Click this link to be taken to PayPal to process your payment for Fasmicro LLC USA.

The Facebook Blockchain and Cryptocurrency

After mobile, and in the depth of AI, the next frontier is blockchain. Facebook has started the game, Verge reports.

Facebook is reportedly planning to launch its own cryptocurrency, according to a report fromCheddar’s Alex Heath.

Currently, there isn’t too much detail, but the company is said to be specifically focused on using cryptocurrency specifically for facilitating payments on the platform, something that could be a pretty dramatic shift given Facebook’s huge user base and existing marketplace section of the site for buying and selling goods. The company is also said to be investigating other ways to leverage the tokenized digital currency and its underlying blockchain technology across its platform, too.

The cryptocurrency efforts are said to be led by David Marcus, who earlier this week was reported to be leading a new blockchain division at Facebook “to explore how to best leverage Blockchain across Facebook, starting from scratch.”

Update May 11th 1:00pm: Facebook released a statement to The Verge, commenting that “Like many other companies Facebook is exploring ways to leverage the power of blockchain technology. This new small team will be exploring many different applications. We don’t have anything further to share.”

If Facebook goes ahead to create blockchain solutions, many things could change in the industry. With a population larger than Africa, Facebook is a planet. Just as banks are adopting Facebook’s Messenger bot instead of building their own versions, many companies would build on Facebook Blockchain. A Facebook Blockchain would be an operating system because the people are already there: it would have at least one billion users overnight.

Yet, I would not believe that Facebook would build a cryptocurrency. If it does that, it would be a recipe to be broken as a company. Ethereum Foundation is already under heat for ether [the U.S. Securities & Exchange Commission is concerned that a small Foundation could oversee such a huge asset]. Facebook would have impacts in multiples to whatever Ethereum is doing today.

The second most valuable cryptocurrency behind bitcoin, Ethereum, is under regulatory scrutiny by the Securities and Exchange Commission (SEC), which is considering whether it should be classified as a commodity or a security.

A Facebook cryptocurrency would mobilize not just startups but banking institutions against the social media giant. If it happens, it can be a currency which will be useful, not tethered to any real-money benchmark because Facebook is a huge continent of itself. Provided everything stays within its network, it can claim that it is simply a “mileage system”, or a “loyalty system” or at best a “transferable reward system” which is uncorrelated with any real currency. Then, it would add in its terms “You cannot exchange the Facebook coin for any other currency. It has no value outside Facebook”. Of course, people would go ahead and trade the coin even if it means swapping Facebook accounts.

People, this would be interesting and could happen. Yes, crazy things have happened in the past: a Facebook crypto could be dangerous to nearly every digital business in this world. That currency could be deployed across its platforms including Instagram.

I noted many weeks ago that Facebook (and Instagram) have become major ecommerce players. Now, Instagram has stepped up the game with a native payment system. The implication is that you do not need to leave Instagram if you want to shop for some items posted by some merchants. I expect sellers to move to these platforms because that is where the customers are.

But if Facebook is wise [ I know it is], it should just focus on blockchain for whatever, and stay away from currency unless it wants to be broken into pieces by regulators.

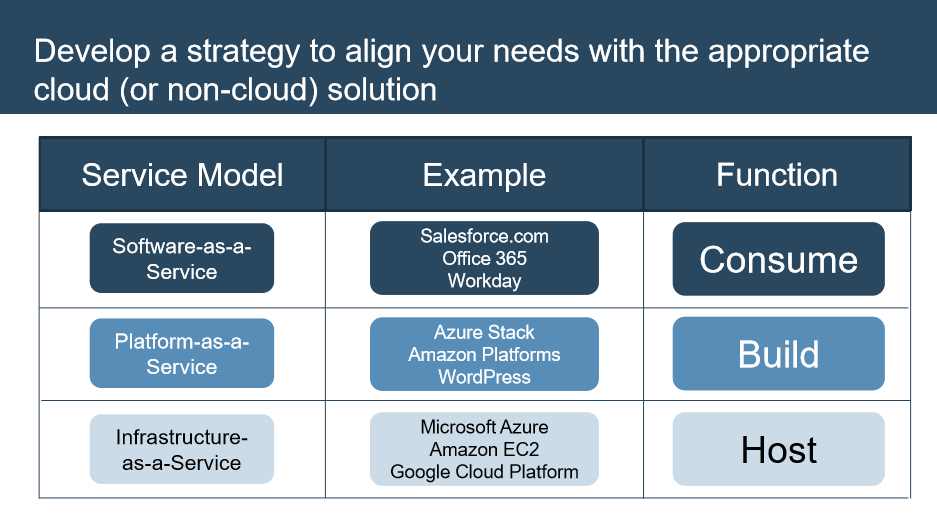

Comparison of Public, Private, Hybrid and Community Cloud Solutions

There are many things to consider when choosing cloud services. In this piece, I look at them, and then compare the different options: public, private, hybrid and community cloud solutions. Certainly, getting the best in cloud requires a strategy, communicating that strategy and executing a roadmap. Cloud is not as easy as many people make […]

ALTON’s Telco Challenge and Solution to Nigeria’s OTT (WhatsApp, Facebook, etc) Issue

Nigerian government should do all necessary to avoid the temptation of trying to regulate the OTT solutions like Facebook, WhatsApp, etc despite the agitations from the industry players. The fact remains that no person can effectively stop the trend of innovation which is global.

“For example, the likes of YouTube, Facebook,Twitter, WhatsApp, Blackberry Messenger and many others are called over-the-top services that are not part of the core services for which operators are licensed.

“These over-the-top services have social, economic and security implications.“If they are not licensed, it means they are not regulated, and in that case, there is no limit to the scope of what they can do.“There is also no control over services and content they may provide,” ] Gbenga Adebayo, Chairman, Association of Telecommunications Operators of Nigeria (ALTON)] said.

According to Adebayo, nowadays people send messages mostly on WhatsApp and some other social media platforms than they do on the conventional SMS services.He noted that telecom operators were only licensed to supply voice, data and text messages for which they were charged on annual basis.“Over-the-top services don’t have those types of attraction, which I believe is a loss of revenue for both regulators and the country,’’ Adebayo said.

While one can understand the challenges these solutions pose to the business models of telcos, the fact remains that telcos still have options available if they want to work harder. For the very fact that users must have internet access to use WhatsApp and Facebook, telcos can move from pay-as-you-go (PAYG) billing to subscription billing. Once the user has paid the monthly subscription, it is largely irrelevant what he/she does with it within a bounded bandwidth/data transfer capacity.

But the telcos do not want to invest in research to invent new business models. And that is why they are complaining. They have the customer biometric data with all demographic data. The industry can create an equivalent of BVN [I would prefer they merge them] to pioneer subscription contract-based billing. So, at the beginning of every month, people have to pay for subscription to enjoy internet on their phones. They would categorize the products based on data transfer/bandwidth tiers. Indeed, the credit system that doesn’t exist in Nigeria can be built. Telcos are well positioned to do just that if they partner with banks.

The problems of OTT are not unique to Nigeria. It is global. Most global telcos which have moved to subscription-based billing are handling the challenges better.

OTT players, are unregulated; they don’t have to have a licence, they don’t have to produce local content, they don’t have to employ anybody in any country, and they don’t have to pay any taxes. Everyone loses with OTT

Aggregation Construct

ALTON’s thinking that “telecom regulators should no longer be neutral to technology regulation” is unfortunate. The fact is this: any telco that blocks YouTube, Facebook, WhatsApp and Twitter in its network would go out of business. And any regulator that tries to do that would not be effective doing it. It is a very complicated challenge that no one can solve in Nigeria through regulation because you are dealing with aggregators who are largely sequestered from your domains.

Twitter does not have any physical presence [I am aware, I must note] in Nigeria but its services are used there. How do you police them? If you push Facebook too much, it can simply abandon Nigeria – we do not have the scale of China to make these companies bend. I am not sure YouTube would change its business model because of Nigeria.

All Together

Telcos should invest in business model research and find ways to move from PAYG to subscription-based billing. That way, they would care less on what people do with their phones on their networks as the subscription must have covered those expenses. Regulating technology would be extremely dangerous. If we allow Telcos to succeed, the newspapers can ask for the same consideration since Facebook and Google are decimating their business models also. When you are dealing with aggregators, you rarely win because aggregators operate with near-zero marginal cost. Yes, their products are extremely valuable to the users even when they pay absolutely nothing [sure, I get it – privacy of data]. If you hit them hard, you would lose the soul of your business.

Comment from LinkedIn

This is a comment on my LinkedIn feed on this piece. You would like this further insight.

Interesting piece Prof. OTT’s are disrupting business model globally like you clearly stated. Evolving their business model could come in as a succor to the Telco operators, which comes with some further investment to really thrive. I also think the Telco operators in Nigeria are not really keen towards further innovations in generating new revenues streams. Preserving their existing revenue stream seems to be their best alternative by seeking for regulations over the OTT. Apparently you get better call quality using the OTT services than some of the providers network, still perplexed at this. The demand for more data to utilize the OTT services led some operators in other developed country to focus on their data services by improving the speed of connections, data plans, expanding the network reach and upgrading their Network to be LTE capable to grow the demands for data. Since Data usage will overtake voice calls at some point, there are specific number of calls or chat I can have per day or data I can consume per month. Innovation towards other value added services, especially content aggregations via the Telco with flexible plans and affordable data bundles packaged can complement for the revenue short falls on Voice.

Three Pillars Driving Amazon and Facebook Growths – Flywheel, Synergy and Vision

The Flywheel model is very important business concept in modern digital businesses. Amazon is built on that. This video explains how Amazon has grown using that concept, integrating synergy and vision in the whole nexus. I have already noted the One Oasis strategy which captures all at the higher level. Simply, if you run a platform business, you essentially have one product which is a platform. By doing all necessary to keep that positive continuum growing, you would continue to do well. The best product in Facebook is that it has many people. Every other thing is largely irrelevant. So, for Facebook, provided it can continue to feed that platform, bringing more people and making the product better, it would continue to find success. Physical flywheels store rotational energy; digital businesses built on flywheel concept improve future customer experiences by using past understanding of the customers.

“The Flywheel” is a very useful analogy for implementing business strategy created by Jim Collins. It describes how driving a new strategy is like getting a huge flywheel into motion. Initially, there is no movement – many people think that the strategy is absurd – it is almost impossible to imagine the flywheel at speed.