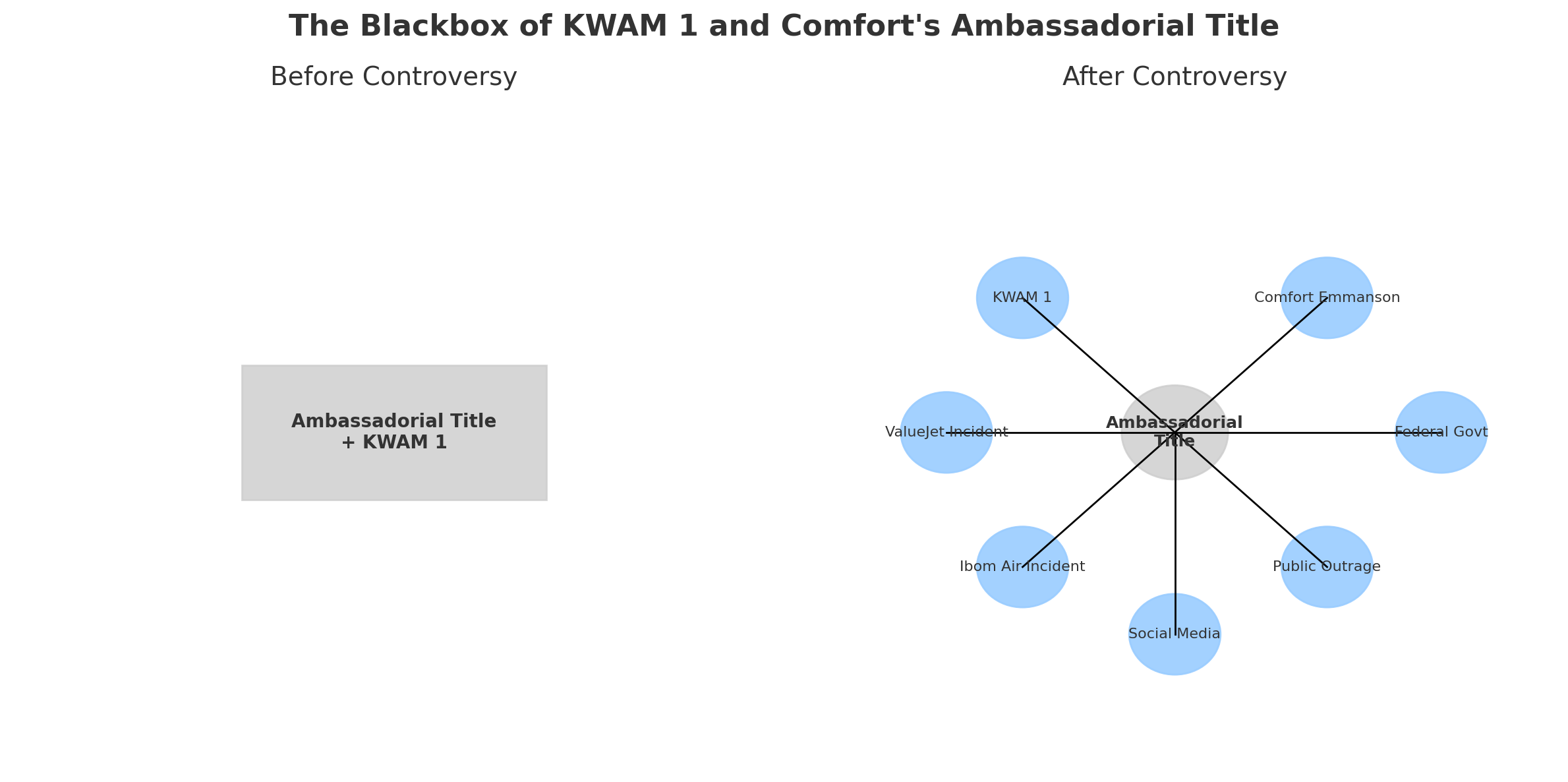

In Nigerian public life, politics, celebrity and governance often overlap in ways that surprise the public. The recent events involving Wasiu Ayinde (KWAM 1), and Comfort Emmanson have become a talking point across the country. What at first seemed like a small government appointment has grown into a national conversation about fairness, credibility and how leaders send messages through their actions. In this piece, our analyst presents the negotiations and renegotiations of the Federal Government’s appointment of KWAM 1 as an aviation ambassador shortly after an incident in which he was accused of unruly behaviour from Nigeria’s X space.

Aviation Minister Festus Keyamo explained that the role was unpaid and intended to promote proper conduct at airports. Still, many Nigerians saw a contradiction. A man who had been in the middle of a dispute over airport security was now the public face of airport security awareness.

The public response became even sharper when people compared this with Comfort Emmanson’s experience. She was involved in a separate case with Ibom Air and was punished much more harshly, including time in prison. For many observers, the difference in treatment raised uncomfortable questions about justice, equality and who gets second chances in Nigeria.

At the centre of this discussion is the ambassadorial title itself. It may be an honorary position but it carries symbolic weight. When the government gives such a title to someone, it signals approval and sets an example. The question is whether this example is one the country should follow.

Several groups of people are now part of this story. There is KWAM 1 himself, Comfort Emmanson, the Federal Government, and political figures such as President Bola Tinubu and members of the ruling party. There are also journalists, commentators and everyday citizens on social media. On another side there are the incidents themselves, the evidence that has been shared, and the concept of the “rule of law” that people keep referring to in their arguments. All of these elements interact to shape how Nigerians see the situation.

The loudest points of disagreement are about fairness and political influence. Many believe Comfort should be treated in the same way as KWAM 1 if the government wants to be consistent. Others think that appointing someone after a security breach undermines the seriousness of aviation safety. There are also those who see the hand of political loyalty and friendship in the decision.

In response to the backlash, Festus Keyamo stressed that KWAM 1’s ambassadorial role was not a reward but a service. He also suggested that Comfort might be considered for a similar position. To some, this sounded like a fair offer. To others, it was simply an attempt to calm public anger without addressing the real issue.

Satire and humour have also played a part in keeping the story alive. On social media, some joked that Comfort should be made “Ambassador of Hostess Services” or that anyone in trouble should commit their offence at the same time as a famous person to avoid consequences. These jokes carry a sharp edge because they point directly at the perceived double standard.

The government’s effort to change the narrative has not closed the matter. Many still feel that the original decision sends the wrong message. In the court of public opinion, symbols matter as much as facts. The ambassadorial title is not just a line in a government announcement. It is a signal that shapes how citizens judge the seriousness of leadership and the values that leaders promote.

What can be learned from this? Leaders should recognise that public trust is built not only on laws and policies but also on the examples they set. Once the public connects a symbolic act like this appointment to broader concerns about fairness and influence, it becomes hard to repair the damage without clear and consistent action. Citizens, on the other hand, show that they can keep attention on an issue by speaking out, comparing cases and refusing to let important questions fade away.