Whether rich or poor, three things are paramount to human existence and survival. Man cannot do without clothing, food and shelter. Out of these basic essentials of life, house or building, an offshoot of shelter, is being possessed and occupied at various degrees and different locations. Despite the significant amount of money committed to the construction of buildings with the intent of protecting lost of lives and wastes, the last two decades have been characterised with incessant collapse.

Between 1971 and 2016, 175 cases of building collapse were recorded in Nigeria with most cases occurred in cities and towns. During this period, Lagos, Abuja (FCT), Rivers and Oyo states had the highest number of cases. They were also the locations with the highest number of causalities. From 2017 to the present year, the trend has not really changed as the two states –Lagos and Oyo continue to dominate the places with the cases of building collapse. Early 2019, Lagos recorded two cases within two weeks, while one was reported in Ibadan, the capital of Oyo state. This increased the public concern over the building collapse in South West region with the significant interest in Lagos.

In the last 5 years, analysis shows that public has been wondering about the best approaches to end the collapse. Their concern about the right procedures voiced through the media and public engagement platforms with the expectation that the concerned stakeholders will take decisive action on the collapse remains a mirage as the experts from government to the private circles do not hesitate to reel out the reasons and solutions for the collapse.

Many have cited climate change and laxity of the professionals, who failed to live above board in their professional calling towards saving life and resources, as the main reasons. However, this piece is not about citing or describing the reasons that have been cited in the last two decades. Rather the piece intends to take a critical look at the reasons from local and international perspectives. Among the people, the questions have been that what is the place of the professionals, regulatory agencies and effectiveness of building and professional codes in ending the collapse? Some have equally argued that it would be difficult for Nigeria to achieve the targets of Sustainable Development Goal 11 –to make cities inclusive, safe, resilient, and sustainable.

Place of Built Professionals and Other Stakeholders

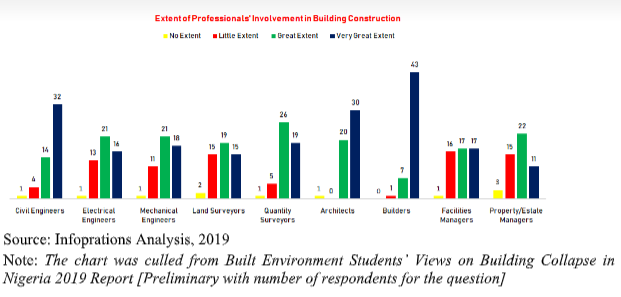

Throughout the world, before a building could be constructed, certain professionals are aggregated as a team for planning and execution. These are the people who have been taught the nitty-gritty of putting each component of a building together towards safety and health of the people and materials likely to be kept in the building.

Like other countries, Nigeria has engineers, surveyors, architects, builders and facilities managers who are supposed to be assembled from building construction. But, the recent reports indicate that the professionals or building owners are either skipping one or two professionals from the Construction Value Chain or approaching the stages haphazardly. The consequence has been what everyone is witnessing in cities and towns –building collapse and loss of lives.

How long Nigerians have to continue counting their losses when the building collapsed? Public believe that professionals have more important roles to play than the governments, analysis suggests. From the analysis, it is clear that governments have the right policies and initiatives to end the collapse, but the activities of the professionals, especially those in materials and supplies markets are not enough.

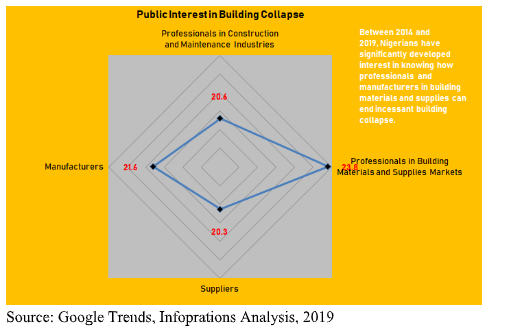

Using the real time data, public interest in how the professionals will end the collapse to save the life of young and old people who are expected to contribute to the growth of the economy has been on the increase in the last 5 years. Between September, 2014 and September, 2019, the more Nigerians had an interest in building collapse, the more they developed more interest in professionals responsible for building construction and maintenance. This result is also recorded for the interest in professionals, suppliers and manufacturers within the building materials and supplies markets. The high interest in professionals and manufacturers indicates that the public wants them to position themselves towards the right processes, people and materials.

Enabling Framework

As pointed out earlier, formulating policies and initiating programmes have never been Nigeria’s disease towards development. The main disease has been a lack of political and institutional will to implement the policies and programmes. Since 1960, Nigeria has had various professionals and national codes for built industries. These codes have been reviewed on many occasions to meet the trends in the industries.

In 2013, Ms Amal Pepple, former Minister of Lands, Housing and Urban Development, noted that the Nigerian government has reviewed the national building code to check incessant building collapse. According to her, the code provides sanctions for any unethical behaviour in the construction industry. Five years later, the federal government through Mr Babatunde Raji Fashola, Minister of Housing and Works, announced a new national building code, aiming at improving on measures to safeguard lives and property in the country.

“We have come up with the new code because government is aware of the fact that most deaths and injuries caused during building collapse are results of unacceptable ways of building. You can find out that in most cases safety measures are not considered in erecting most of the failed structures,” he said.

Deviating from the normal tradition of asking professionals and concerned stakeholders in the public sector about the effectiveness of the codes –national and professional, students’ views about the effectiveness have been sought and analysed. According to them, in spite of having the right building regulations and standards in Nigerian built industries, the lack of full implementation has continued to endanger life and property across the country.

When they were asked about the effectiveness of the national building code in reducing building collapse, over 39% said it is less effective while 31.4% said it effective. Their responses to the effectiveness of professionals code is mind-blowing, as over 45% said existing professional codes have not really helped in containing incessant building collapse.

From this, one needs to be curious about the basic of constructing or developing standard building being taught in Nigerian higher institutions. Why is it difficult to translate the fundamentals that have been proved to the academics for the award of degrees into practice? The students answered. Forty-nine percent of the students said the fundamentals are practicable, while 11.8% indicated that they are very practicable.

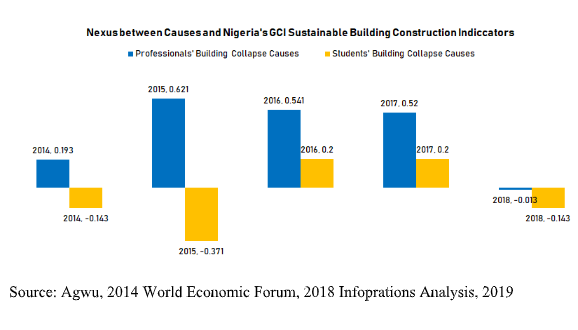

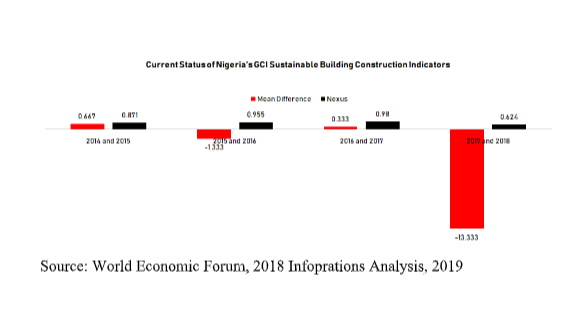

Those who belong to less practicable criterion (37.3%) more than those who believe in the high practicability of the fundamentals in the industries. From these results, it is glaring that governments, professionals and civil society organisations need to come together and map out how the building construction fundamentals, regulations and professional standards should be enforced. This has been further intensified based on the outcomes of the analysis of the country’s Global Competitiveness Sustainable Construction and causes identified by students and professionals (see below chart for further clarification).

Failure to map out and develop the right strategies will continue to be the source of incessant building collapse. The students believe that in the next 5 years Nigeria will experience building collapse more than what she has had in the previous 5 years. Already, available statistics have shown that the cumulative number of lives that would be lost in the next 50 years varies between 1,775 and 1,790.

Can Resilient Cities Be Achieved in Nigeria?

Nigeria really needs to be worried about the building collapse because it will never be left out from the countries that have been projected to have more than 1 billion new houses by 2050. Less than 31 years to the year, many houses and structures have sprung up in cities such as Lagos, Ibadan, Port-Harcourt, Abuja, Kano among others, while the old ones are begging for preventive maintenance. With the effects of climate change that have projected to have significant impact on buildings with substandard materials, the concern now is can Nigeria build resilient cities in its six regions? How can it be achieved? The results of analysis of the country’s position on global competitiveness index provide the answers.

As the analysis establishes, Nigeria needs to work on her Global Competitiveness Index Sustainable Building Construction Indicators. It needs to work on reliance on professional management, trustworthiness and confidence, availability of latest technologies, firm-level technology absorption, local supplier quantity and production process sophistication.

When the professionals’ identified causes (use of substandard designs, materials, manpower and procedures) of the building collapse are analysed along with the severity of these indicators, analysis reveals that one unit of the causes reduces one unit of having good rankings for the indicators by 38.3%. Working on the causes (bad designs, wrong foundation, wrong site, bad usage of the structure, poor technology and inexperienced contractors, high population, weak building process and poor physical development control) identified by the students will help Nigeria to achieve a 93.1% increase in good rankings.

These results were further explored with correlation analysis of the indicators between 2014 and 2018. Analysis shows that the rankings earned in 2014 and 2015 were linked strongly. This is also obtained for 2015 and 2016, 2016 and 2017. However, the indicators failed to connect in 2017 and 2018, indicating disparity in the rankings. The implication of this is that in the previous years (2014 to 2016), Nigerian governments’ efforts to improve on the criteria being used by the World Economic Forum for the indicators measurement did not yield important results.

From the analyses, it has emerged that professional codes of conduct, institutional and legal framework are weak to ensure sustainable building construction. As long as these continue to be the pain points, saving lives, money and building resilient cities will remain unattained for the next few years. According to the World Bank, “Building codes and land use planning have proven to be the most effective tools to increase health and safety in cities and reduce disaster risk.” Yet, Nigerians remain vulnerable to building collapse despite the structured of its code that ensures inspection of building at pre-design, design, construction and post-construction stages.

With the persistent collapse and the number of people who have lost their lives, it would not be a bad suggestion if Nigeria goes Hammurabi’s way. According to many sources, the Code of Hammurabi is one of the oldest written laws in human history that criminalises poor construction practices beyond the mere prosecution of the offenders. Between 228 and 233 codes, “If a builder builds a house for a man and does not make its construction firm, and the house which he has built collapses and causes the death of the owner of the house, that builder shall be put to death.”

This code simply tries to create proportional justice. When the code is adopted, the family of a building collapse victim will have two options. Having family member of the contractor or builder killed in the same way the victim died or taking blood money, equal to the value of the victim.