Public Notice: If you are in any of the Lagos bus terminals, support the new fare system. Enjoy your travels in our Centre of Excellence. The fare system is simpler, better and takes away frictions.

Public Notice: If you are in any of the Lagos bus terminals, support the new fare system. Enjoy your travels in our Centre of Excellence. The fare system is simpler, better and takes away frictions.

By Dr. Nnamdi Madichie & Dr. Chinedu Madichie

In a 2013 Special Issue on “Is the Middle East the land of the future?” a range of papers debated how the region was faring in terms of meeting the millennium development goals, and concluded that the targets had been missed in the most desperate sectors. Indeed, even in the fastest growing economies of the Middle East proved that nothing could be concluded as a given. A similar observation had been made in the case of Africa two years earlier in a journal special issue entitled “Is Africa the land of the future?”

In this article, the focus is on highlighting the role of the African diaspora in actualising the Sustainable Development Goals (SDGs) on the back of the missed targets of the Millennium Development Goals (MDGs) that elapsed in 2015. The study commences with a re-articulation of migration, the value and constraints of remittances, contribution of the African Diaspora and ultimately, what these all mean for success in achieving the SDGs.

Migration is often viewed negatively by home, transit, and destination countries. While African countries tend to label it a “brain drain,” destination and/ or recipient countries consider it as a burden on available resources. This has resulted in the inadequate attention migration and migrants contribute to sustainable development – especially from the purview of the youth and notably international students. It is for this reason that the African Diaspora Network in Europe (ADNE) advocates for the voice of diaspora to be included in development policy planning both in Africa and in Europe. It is the opinion of ADNE that well managed migration policies would bring about an optimal use of diaspora contribution to development considering the huge demographics of migrants in the world. Examples of such policies include easier access to legal status in destination countries, enabling dual-citizenship, reduced bureaucratic procedures and administrative hurdles, etc.

Indeed, the much-touted SDGs and the 2030 Agenda for Sustainable Development have provided new opportunities for African diaspora involvement in the face of the partly missed targets of the MDGs that preceded these goals. It is our view that the diaspora have the wherewithal to contribute towards the SDGs, particularly on the targets of ensuring safe, orderly, and regular migration; reducing the costs of diaspora remittances; and improving data on the skill sets of these groups.

While target #1 of the SDG on ending poverty, and target #12 on improving data with a view to establishing diaspora networks to facilitate the circulation of knowledge, ideas and technology for capacity building to take off, it is paradoxical that while the diasporas are important actors in economic development, they are still mainly considered shortcuts to leveraging financing – especially remittances – and channelling funds for sustained development in Africa – in a sub-optimal manner. This attitude underscores the need for alternative platforms of innovative contributions of the diaspora for the development of the region.

We posit, therefore, that the impact of diaspora on the 2030 Agenda should not just be multidimensional, but also multifaceted, requiring an in-depth consideration by African governments and other stakeholders in ensuring the actualisation, and effective deployment of three key initiatives – notably (i) leveraging diaspora remittances, trade and investment; (ii) capacity building (transfer of skills, knowledge and technology); and (iii) advocacy and involvement in development policy making and implementation process.

Unpacking these further, first, as far as Remittances, trade and investment goes, there is a need for Diaspora remittances and financial contributions are well mobilised through various instruments including, but not limited to, bonds, securitised remittances, and special banking arrangements. The World Bank and other development partners have revealed that remittances by African diaspora surged by 3.4% to US$35.2 billion in 2015. However, this amount doesn’t directly translate to development due to many challenges such as the very high costs involved in money transfer, the technical complexity of alternative innovative platforms – going beyond funds for the day-to-day needs of families. A larger, more consolidated option channelled towards productive investments fostering entrepreneurial rather than dependency culture is needed.

Second, in relation to capacity building is another area where technology and skills transfers and modern management practices can contribute. Examples abound where diaspora have galvanised public private partnerships (PPPs) in sectors where such expertise is not locally available. This conduit in knowledge and skills transfers has proved effective especially during the Ebola epidemic when UK-based Sierra Leonean health workers volunteered to provide cultural awareness training for anyone travelling to Sierra Leone. Another example is BethAri Limited, a management consultancy with diaspora expertise working in partnership with West African Health Organisation(WAHO) on capacity building and skills development for pharmaceutical regulatory practices in West Africa. It is envisaged that these examples can be built upon in a more significant manner so as to make the SDG targets a reality by placing the diaspora engagement at the core of the development process.

Third, and finally, Advocacy and development policy engagement, the nation-building process also relies on social and political dialogue, advocacy and awareness, and stability for sustainable development. African governments have recognised the need to engage diaspora by providing an enabling environment for potential contributions of the latter. This includes creating economic and social linkages, accelerating structural reforms and providing incentives. It has also been established that country ownership of diaspora strategies and strong ties with the diaspora, underlined by a shared vision, helps commit the diaspora and government to act synergistically.

A typical example of this exemplary vision of diaspora engagement by the Nigerian government was the establishment of Nigerians in Diaspora Organisation (NIDO) worldwide, where office space is provided at embassies to facilitate such initiatives. Other African countries Rwanda, Kenya, Ethiopia, to name a few, have all launched initiatives to engage with the diaspora. We, therefore, advocate for the Diaspora to be viewed and treated as development partners – i.e. to be considered, not just as sources of finance for development, but also as development partners. As one study points out “for Africa’s economies to successfully transition from their current state of commodity-dominated production to high value-added production, governments in the continent must design and implement strategies to harness their grossly underutilized diaspora in developed countries.”

African diaspora may have the capacity and patriotic mind-set to contribute to national development, but require concerted efforts by all stakeholders to develop policy objectives that could facilitate diaspora mobilisation. However, poor policy choices, lack of clearly defined objectives, poor implementation plans, as well as weak and inaccurate data on the diaspora remain stumbling blocks.

There is an urgent need for national diaspora engagement strategy to build an African Diaspora Skills Database in order to fully understand the socio-economic and demographic characteristics of the diaspora, their attitudes, and possible areas of interest for collaboration, and most importantly, avenues for promoting the optimal use of diaspora expertise in their home countries. We hope to see more concerted efforts in this regard and institutional support that would enable these efforts come to fruition.

That in our view would open up a new world of Diaspora Resource Management (DRM)– arguably an offshoot of International Human Resource Management.

About the Authors

Dr Nnamdi Madichie is Director of the Centre for Research and Enterprise at the Bloomsbury Institute, London. He is a Fellow of the Higher Education Academy and former Editor in Chief of the African Journal of Business and Economic Research. In addition to being a member and key participant of the Association of Commonwealth Universities, Dr Madichie has also worked on industry projects with the London Development Agency, as well as having contributed to the United Nations Conference on Trade & Development (UNCTAD), World Investment Forum Round Table, which culminated in the launch of the Business Schools for Impact project. He is also co-author of recently published book on Digital Entrepreneurship in Sub-Saharan Africa Challenges, Opportunities and Prospects as part of the Palgrave Studies of Entrepreneurship in Africa series, highlighting the intersections of entrepreneurship and the world of digital in the African context.

Dr Chinedu Madichie is former Chairperson of the Nigerians in Diaspora Organisation Europe (NIDOE), Belgium-Luxembourg Chapter and former Senior Adviser (Entrepreneurship & Private Sector) and Board Member of African Diaspora Network Europe (ADNE) based in Brussels. Dr. Madichie is a life-sciences graduate with almost 20 years professional experience in the pharmaceutical industry. He is the Founder/CEO of BethAri limited, a general consultancy organisation whose clients include the Nigerian National Agency for Food and Drug Administration and Control (NAFDAC), the West African Health Organisation (WAHO) a Specialized Institution of the Economic Community of West African States (ECOWAS) responsible for health issues and numerous pharmaceutical companies in Africa & Europe.

The Central Bank of Nigeria plans to recapitalize banks:“Banks will therefore be required to maintain higher levels of capital, as well as liquid assets in order to reduce the impact of an economic crisis on the financial system,” he said.” That is the right thing to do especially since the stock market has simply refused to make amends after the ocean-bottom of 2008.

To achieve Financial System Stability, Mr Emefiele said a resilient and stable financial system was imperative for continued growth of the country’s economy given the intermediation role of a financial institutions, to support the needs of individuals and businesses.

“In the next five years, we intend to pursue a programme of recapitalising the banking Industry to position Nigerian banks among the top 500 in the world.

“Banks will therefore be required to maintain higher levels of capital, as well as liquid assets in order to reduce the impact of an economic crisis on the financial system,” he said.

Recapitalization/redesigning happened about ten years ago and we lost some brands. This time around, depending on the amount CBN is pegging the new capital requirement; we may experience the same thing. Unfortunately, most banks will not do the recapitalization at the position of strength since it will be a double-whammy: fintechs are there practically asset-light while government wants me to hold more capital to compete with them. When you hold more capital, you may look good on paper but actually you are carrying cost, and that means inefficient on the utilization of the factors of production. But banks need to do the needful because they hold other people’s money!

I see about 6 banks departing the scene after this CBN exercise. It will be hard for them to get new capital at good terms because the market is ferociously tough. Remove the amalgam of fees on customers, they will pile losses as their interest-incomes [where you expect banks to make money from] are largely insignificant!

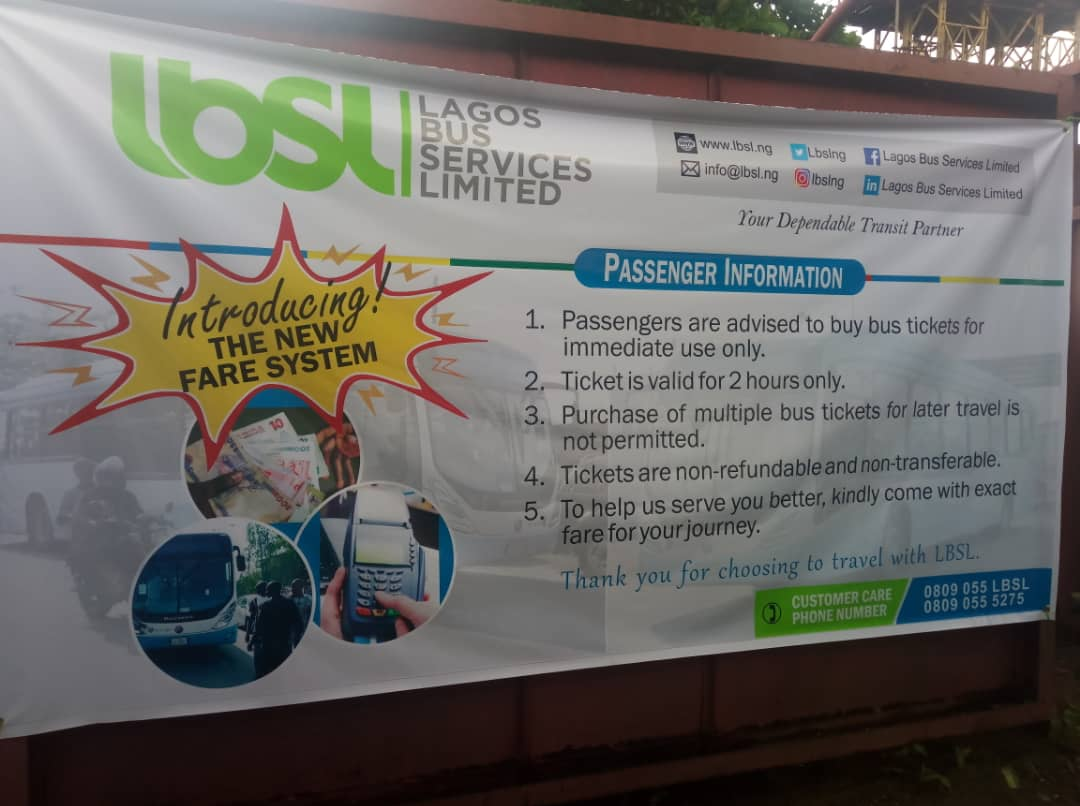

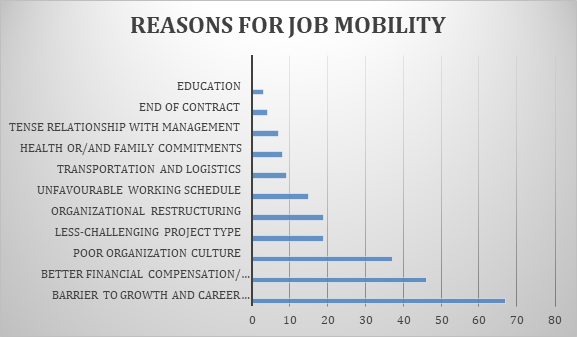

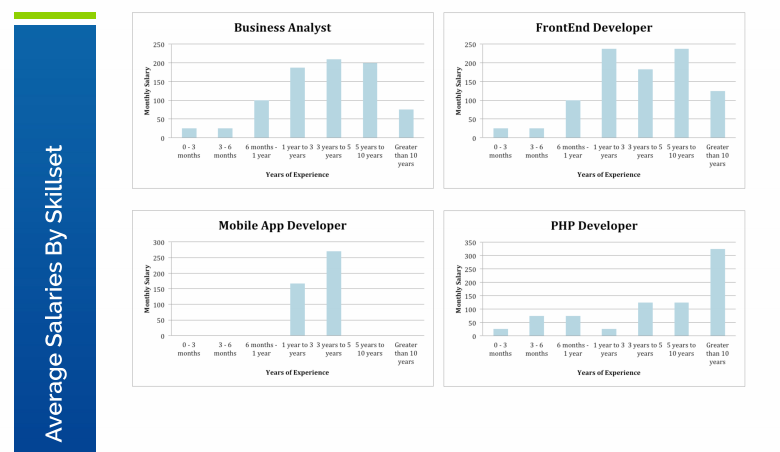

Cousant Connect has published a report titled “The Nigerian IT Jobs Report, 2019”. It examines where job opportunities are in the Nigerian IT sector: “The demand for IT skills in Nigeria is continually increasing with many more sectors of the economy now embracing technology. However, there is still a lack of information on where the opportunities lie in the IT Jobs market and average salary ranges. This IT Jobs report gives deep insights into the skills that are in high demand, the average salary for each industry and skill set.”

Looking at the data, mobile app developers seem to be running the market on wages especially within 3-5 years of experience.

Some plots from the report which can be downloaded here.

It is evident that distributed energy will rule this age for Africa. Yes, while heavy-asset distribution companies (DISCOs) are crying for no money, African renewable startups are raising tons of money. You do not need a seer to understand: remove government subsidy, most African electric utility firms will collapse.

Investors are voting for the startups and those startups are chipping the market from the national grid, taking the best customers along. The implication is that over time, national grid players will enter severe paralysis as they will not have profitable customers to serve at least in residential power.

Nigerian distributed utility company, Arnergy, has announced it has raised $9 Million in a Series A round of funding led by Breakthrough Energy Ventures with participation from the Norwegian Investment Fund for Developing Countries (Norfund), EDFI ElectriFI and All On.

Arnergy is a distributed utility company that provides energy solutions tailored towards energy reliability in emerging markets. Our energy solutions empower businesses and residential customers through the design, sale and installation of affordable and reliable, distributed energy systems. Target business verticals include, but are not limited to healthcare, education, hospitality, agribusiness, financial services and micro businesses that are driving impact and producing positive economic outcomes in their local economies. For more information visit http://www.arnergy.com.

“We are excited to enter this next phase in Arnergy’s development with investors that share our vision of tackling the most pressing energy challenges across emerging market economies, starting with Nigeria. We believe that energy needs in Nigeria have surpassed rudimentary requirements of low power utilization and our product offerings are solving for reliability and not just access,” said Femi Adeyemo, Founder and CEO of Arnergy.

Arnergy’s distributed renewable energy systems harness the combination of solar power, superior storage solutions and proprietary remote management technologies to deliver scalable, reliable and affordable energy solutions that are tailored to tackle issues related to intermittency and grid unreliability. Since launch, Arnergy has delivered over 2MW of installed capacity and over 5MWh of storage capacity to business and residential clients across Nigeria.

Arnergy’s market scaling ambitions, fueled by the influx of new capital, will include new business models and partnership opportunities, as well as consumer financing and channel expansion activities.Targeted verticals for the company’s 5KW modular systems will include small businesses, healthcare, hospitality, financial services, agribusiness and education.

About Arnergy