In our contemporary time, there is one fundamental element that early stage investors look for as they evaluate companies: leverageable growth. Leverageable growth, unlike linear growth, is a type of growth that is largely infinite because the nexus upon which it happens is unbounded and unconstrained by marginal cost. In other words, this is the type of growth that when it begins nothing can stop it because the cost of growth is practically and marginally zero. It is the type of growth that can reach any part of the world!

For that environment to happen, the company needs to operate in a largely big sector with a lot of upscale which will allow the company to scale and grow. If the market is not big, even if the company has the necessary mechanics for growth, it cannot, because a ceiling exists which limits it. For example, making electric bulbs that can last for ten years but cost N200,000 per unit in Nigeria may be a great product but the size of the market for that type of bulb will limit its demand in Nigeria.

Yet growth goes beyond just selling products. It is about the way that product can sell after the initial fixed cost. Fixed cost is the core cost invested to create the product. After that, what matters is the marginal cost [yes, the variable cost is muted here] when growth models are developed. Marginal cost is the cost of producing an additional unit of a product. When that is close to near zero, it means the product can scale massively and can attract leverageable growth.

Interestingly, it is technology companies that exhibit this nature of having close to near zero marginal cost, and that is why they can grow exceedingly fast. Take some examples:

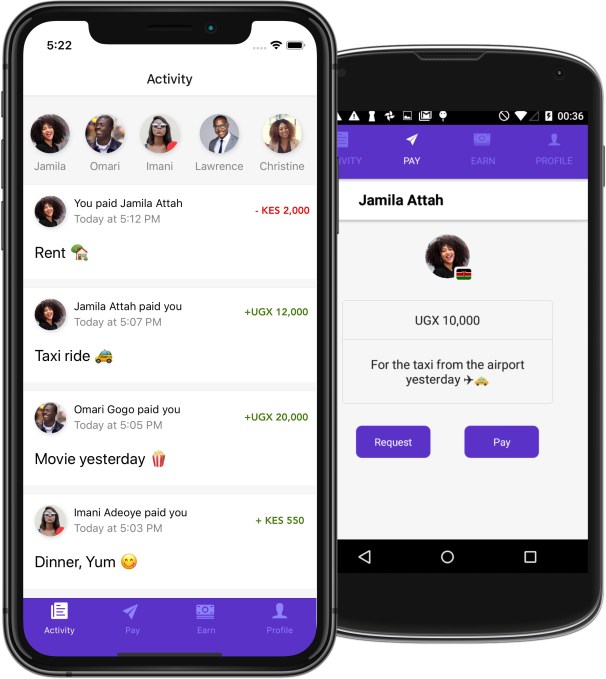

- Once Uber app was created and the infrastructure running, the core fixed cost has been spent. What follows is marginal cost (i.e. distribution and transaction cost). That marginal cost is very low as Uber begins to add new customers to its ecosystems. Because that cost is very low, Uber can scale provided the market has room for it to scale.

- Facebook connects people across the globe. The cost of this connection is close to zero at marginal cost level. The transaction cost is close to zero and because this connection happens on the web, the distribution cost is zero. Yes, Facebook marginal cost is zero and that means it is exceedingly scalable. I have put the scalable advantage of Facebook to be close to perfect because its product makes it unbounded by anything for growth.

It is important to understand that it is not only software companies that can exhibit this inherent scalability of near zero marginal cost. A company that makes very great microchips can indeed have a different domain of marginal cost. NVIDIA which makes exceedingly high-grade graphic processing microprocessors that power gaming, AI processing units and high-intense processing systems is a scalable company. Once the R&D on the chip has been done, the additional cost of making additional unit of the chip is practically zero. Silicon is largely free – it is sand. The real deal is building the intellectual property of that design. Mass producing it is not a problem.

The Basis of this Thinking

When Naspers, a South African company, made one of the most successful venture investments ever, it took a clear risk: invest in Tencent and hope it works out. And it did work out, generating billions of dollars for about $34 million the company had invested. Broadly, investors are looking at massive return and not linear return because the risk they are taking is also huge. These are people that know they can get linear returns in Treasury Bills or real estate but yet go ahead to seek leverageable growth that can bring in multiples if things work out.

So when South Africa’s Naspers invested in China-based Tencent $34 million, it was making a huge call, in 2001. Today, that $34m berth is now worth $170 billion (with b), based on Tencent’s current market capitalization. Magically, Naspers is the 65th most valuable company in the world. That berth is perhaps the greatest investment in Africa.

All Together

So when you meet early stage investors, here are two questions you need to be ready to answer:

- Do I have a business model that can generate leverageable growth? In other words, do I have a company that can scale with near-zero marginal cost?

- Do I have a market that is big enough to enable that growth and scale to happen without a ceiling?

If your answers are YES and you can demonstrate that you can have the capabilities to execute the playbook, you will likely get the funding. Capabilities include technical, operational and other necessary skills required to run a business. Those capabilities do not need to be only you – here, investors will be looking at your team.