Samsung is having a real challenge in Africa as Tecno has overtaken it as the leading smartphone brand in the continent. Yet, Samsung has one solid technology it can deploy to provide it a good competitive positioning: Bixby, the voice assistant technology.

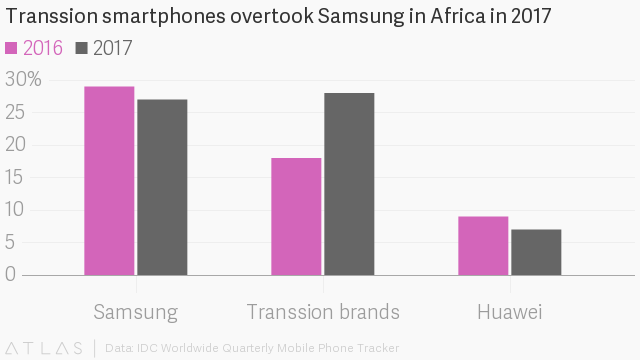

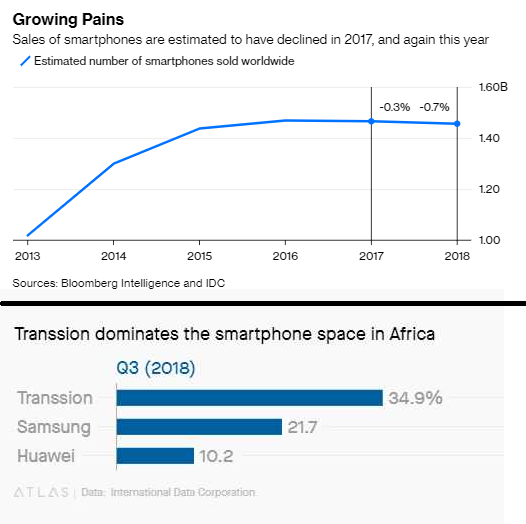

In 2018, Samsung is expected to lose up to 6% (from 27%) of market share in Africa. Transsion will hit 35% (from 28%), and is projected to hit excess of 50% by 2021 because it delivers many things at once: affordable pricing, regional marketing, good product and innovation in local necessities like multi-SIM cards.

Tecno inspires me on how to build and run a hardware business in Africa: fashionista pricing does not work! This is one company you must study; it has proven that Africans do not care on brands when pricing makes no sense

As I have noted, Africans have enjoyed voice communication for ages, and bringing Bixby at scale and biased for our language flavors, will give the company an opportunity to win markets and territories in the continent. But in this case, Bixby will not just be for communication but as a vehicle to stimulate financial inclusion, trade and commerce where it becomes an operating system for banks to make loans, traders to transact businesses, consumer payment, etc, via voice.

What Walmart, Google, Microsoft and Amazon are all doing is setting up the stage for the next battle in computing: voice operating system. Anyone that builds the best will triumph. Think of Google Search supremacy over Microsoft Bing and Yahoo Search, and how Google has come to dominate search. The voice business will not just be for London and New York, the developing world has massive opportunities in the voice space since that is where the highest level of illiteracy exists at the moment. Computing delivered through voice will be more appealing there over the present text-based format. For entrepreneurs with capacity to do voice, this will be highly rewarding in places like Africa.

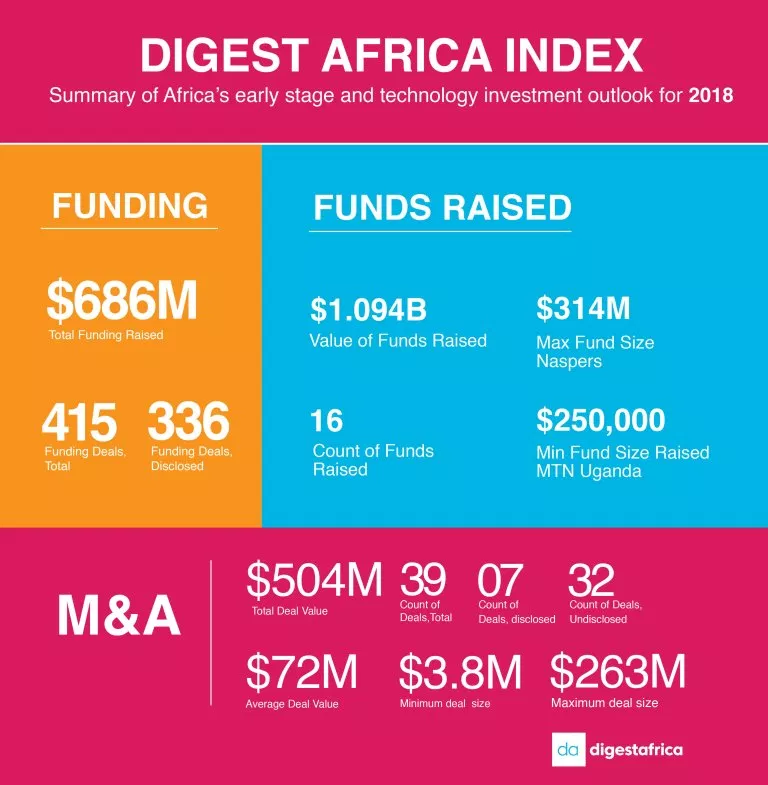

To do that, Samsung has to partner with local microfinance institutions, banks, and startups, offering the technology through its smartphones and supporting everything with initial $1 billion to seed Bixby Finance Africa. If it does that, it will become a dominant platform, far ahead of Tecno, as many will move into the ecosystem to enjoy business via voice in the continent. Samsung Pay, exclusively available on Samsung phones, should power this Bixby Finance.

But where it focuses on competing purely on hardware, I am not sure Samsung has any chance because Tecno does that simply better as its manufacturing is more local and it seems to have better local insights on the smartphone business. Tecno has accumulated a lot of capabilities in Africa and cannot be overtaken by making pure hardware.