Welcome to This Week in the Capital Market, a summary of events, headlines, comments and lessons from key events in the Market. This week’s roundup covers the performance of Nigerian Stock Exchange All Shares Index (ASI), investment insights, Nigeria’s tech giants – Interswitch and Jumia. We closed the gist with a question: what is missing in the world that Jack Ma and Co. are looking for in Nigeria?

-

How do you measure the performance of the stock market?

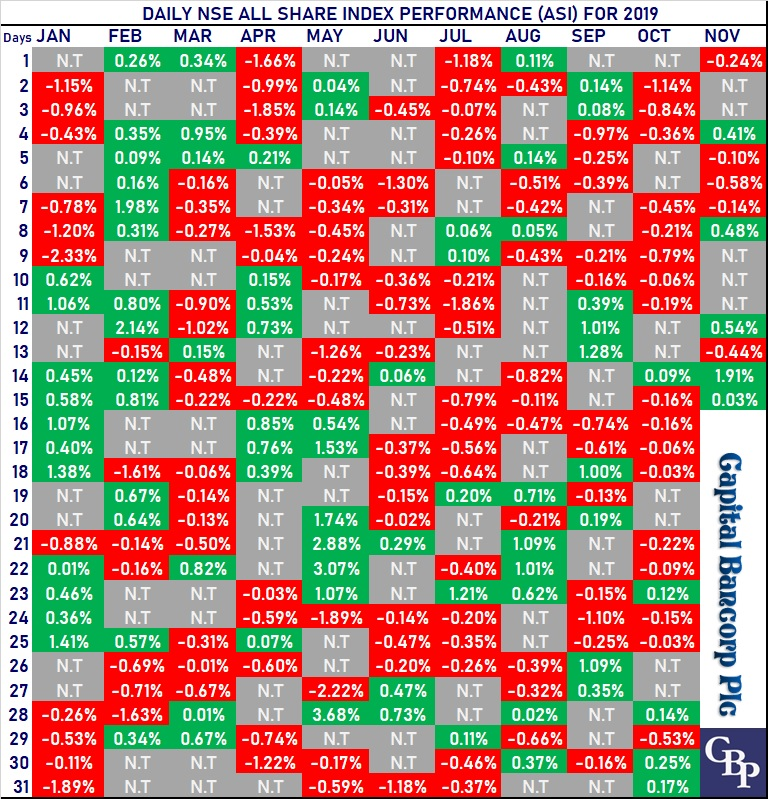

For investment enthusiasts, ASI is a parameter used to measure how well a stock market is performing. You can view it as the daily ‘jamb score’ or ‘CGPA’ measuring the combined daily performance of all stocks in the equities market. As an example, the ASI ‘scored’ 26,339.11 on 13th November, 2019 and recorded a higher score of 26,843.11 on 14th November, 2019 reflecting a growth of 1.91%, when this happens we say the market gained or closed in green vice versa.

The Nigerian Stock Exchange All Shares Index (ASI) has closed mostly in the red (loss) zone this year, leaving most stocks largely underpriced. Currently, our ASI is one of the worst-performing equities indexes globally; for the record, our stock market used to be the toast of Investors globally. Find below a pictorial representation of the daily performance of the ASI in 2019.

Falling ASI or stock prices cause panic in some investors, but fluctuations in the stock market represent business as usual. Investors who are comfortable with this reality know how to respond to falling prices and how to pick companies that are good buys when stock prices are on the downward trend.

Lesson: what should you do when the stock market is in red?

Find a good stock (company) that is underpriced (cheaper than it should be), buy and be patient. Most importantly, you must know your investment objective, risk appetite and investment horizon (how long you want to hold the investment).

-

Last week Thursday Stock Market Frenzy: crashing treasury bills rates, bulls to the rescue

On Thursday, 14th November, 2019, the market gained 1.91% to close in green. The highest gain witnessed in a day since May, 2019. This led to a frenzy among investors. In fact, the frenzy is a good reflection of exactly what the market is about, it’s about impressive financial results, directives, regulations, government policies, trends etc.

What caused the frenzy this time?

On 23rd October, 2019, CBN issued a directive excluding individuals and local corporates from investing in ‘high-yielding’ Open Market Operations (OMO) auctions. As a result, the second T-Bills auction after this directive drove rates into the region of single digits (the lowest in 3 years) leaving Investors with zero real returns as follows:

- 91-day tenor: 7.7998%

- 182-day tenor: 9.00%

- 364-day tenor: 10.00%

The current inflation rate is 11.24%, if you invest in any of the treasury bills above, you have not added anything to your wealth. As a result, Investors dashed to the stock market on the 14th of November, 2019 to hunt for stocks with potentials for higher yields and returns.

Typically, when money market rates are down, the equities market becomes attractive for better returns. This explains why the stock market achieved a 6-month high performance on 14th November, 2019 when the treasury bills rate hit a 3-year low on 13th November, 2019. In investment, a lot can change in two days.

Lesson: ensure your investment portfolio is appropriately diversified between the money market and equities market investments.

-

Visa plans to stake $200 million Nigeria’s pioneering fin-tech company

According to Sky News reports, US-based payments giant, Visa is set to invest $200 million in Interswitch in return for a 20% stake. Do the maths (100/20 times $200m), this will effectively value the company at no less than $1 billion. According to the report, both parties are in advanced talks and could be announcing the deal anytime soon.

If all goes as announced, Visa will become one of the major shareholders in Interswitch; a strategic move that will put Visa in a good position ahead of Interswitch’s planned IPO in London during the first half of next year.

Food for thought: Interswitch was founded in 2002 and it’s already valued at $1 billion, Union Bank was founded in 1917 yet valued at just over $560 million, says everything about possibilities and the power of technology.

-

Jumia’s losses widen as JumiaPay accelerates the possibility of profit in 2022

Jumia’s growth initiatives are impressive as seen in their financial reports and they have a real potential to take advantage of the emerging African market.

Clearly, the allegations of fraud made about the company may have been overblown and less material than feared, fake orders and orders originating as a result of JForce agent misconduct accounted for 1%-2% of total sales in 2018, and less in 2019.

Key highlights of operational and financial performance:

- Added 636,000 new customers during the quarter.

- Jumia now has 5.5 million annual active customers, up by 57% from 3.5 million in 2018.

- These customers have made 7 million orders as at Q3 2019, up by 95% from 3.6 million recorded in 2018.

- On the revenue side, Jumia continues to drive monetization from diversified marketplace revenue streams:

- Commissions charged to sellers grew by 27%.

- Delivery fees charged to consumers grew by 82%.

- Value-added services, which include services to sellers around logistics, packaging, content creation, grew by 33%.

- Revenue from ad solutions to sellers and advertisers grew by 125%.

Sadly, 3rd quarter operating losses widens by 22% to $55 million year-on-year.

Going forward …

According to the GSM Association, a trade group representing mobile network operators worldwide, in 2018, sub-Saharan Africa witnessed 1.7 billion interpersonal payment transactions totaling $26.8 billion via mobile phones, this presents a huge opportunity for JumiaPay. Currently, JumiaPay primarily handles purchases made on Jumia’s e-commerce marketplace.

“On payments, we’re making great strides with JumiaPay, which is showing very strong growth momentum in both volume and transaction terms. The JumiaPay on-platform total payment volume increased by 95% year-over-year, while the number of JumiaPay transactions accelerated by 262% over the same period. These are excellent results. We’re very pleased with the development and traction of JumiaPay.” Sacha Poignonnec, Co-Founder & Chief Executive Officer

With the bubble recorded by JumiaPay, a lot can happen before the projected 2022 year of profitability for Jumia.

-

What is missing in the world (of opportunities) that Jack Ma and co. are looking for in Nigeria?

On Thursday, 7th of November 2019, co-founder and CEO of social media service, Twitter, and mobile payments company, Square, Jack Dorsey along with four other executives of Twitter were in Lagos.

The following week, Jack Ma, former CEO, Alibaba turned up in Abuja for the Digital Economy Summit. According to a report by Channels Television, Jack Ma said he is ready to invest in Nigeria through his “Four Es” programme – E-infrastructure, Entrepreneurship, E-government, and Education.

What is missing in the world that they are looking for in Nigeria?

If you were expecting to find an answer here, sorry, I don’t have your answer. I guess that’s why I’m not a Founder yet. One thing is clear, the tourist potentials of Nigeria have not improved so they did not come here for the fun of tourism…they were here for something.

Whatever it is they are looking for, may unleash a goldmine of solutions and gains. We hope you will find it before they do, cheers to the next Founder.

It’s a wrap for the week!