Good job Barr Adebayo Shittu, Minister of Communications, Federal Republic of Nigeria. The Honourable minister works really hard. He has so many ideas and he is working. While I do not like the smart city initiative, I am in for his plan to establish an ICT Bank, as reported by the Guardian.

Adebayo Shittu, minister of Communications, has said the Federal Government will soon establish a specialized bank to cater for the development of the Information and Communications Technology industry.

Shittu who stated this at the 13th International Conference of the Nigeria Computer Society (NCS) in Abuja on Tuesday also disclosed that the proposed ICT University would take off in September.

Justifying the decision to establish an ICT development bank, Shittu said the regular banks cannot cater for the needs of operators in the ICT industry because of the time it takes to develop ICT products and services, from conception to market.

The minister said the proposed bank was provided for in the ICT Roadmap which, he said, has been approved by the Federal Executive Council.He said, “I am happy to inform you today that the Information and Communications Technology Roadmap has been approved by the Federal Executive Council.

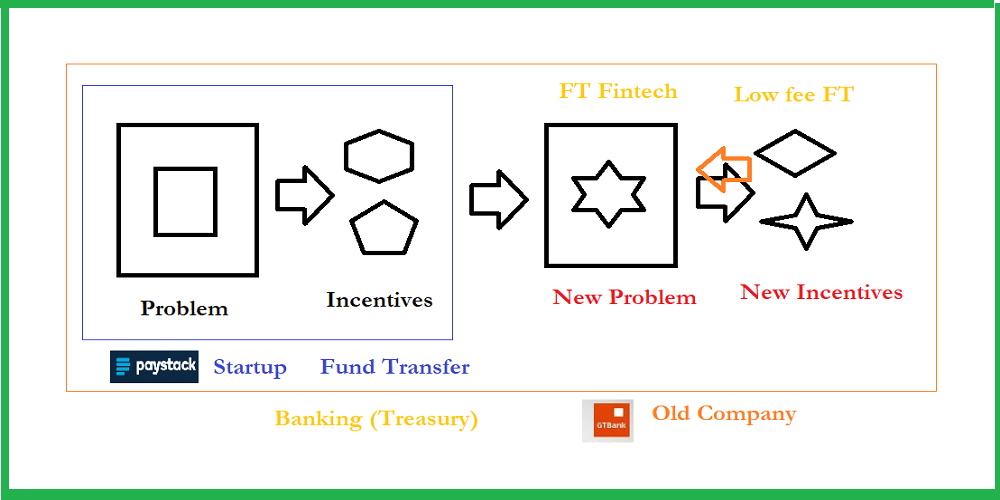

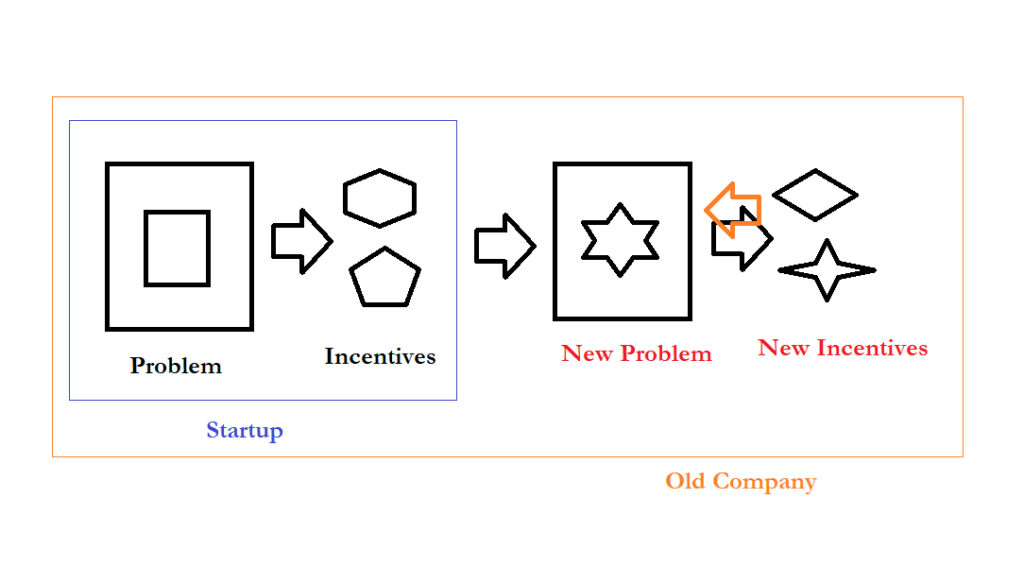

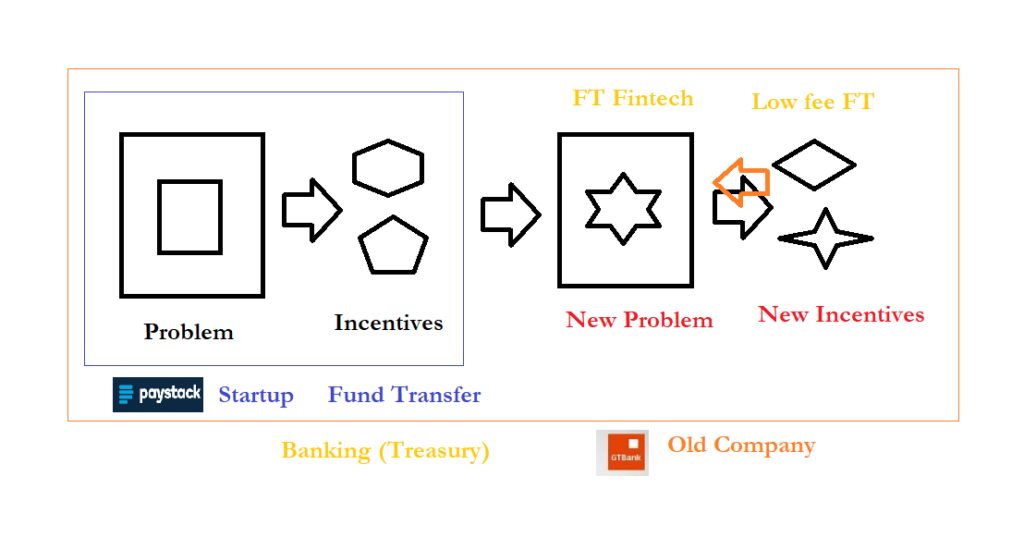

The fact is clear: the present funding institutions are not structured for funding startups. Startups can go for years, without a single revenue. This means the commercial banks and Bank of Industry cannot help. Hence, what the Honourable minister is planning is a good one.

Here, I offer some perspectives on how our Honourable minister can make this bank deliver on its mission. It has to be totally different from Bank of Industry (BOI), which requires entrepreneurs, to get sureties, and in some cases collateral. to access capital The fact is this: only those with means can have access to those documents or assets.So, at the end, the people who may need the funds, never get support from BOI.

ICT works on brainpower and that must be recognized. That one does not have rich family members for sureties, or parents that own assets like land, which can be used as collateral, must not limit the individual.

Also, it has to be totally different from the way commercial banks support companies today. The 20% interest rate will not work, when startups have to build businesses over years, before they start making money. We need a new model to build this bank which is certainly going to play a huge role in our future. This week, I made a call for African Union to take action to accelerate such funding mechanisms, across the continent.

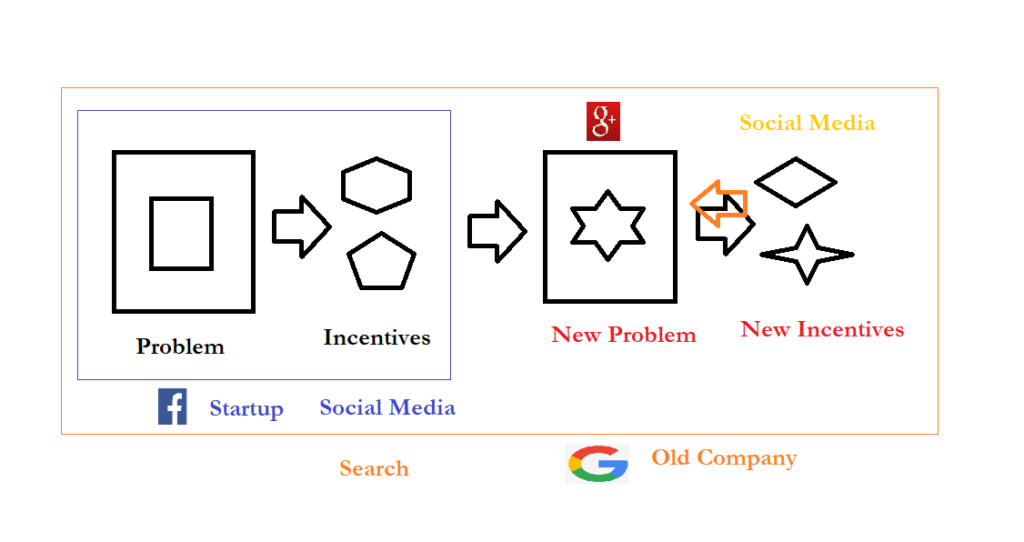

This is huge [Y Combinator $1 billion planned fund] and this will ensure the next generation of companies, indeed future Dropbox, Facebook, and Google, will be seeded in America. America is such a blessed country that its private companies can drive such national agenda. It is simply unprecedented at the scale they do this. As their President tweets tonight, he knows that some people are holding up for America, irrespective of whatever he will do tomorrow

We present core pillars for considerations by the Honourable Minister and his team as they craft this new bank:

- Make the bank a clearing house: This means the bank will not invest directly by itself. Rather, the bank will pool the funds and invest in venture capital firms with locations in the specific regions in Nigeria where they will be investing. Venture Capitalists (VCs) will be required to have presence in the regions where they will invest and they must have capabilities beyond writing cheques.

- Allow VCs to compete for the funds/Local Presence: The VCs can be local or international, but they must be located in the specific region of Nigeria where they have to invest.This is important as Nigerian startup problem is not just money. They need many things like mentoring, networks, linkages etc to get ahead.

- VCs must De-risk the Bank: VCs must provide collateral, in different forms, to protect government as the funds are provided to them. We want only funds which are sure they are coming to invest, to join this game. And only funds with at least 3 years prior-investing experience can participate. Banks can be allowed to also participate but they must run it separately from the way they run their current lending programs,

- Offer Funds at 5% interest rate to VCs and Strategic Guarantee: VCs will take the loans at 5% interest rate with funds return due within 10 years. It is important the funds cost the VCs something so that they know they have to work. Government will also have to guarantee up to 75% of losses in seed funding phase, maximum of $20,000 and not more than 5 of such, pear year, for any VC. This is important to give them room to take more risks, instead of waiting for post-revenue startups. Other investments phases, above $20,000, will not have any government guarantee.

- Tax Holiday: Every VC will have the opportunity to defer paying taxes from the profit arising from government fund for 10 years, provided those specific taxes are re-invested. That means if they make money from the government tax, they do not have to pay any tax on it provided they re-invest that waived tax into startups. For other funds, not connected to government support, government can also offer them the same. Please note that they can use the profits to do whatever they want. But only the taxes they could have paid to government is what I am proposing they avoid paying and put back to work

- Investment Committee: VCs will have their investment committees and will run their businesses independently, but whenever they need to invest any money from the government-supported fund, they must inform the bank. Government will just record the transaction, nothing more. The VCs must be required to have independent investment committees, drawn from industry to ensure there is no corruption in the system.

The ICT Bank is a good idea, and must be managed to avoid bureaucratic mess. We have to structure it in such a way as to make it easier for our young people that need the funds to access the opportunities.