as a credible choice in the crowded altcoin market.

Crypto Market Implications

The combination of AI integration, robust presale traction, and a $4 trillion bull market backdrop positions Ozak AI as a high-ability altcoin in 2025. Investors looking to diversify beyond Bitcoin and Ethereum may want to find Ozak AI specifically compelling due to its early-stage upside and application-driven version. While setup altcoins offer balance, Ozak AI offers the risk for oversized returns, mainly for the ones coming in for the duration of the presale stages.

For investors searching for high-growth possibilities, Ozak AI represents a completely unique combo of credibility, innovation, and early traction. The venture’s low presale price, strong network aid, AI-powered functionality, and legitimate audits make it a standout option in 2025’s crypto market. It enhances investments in top altcoins at the same time as providing publicity to the rising AI-driven crypto area.

Ozak AI has demonstrated itself as a top project for 2025 with over $2.28 million raised, 800 million tokens sold, and strong credibility through audits and listings. Positioned amid a $4 trillion bull marketplace, the challenge gives good-sized upside potential as opposed to mounted cryptocurrencies like Bitcoin, Ethereum, Solana, Cardano, and XRP. For traders seeking to integrate innovation, transparency, and high ROI capability, Ozak AI is a presale opportunity that can’t be left out.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides an innovative platform that focuses on predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized community technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto lovers and corporations make the perfect choices.

For more, visit

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi