By Nnamdi Odumody

Ping An Insurance is the leading Insurance services provider in China, serving 538 million online customers and 184 million retail customers through its ecosystems of financial services, healthcare, auto services, real estate and smart city solutions. It is the world’s biggest insurer with a market capitalization of $181.4 billion and earned revenues of $144,197 billion in 2018.

Ping An Good Doctor, China’s largest online healthcare services provider, has now expanded its AI-geared “one-minute clinics” across eight major Chinese provinces and cities. With signed service contracts for almost 1,000 units and a growing user reach of over 3 million patients, the company has stocked its 24/7 compact booths with more than 100 categories of cryogenically refrigerated common drugs, purchasable through smart vending machines. Each clinic houses an ‘AI Doctor,’ trained to collect data on patient symptoms and medical history through voice and text input, after which one of Ping An’s human doctors provides remote diagnosis, medical advising, and immediate online prescriptions.

Ping An invests $1billion annually on Research & Development with 22,000 R&D staff, and has over 4,000 patents even as they invested $22 billion on AI for sales and marketing in 2017.

Applications of Technology

These are some areas it has deployed technologies:

- Internally generates higher return for core businesses. Customer segmentation and precision marketing for cross-selling and up-selling 20 percent plus 12 month conversion rate, gaining 67 percent more repeat buyers.

- Image Based Auto Insurance Loss Verification Technology for 100,000 plus vehicle types and 500 plus risk factors with 92 percent loss verification accuracy.

- AI and Biometric based credit risk management which detects fraud based on micro expression recording 1.18 percent credit card Non Performing Loan rate among the least three in the industry.

- Ping An FinCloud (the largest proprietary cloud platform in the Chinese financial services industry) is connected to 70 percent of Ping An’s core business. It externally provides and monetizes technology by One Connect (OneStop financial Cloud Platform). It’s Smart Fast Claim has 7 partner institutions recording 3 billion Rmb leakage reduction in the first quarter of 2017, and 20 billion Rmb potential revenue was generated from risk leakage control.

- Intelligent Personal Loan Solution had a billion plus usage in 2017 while intercepting 15 million frauds. Loss from internet fraud is 0.6 percent of Chinese GDP.

- Cloud Service Platform for Small & Medium Banks partnered with 400 plus banks. It is compliant to Chinese banking and financial services Regulatory Authorities. Its target market is 600 plus SMB’s which hold 40 percent of bank assets in China.

Ping An in Healthcare

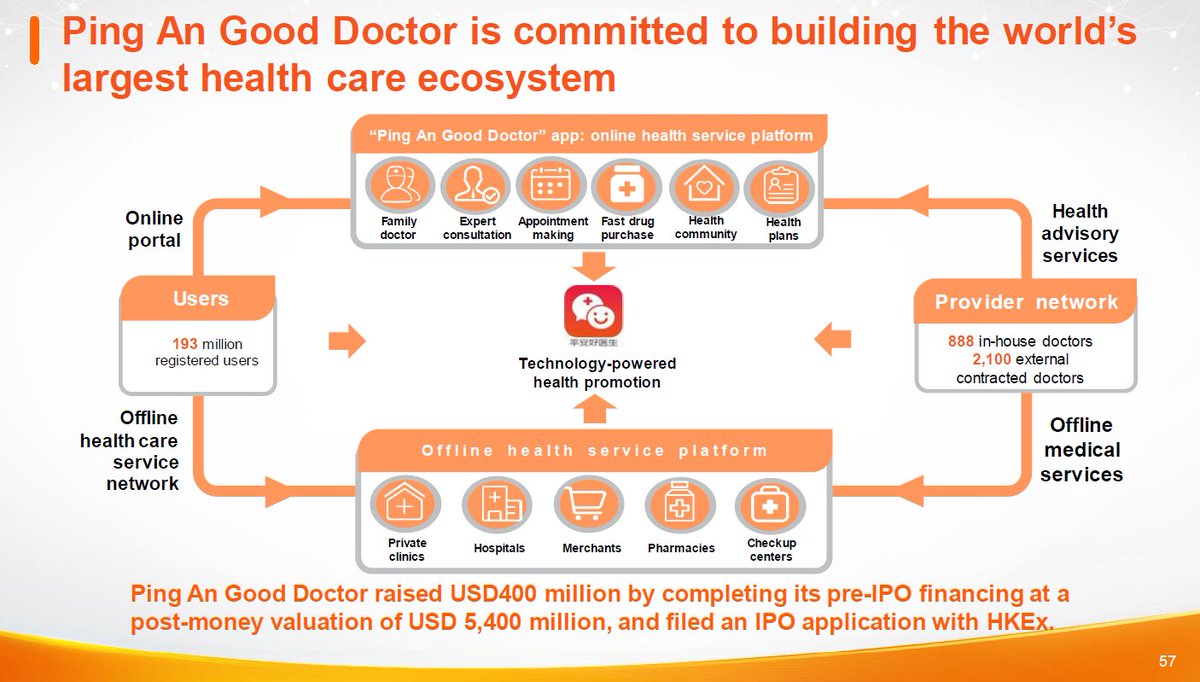

Ping An Healthcare & Technology Company is the leading one stop healthcare ecosystem in China. It combines mobile health plus Artificial Intelligence to provide every family with an e-health profile and everyone with a health care management plan. Ping An Good Doctor which is an online portal has established a comprehensive healthcare ecosystem which covers family doctor services, consumer healthcare services, a health mall as well as health management and wellness interaction.

As at Dec 2018, Good Doctor had 265 million registered users while its monthly active users had reached 54.7 million. It is the largest mobile medical application in China in terms of user scale, employing more than 1,000 medical personnel (Assistant Supervisor Level or above from Class III Grade A Hospitals) in its in-house medical team and contracts with 5,203 renowned external doctors. The in-house medical team empowered by its proprietary AI provides users with 24 hour online consulting services. Good Doctor collaborates with over 3,000 hospitals to provide services such as hospital referrals, appointments and inpatient arrangements. It also partners with more than 2,000 healthcare institutions including physical examination centers, dental clinics, cosmetic surgery institutions and more than 15,000 pharmacy outlets to provide personalized health and wellness services to their users.

By integrating it’s AI empowered medical team, external doctors and offline network, Good Doctor has established a closed loop healthcare ecosystem which enables its users to enjoy personalized healthcare services along its value chain.

All Together

Nigerian Insurance companies should learn from Ping An in order to create new revenue streams by plugging into the opportunities digital transformation provides by redesigning their operating models for the Fourth Industrial Revolution.