I admire China. That country is very brilliant in its technology policy. In its economic and commercial policies, it is not far behind. I do not know of any nation in history that has accomplished what it did. It condensed what took the West one hundred years into 25 years. China has a population that is bigger than Africa’s, but its people are not dying in the Mediterranean, for attempting to smuggle themselves into Europe for menial jobs.

Yet, China is not perfect. It is a puzzle that no one understands. The West will bash it, only for the next day to ask China to come to party. It is a country that has become so confident of itself that it wants most things done on its own terms.

Think about it: China banned Facebook in the country, but it is also one of the main advertises on Facebook. It does not make sense, but when you pay more attention, you will understand that China operates that way. For all it does in the world, it is what it thinks will help its economy that matters. If advertising on Facebook makes that possible, there is no problem with that.

Cisco is now on its 8th consecutive quarterly drop, not because of competition from any U.S. company, but because of one major Chinese company named Huawei. In a period of global expansion, who would have projected that Cisco will be in this type of mess. Huawei has won, not just on pricing but also on technology.

If you go deeper, the trouble in GE today and its cutting or eliminating dividends momentarily is because of competition from China. The more I study all the press releases and the statements from GE, the more I see one key factor: GE is extremely powerless because its markets have changed dramatically. It will be tough quarters ahead for GE. Chinese state enterprises own the markets GE is participating in right now. Always remember that when China brings funds, Chinese companies do the jobs with Chinese machinery and technologies. When that happens, someone has to win and some will of course lose.

Even the challenges IBM has faced recently can be attributed to China. If the global economy is expanding and some of the finest Western companies are experiencing decreasing revenues, it simply means that someone is taking market share from them. China is indeed that someone. The wins are everywhere including in supercomputing.

Overall, China now leads the supercomputing race with 202 computers to the US’ 144. China also leads the US in aggregate performance. China’s supercomputers represent 35.4 percent of the Top500’s flops, while the US trails with 29.6 percent. With an anti-science regime in charge of the government, America will only continue to see its technological lead decline.

When I read that Qualcomm is investing millions of dollars in China, I smiled.

“This group of innovative companies focuses on AI, IoT and other areas. We strive to help these companies make their ideas and creativity a reality, by providing financial, technology and business support. Qualcomm Ventures will continue to enable innovation among startups in the frontier tech areas, and help grow the entire industry,” Quinn Li, VP and global head of Qualcomm Ventures, said in a statement.

Simply, from Qualcomm to Apple, Google to IBM, everyone has seen that the future belongs to China. It is obvious and there is nothing within view that can change that trajectory. China has advanced so much in manufacturing that no one even wants to try anymore. To try, you simply have to pay Chinese to come and open a branch office in your locality as the state of Wisconsin USA is doing.

Gov. Scott Walker (R) and Foxconn Technology Group Chairman Terry Gou will sign a final agreement Nov. 10 granting the electronics giant $3 billion in tax incentives for a massive manufacturing campus in southeastern Wisconsin.

Yes, an American state is offering $3 billion tax incentives to a Chinese firm. That is the story these days: China is coming and it has its own terms. You either comply or another nation takes the opportunity. And what they are doing is working as they continue to rack up billionaires. From Wall Street Journal:

The number of billionaires in Asia surpassed that of the United States for the first time last year, according to a report by UBS and PricewaterhouseCoopers. The number of Asian billionaires grew by 23% last year, compared to 5% in the US, and half of those billionaires were Chinese.

According to Fortune Magazine, “on average, a new billionaire is minted there every other day” in Asia. That Asia is primarily driven by China. China is winning and there are many reasons why that win will continue:

- China has a working leadership that gets things done. When they want to execute on a project, China mobilizes its citizens to get that job done

- China is winning on trade. When you win economically, good things happen. As they turn out great empires like Alibaba, Tencent and Huawei, the strength of China will widen. Forget that Chinese government plans to take “equities” in some of these digital companies. That is also why it is China – a government takes equity in a private company so that it can be part of the company’s strategic decision making.

On top of all the external controls, Beijing is also considering taking a stake in some of China’s largest internet companies, according to the Wall Street Journal. Planting a flag in those firms would likely give the Chinese government a more absolute role in corporate decision-making.

- China is doing a lot in the technology space. Some of the most fascinating technology companies of the future will come from China. The resources they have will give them an edge.

All Together

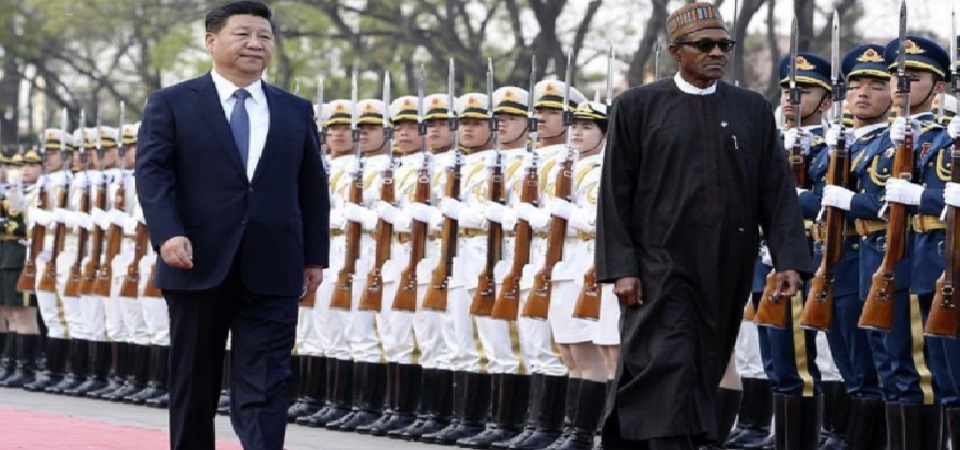

My recommendation for Nigeria is to push towards a stronger relationship with China. We need to be thinking of the state of the world in 30-50 years and how China is going to be making most calls. A man that gives cash is always at better positions to one that gives credits. China comes with cheque while the West comes with forms to apply for credits. You can accuse China on whatever you want to accuse it, but the fact is this: it is not freezing your brain to agree to its terms. If a Chinese company had come to Nigeria with a condition that it would not pay tax for years, many people will complain. But Wisconsin State, USA did just that. Brazil has been doing that regularly, attracting Chinese firms who use Brazil to serve Latin America. We need to have a real policy to understand China.

I do believe that Nigeria can begin that process by making efforts to structure its scholarships (NDIC, NITDA, NCC, etc) to include Chinese universities, not just American and European ones. And those scholarships cannot just be for technology and engineering, but also policy. When we understand China, it will be easier for us to do business better with China.