Here are some photos from our lab. It is an imaging system.

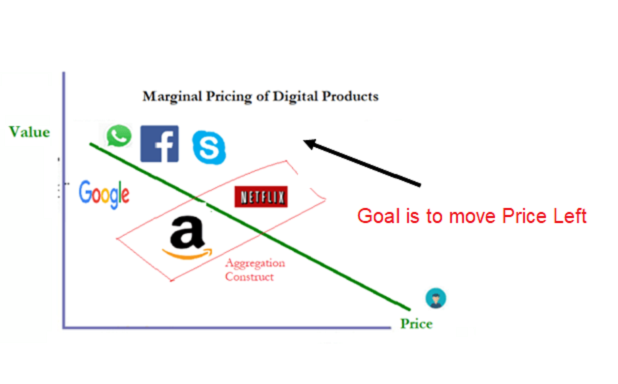

In a perfect market, the marginal cost of a digital (online) product is zero. This means that the price of a digital product tends to zero: welcome freemium and ad-supported business. However, only firms with network effects dominate and benefit. The core reason is that if in a perfect market, and the marginal cost of producing digital product is zero, the price will inevitably go to zero.

This is the heart of the freemium model where you get many things free, which is possible because of the aggregation construct, where companies provide those digital products and then create an ecosystem to sell adverts. The firms benefit more than the suppliers by providing the platforms [Facebook makes money for photos supplied by families. Sure you like the Likes]. As shown in the Figure, great companies deliver the near-zero marginal price for high quality product, making it challenging for anyone that carries a non-zero marginal price to compete, exacerbated if the product is even not top-grade. This is one of the biggest challenges digital entrepreneurs face.

Students of Federal University of Technology, Owerri (FUTO) Nigeria visited one of our design centers in Eastern Nigeria yesterday to learn about microelectronics, embedded electronics, FPGA and AIs. I graduated from this university and we have had a solid partnership for years. In short, most of our engineers are FUTO graduates. We work with the university to train the students on what we need. I have also taught courses in my former department. Our Intel FPGA partnership, one of the two in continental Africa, continues to be strengthened because of our FUTO partnership.

In this Harvard Business Review piece, I wrote on how we could learn from ants to become better leaders. I was on a trip to a leadership workshop of IEEE (Institute of Electrical & Electronics Engineers). As the then-GOLD Chair of IEEE Boston Section, the largest section in U.S., I was responsible for managing MIT, Harvard and other universities in New England. Here are the key attributes of ants: teamwork, trust, openness, diligence, and tenacity.

As I watched them, the theses project flashed to my mind. Wouldn’t it be good to trust others to help you? Right there, I made the following decisions on the project:

The ants worked as a team: I will form a team, bringing professionals together.

The ants trusted one another: I must do away with the notion that only by working alone can I ensure quality.

The ants were open: I will share the idea with like-minded people. I later got a Boston area professor to lead the design. When ants discovered food, they informed others, who came along and helped.

The ants were partners and of different sizes: I will bring help and make the task our project, not mine. As much as possible, each team member will get assignment based on his capability.

The ants were diligent and focused: The team must keep working, even slowly. Deadlines will give us focus.

The ants regrouped: I will be open to try new ideas if present ones are not working.

Few days later, the Catholic Church picked the piece and integrated it into a leadership manual. Mumbai’s DON BOSCO’S MADONNA, a publication of the Catholic Church, still has a link online. There Fr. Erasto Fernandez deepened the piece. It made one of the best articles of the year from the Harvard Business Review with the founding partner of Clayton M. Christensen investment firm using it to explain delegation.

If you can, read that piece. You would become a better Founder. Unless you are Open, you cannot delegate. And until you begin to Trust, you cannot expand the business. When only you is smart [you think], you cannot build a functioning Team. The point is this: that business has not grown because you cannot find someone that can manage an extra branch or responsibility. So, it remains a small shop. Unless you become like an Ant [trusting people, opening up, learning to delegate, forming team spirit, etc], you would remain a shop, small and irrelevant.

We all know that Nigerian banks are declaring tons of money as profits. If you check very well, the transaction-based fees are growing faster than the interest-based fees. In other words, banks make money by charging fees. Lending is an after-thought. (This is not necessarily the fault of banks; topic for another day.)

One of my banks charges monthly debit card maintenance fees. Yet, if you want to avoid debit card to use paper mandates, they impose fees. Largely, there is no way you can put money in the bank without paying to get it out. The bank management few years go stopped automatic rollover of Treasury Bill investment to make sure you initiate the contract monthly so that all the fees are repeated, monthly. It is unfortunate.

But I can absorb the fees. Not many of my fellow citizens can. As I have noted before, unless the Central Bank of Nigeria can get ahead of these fees, its financial inclusion crusade would be muted.

To accelerate financial inclusion, the Central Bank of Nigeria should reform the varying levels of fees in the banking sector. Those fees could be discouraging the very people it wants to attract into the banking sector. For someone making N18,000 monthly and having to part with N300-N500 on fees and associated SMS charges, it could be a disincentive to bank. People are smart and when there is a burden via fees for extremely cost-sensitive people, any policy will collapse. CBN needs to revisit bank fees and work with our banks to find better ways to offer products that can reduce cost burdens on poor citizens. This is not a problem that technology can fix because the fintech companies do not take customer deposits. So, it is only policy that can solve this, and only the central bank has the capacity to make that happen. Yes, banks are not charities and are there to make money. So CBN needs to balance its policy.

Banks lost 2 million customers in 2017, dropping from 61 million to 59 million. Active bank accounts also shrank, from 65 million to 63.5 million in 2017.

Despite Central Bank of Nigeria’s (CBN) effort to promote financial inclusion, the Nigeria Inter-Bank Settlement System (NIBSS) banking industry statistics shows that the number of customers using financial services reduced in 2017.

The statistics obtained by the News Agency of Nigeria (NAN) from the NIBSS website on Sunday, showed that the total number of bank customers dropped from 61 million in 2016 to 59 million in 2017.

Similarly, active bank accounts reduced from 65 million in 2016 to 63.5 million accounts in 2017.

According to News Agency of Nigeria, banks think people are closing accounts because of Buhari anti-corruption efforts. That is partly the reason, but relying on that is laughable. The total number of civil servants in Nigeria at positions to do corruption is not in the region of 2 million people. So, there is no way we would lose two million customers purely because of anti-corruption crusade in the 3rd year of Buhari presidency.

“When Buhari assumed office, many people abandoned their accounts, especially civil servants because of fear of investigation.

“While some out rightly closed down their accounts, others opted for gradual withdrawal so as not to raise alarm,’’ the source.

Here are the main reasons:

Fees: But when you speak with people, the answer is clear: “A bank customer, Olaitan Alagbe told NAN that she closed some of her accounts due to unnecessary and illegal charges by banks”. Yes, customers do not like the fees. So, the easiest way to manage that is to close the account. As I have noted someone earning N18,000 monthly could lose N500 on bank charges monthly. That is very significant.

Interest Rate: Another reason is the low saving rate. From a bank customer according to NAN: “First of all, the interest rate is next to nothing, so there is little reason to keep your money at the bank when you can turn it over doing other businesses”.

When you combine high fees and low savings rate, CBN would begin to see why people are losing interest in the bank sector. Of course, the people who can afford the bank fees would not close an account because of N500 charges. But the citizens, usually the poor, who the bank wants to join the sector would struggle.