Africa’s early stage and technology companies for the year 2018 raised a total of $1.19 billion in total deal value even though 103 deals – representing 22.7% of the total 454 deals recorded – never disclosed their amount, reports Digest Africa Index. Fintech won the race and Naspers was dominant as a funder. Also, Digiest Africa team picked some deals missed by WeeTracker which had reported $726 million as total raise.

Last year recorded a whopping $1.19 billion in total deal value even though 103 deals – representing 22.7% of the total 454 deals recorded – never disclosed their amount. However, we also believe that the figure could have been higher than $1.19 billion had the values of certain deals been disclosed. Jumia and M-Kopa are among the companies that never disclosed their deal amounts.

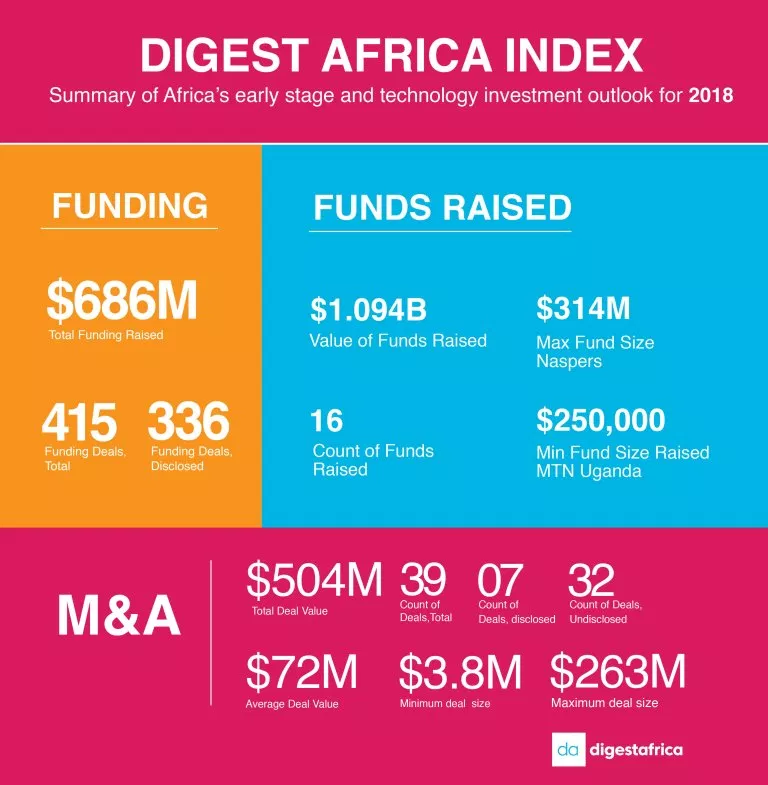

Technology companies across Africa raised a total of $686.4 million in funding across 336 disclosed funding deals of the 415 recorded. The East African region, with $303.9 million which translated into 44.2% of the total funding raised, registered the highest amount. Amongst countries, Kenya, with 22.8% ($156.5M) of the total funding raised, recorded the highest while the financial services sector recorded the highest amount of funding raised on the continent with 92 deals representing $276.7 million.

The financial services sector contributed 40.3% to the total funding raised across the continent in 2018. There were 39 M&A deals recorded in Africa’s technology space though only seven (7) of these were disclosed. South Africa registered the highest number of deals with twenty-four (24) and six (6) of the deals whose amounts were disclosed also came from the country. Compuscan, which Experian acquired for $263 million, and WeBuyCars that was acquired by Naspers for $94 million – through OLX Group – recorded the highest M&A deal values.

Lastly, a total of sixteen (16) technology-focused funds were raised adding up to $1.094 billion in value. 69.8% of the funds raised were early stage focused and 47.7% of them were sector agnostic. Naspers’ $314 million South Africa-focused fund was the largest fundraising/commitment recorded in 2018. European Investment Bank (EIB) was the most active investor on the continent participating in investments into five (5) funds: Partech Africa Fund managed by Partech Ventures ($70M), Novastar II managed by Novastar Ventures ($72.5M), Tide Africa Fund managed by TLcom Capital ($40M), Sawari Ventures North Africa Fund I managed by Sawari Ventures ($35M) and Africa Tech Ventures ($10M).