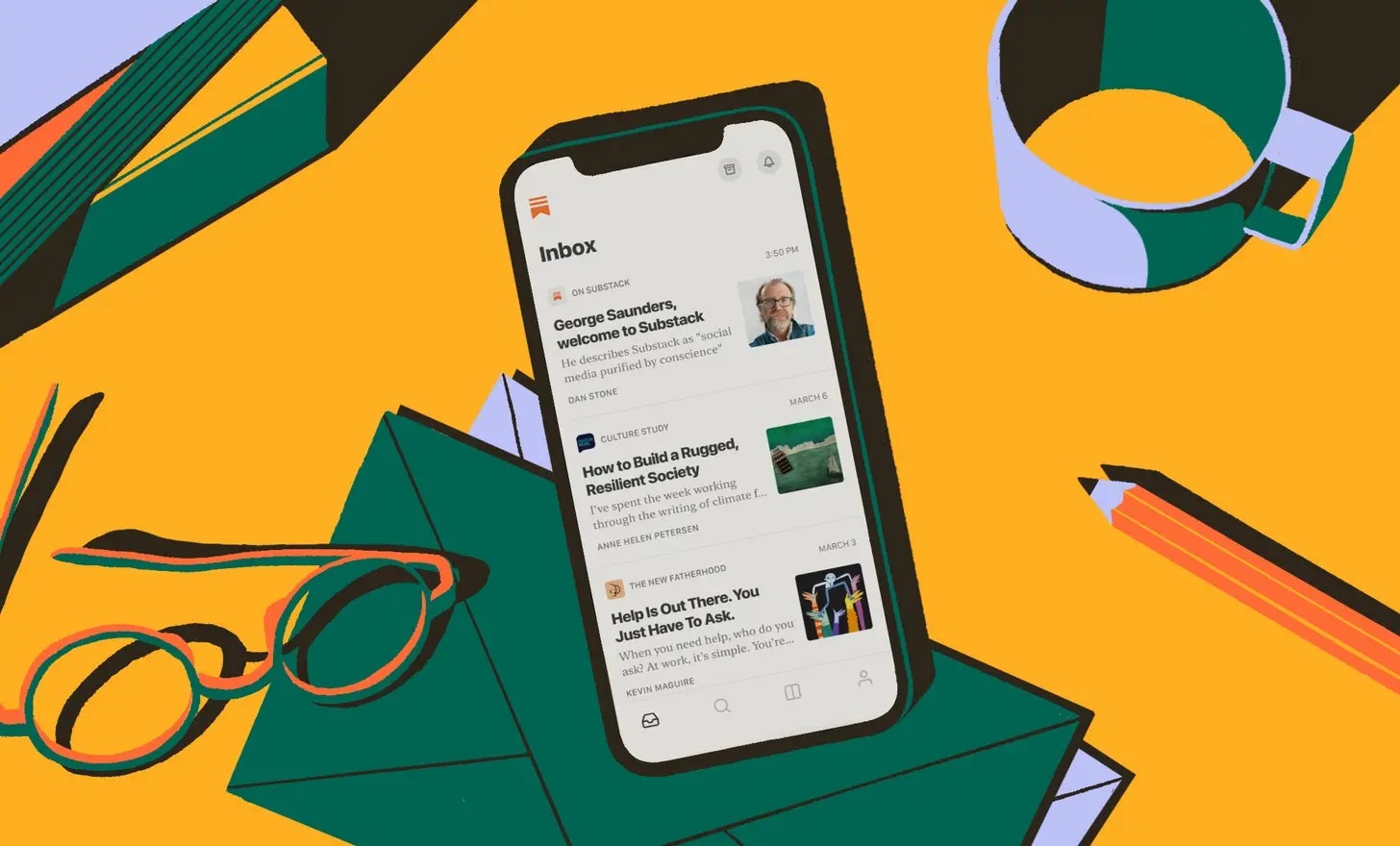

Newsletter subscription platform Substack has announced it will begin using Apple’s new rule that allows apps in the U.S. App Store to link users to external payment systems, a change that stems from Epic Games’ long-running antitrust battle with the tech giant.

The shift means Substack subscribers can now pay creators directly through web-based transactions without Apple’s 30% commission fee eating into revenue. For creators, this translates to higher earnings and more control over pricing. For readers, it means cheaper subscription options, since Substack says iOS subscription prices will now be automatically adjusted upward only if processed through Apple’s in-app purchasing system (IAP). Creators, however, retain the ability to disable this pricing adjustment.

“Support for external payments will benefit both creators and their readers,” Substack explained. “Consumers will now have the option to choose between Apple’s system or direct web payments, all without leaving the app.”

The move puts Substack in the company of Spotify, Patreon, and Amazon Kindle, all of which have begun steering users toward external payment options since Apple was forced to loosen its App Store rules in May. That change followed a U.S. court ruling in Epic Games’ lawsuit against Apple, where the court found Apple’s prior ban on external links was anti-competitive.

For Substack, which has more than 30,000 publications offering in-app subscriptions, the implications are significant. The company said early testing of the expanded payment options has already led to a boost in paid sign-ups, though it declined to share exact figures. Substack also announced migration tools to help writers shift existing subscribers from Apple’s system to its own. The platform will continue taking its 10% cut on subscriptions, but only on the base web subscription price.

The changes will apply only to new subscriptions purchased through the app. Existing Substack writers don’t need to take action unless they want to offer discounts for those who continue using Apple’s system. Importantly, Apple still requires apps to provide IAP as an option and does not allow developers to fully opt out.

While this new policy applies to the U.S. App Store, Substack said it is still “evaluating” whether it makes sense to extend the changes to the European Union and the U.K., where Apple faces stricter and more complex rules under the Digital Markets Act (DMA) and U.K. competition regulations.

Industry analysts note that Substack’s decision underscores how the Epic Games ruling has begun reshaping the digital subscription economy. By bypassing Apple’s commission-heavy ecosystem, platforms like Substack are creating pricing flexibility that could drive greater adoption of direct-to-creator models—something smaller publishers and independent writers have long pushed for.

The Legal Battle

In 2020, Epic Games sued Apple, accusing the iPhone maker of running an unlawful monopoly by forcing developers to use its payment system and charging commissions as high as 30%. Epic deliberately provoked the fight by enabling a direct-payment option in Fortnite that bypassed Apple’s system, prompting Apple to kick the game off the App Store.

The lawsuit became one of the most closely watched tech legal battles in recent years. In 2021, Judge Yvonne Gonzalez Rogers ruled that while Apple was not a monopoly under federal antitrust law, its App Store practices were anti-competitive. The court ordered Apple to allow developers to steer customers to external payment systems. But Apple didn’t.

On April 30, 2025, U.S. District Judge Yvonne Gonzalez Rogers ruled that Apple had violated a 2021 court order that barred the company from preventing developers from informing users about alternative payment methods. The judge declared that Apple had “not made a good faith effort to comply” with the injunction and referred the tech giant to the U.S. Justice Department for potential contempt proceedings.

Judge Rogers also ruled that Apple cannot charge developers for purchases made outside of its App Store, a major blow to the company’s longstanding revenue model. This ruling directly opened the path for Epic to return Fortnite to the App Store under its own payment terms.

Epic’s broader battle is still ongoing, with both sides claiming partial victories, but the rulings have already reshaped the global app economy. Substack’s move is the latest proof of that impact.