While Dogecoin (DOGE) and Shiba Inu (SHIB) have long been the top meme coins, a new contender, with its presale momentum soaring and more investors flowing in, Little Pepe (LILPEPE), is generating significant buzz as a potential 50x investment opportunity. Here’s why LILPEPE may soon outshine DOGE and SHIB.

A Presale Setting Records

Little Pepe has taken the meme coin community by storm. Its Stage 10 presale sold out faster than expected, raising over $19.32 million, showcasing the extraordinary demand behind this project. Stage 11, currently priced at $0.0020, has already gathered over $1.5 million in under three days, signaling that the appetite for this coin is far from slowing down. Adding excitement to its presale, the team launched a $777k giveaway where 10 lucky winners will each secure $77,000 worth of LILPEPE tokens. With more than 232,000 entries, investors are lining up for their chance to be part of this growing movement. A minimum investment of $100 is required, giving even small investors a fair shot at joining the community.

The Potential for 50x Gains

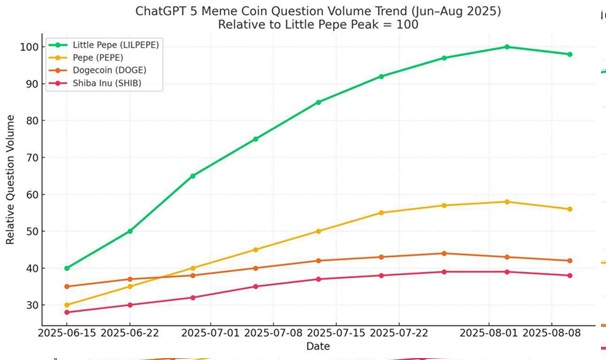

The buzz around Little Pepe is more than hype—it’s backed by strong numbers and projections. Analysts suggest that if LILPEPE follows through on its current trajectory, it could deliver returns of 50x or more. That means a modest $2,000 investment could transform into $100,000, making it one of the most lucrative opportunities in the meme coin sector for 2025. Even more impressive, data from ChatGPT-5 trend analysis indicates that from June to August 2025, Little Pepe is leading in question volume compared to PEPE, DOGE, and SHIB. This surge in community interest shows that the spotlight is shifting toward LILPEPE.

Little Pepe (LILPEPE) As the Next Generation Meme Coin

Both Dogecoin and Shiba Inu had their moments in the spotlight. DOGE benefited from Elon Musk’s endorsements, while SHIB drew attention with its ecosystem of tokens. But LILPEPE is positioning itself as the next-generation meme coin with unique traits:

- No taxes – Transactions are straightforward without hidden costs.

- No rug pulls – Investor trust is safeguarded by a fully transparent and fair launch system.

- Community-first culture – The project thrives on hype, humor, and togetherness.

A Roadmap Full of Surprises

Unlike many meme coins that stop at hype, LILPEPE has an engaging roadmap designed to keep the community invested for the long haul. In its current “pregnancy stage,” the project playfully describes itself as “cooking in the cryptowomb with Mumma Pepe.” This creative branding sets the tone for the token’s future, where community hype is at the core of its growth strategy. More milestones are expected post-presale, including strategic listings, community rewards, and expanded marketing campaigns designed to spread the Little Pepe brand across crypto communities worldwide.

Security and Trust Backed by CertiK

One of the biggest concerns for meme coin investors is security. The team behind Little Pepe has tackled this head-on by securing a CertiK audit. With an impressive 95.49% security score, the project assures investors that safety and transparency are taken seriously. This makes LILPEPE one of the most trusted meme tokens currently in presale.

Upcoming Listings and Exchange Plans

Visibility is key to growth, and Little Pepe is already making moves. It’s now live on CoinMarketCap and will hit two leading centralized exchanges right after the presale wraps up. Even bigger plans are in the works: the team is pushing hard for a listing on the biggest crypto exchange in the world. With these steps in place, the post-launch trajectory of LILPEPE looks strong.

Conclusion

Little Pepe (LILPEPE) isn’t just another meme coin—it’s a project with momentum, creativity, and serious potential. With a presale that continues to break records, an active community, and ambitious plans for listings and expansion, LILPEPE could well be the token that overshadows DOGE and SHIB. For investors looking to secure a spot in what may be the next 50x meme coin, the window of opportunity is wide open. As 2025 unfolds, Little Pepe has all the ingredients to claim the throne as the most exciting meme coin of the year.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken