In this piece, I explain why Nigeria should work to become a global center for regulated cryptocurrency/blockchain apps. Since the leading nations like U.S. and Germany have refused to regulate these new technologies, Nigeria has an opportunity to lead and enjoy the benefits inherent in them. Whether the world likes it or now, bitcoin or its incarnate under the architecture of blockchain is certain to be part of future commerce. The earlier we understand that and make it legal, the better.

9Mobile (nee Etisalat) Logo Resembles This U.S. Apparel Logo

I was in Target last night for back to school shopping and saw this logo of an apparel company. Quickly. the 9Mobile logo flashed through my memory (if there is anything like flashing through memory). Sure, 9Mobile will not be selling clothes in America. But should it decides to do so in the near future, it may have some minor issues.

Brand Logo of Champions in Target USA

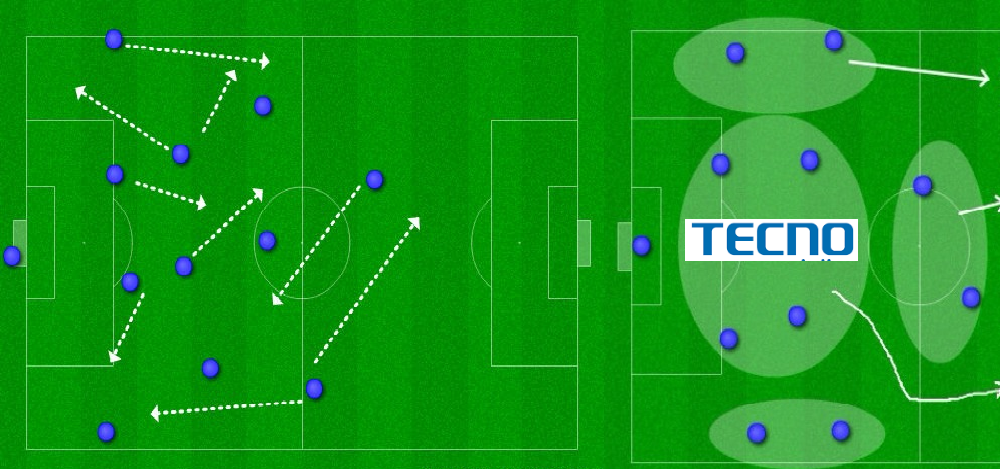

Tecno Mobile’s Attacking Football

Tecno Mobile likes football. And it is playing its favorite position – attack. Across Africa, as the football season begins, it will be wearing Camon CX Manchester City Limited Edition Smartphones jersey. Guardian describes it elegantly thus: “Tecno Camon CX flagship is the latest in a line of photo-focused smartphones of the Tecno Camon series; best known for its premium camera upgrades and pocket friendly price tag. The Camon CX Manchester City Limited Edition features the City blue colour and includes the official crest on the reverse”.

Tecno is amazingly impressive and beloved by its fans. It has figured out how to make good smartphones that fit into most people’s budgets. It is treasured in Nigeria, welcomed in India, hailed in Pakistan, and loved in most parts of the developing world. It is very local and yet international in vision. It is scoring and winning the game of smartphone business in most parts of Africa. It offers a great lesson on how to unlock value in new markets through superior mix of quality and pricing.

The Phone Company for Fans

Tecno is one of the fastest growing mobile device brands in Africa. It started business in 2006, in Hong Kong, and today operates as a subsidiary of Transsion Holdings. It has won hearts with its balance on pricing and quality. Today, the company competes for market share against Samsung in the smartphone mobile sub-sector. And head-to-head, Tecno is doing very well, in Africa, against Samsung.

How did it do this? Tecno feels local while Samsung seems exotic and foreign. In deeds and ways, Tecno looks like the nice guy that just arrived in a party and everyone wants to shake his hands because he is sociable and accessible. It has figured out how to work with local partners like SLOT System while engaging hundreds of shops as outlets. You will not feel any elitism in the business model. Its goal remains scoring more goals and it does know how to do just that.

We estimate that Tecno commands more than 20% market in most African markets (excess of 12 of them) where it does business, today. Its products are really good and it has the local chemistry. Its latest product, the new dual front Led flash device, Tecno Camon CX, is a great product for Africa, when you consider the price and the quality.

Playing Football

Tecno wants to move up the branding pyramid and it has started that by working with Manchester City Football Club in England. Man City, as the club is called, is very popular in most parts of the developing world. The visibility and the equity it will get from this will help it fight any brand perception challenge from Samsung. While Samsung has branded with Chelsea FC England, Tecno is taking it to the next level: unveiling a phone for the lovers of the game and the fans of Man City. As Man City scores, Tecno expects to also score. But its scores will be counted in money.

An Uncertain Future

Tecno looks good but it has a faulty business model. It is a hardware company in all elements of it. That is a very bad thing. It has no platform and technically does not own any customer. Tecno is very vulnerable and the company knows that. Selling hardware is a great business but over time, the limit catches on. From Nokia to Blackberry, we have come to believe that fans are not dedicated disciples because as soon as they get the phones, they forget the hardware. The experience is abstracted out of the hardware into the solutions the hardware supports. Facebook, Instagram, and more become the fun while the phone is the pipe. No one remembers the pipe that much unless you are iPhone or Galaxy.

Great modern hardware companies own their fans. Apple has shown that through its business model with App Store and its ecosystem of music and contents. It is not very certain what Tecno will do, if Apple in the next two years decides to offer a new category of the iPhone, moving the present relatively expensive one to iPhone Star but making one that can compete with Android devices. Provided Apple makes the design so unique not to reduce the value of the expensive version, it can still deliver the value for those that use iPhone as a status symbol. The cheap iPhone will help Apple win new customers in developing world. Alternatively, Apple may even name the cheaper version of its phone Apple, while keeping the name iPhone for the current expensive brand.

Huawei, Xiaomi and others are coming. And these competitors are very experienced and battle tested. There is no inherent defense which Tecno has built since it does not operate any platform. As we learn about the challenges of Xiaomi which has China as its main market, hardware is open to so much disruptions.

According to figures released this week by research firm IDC, Xiaomi saw sales of its smartphones drop by almost 40% in China during the second quarter of 2016 when compared to the same period in 2015. The overall Chinese market grew during the same period by 4.6% and while Apple suffered a similarly large drop in sales, Xiaomi’s real competitors in the mid-to-low end of the market – Huawei, Oppo and Vivo – all saw significant growth.

In the 12 months following its record-breaking valuation, Xiaomi missed smartphone sales targets — twice — as well as revenue targets. According to analyst Richard Windsor revenues could drop a further 10-20% in 2016 to give Xiaomi a valuation of just $3.6bn.

These are the major problems ahead for Tenco as it operates in Africa:

- Africa does not really have much of phone brand loyalty. So, they can switch very fast for good deals. As people buy these phones, if they are not tethered to any ecosystem, they can be lost to the next big thing that offers more value. The way people migrated from Blackberry to other brands should be a huge concern for Tecno,

- Huawei is a beast which is waxing stronger across the globe. It is closing up with iPhone on total phone shipment; Samsung remains the leader. These firms will sooner or later begin to put interests in Africa. That will be a challenge for Tecno which is relatively small.

According to the latest statistics from analyst house Canalys, Apple shipped 41 million iPhones around the world in the second quarter of this year – 2 percent up from the same quarter in 2016. Samsung remains the leader of the pack but with flat growth, shipping 79 million units in the quarter.

However, Huawei shipped 38 million smartphones in Q2, up 20 percent year-on-year. Oppo and Xiaomi, two other Chinese brands, also showed tremendous growth, securing their fourth and fifth places with 44 percent and 52 percent growth respectively.

- Thin Margin: Part of Tecno strategy is its thin margin. The phones are really affordable and that means it is leaving money on the table. How far that strategy will carry it remains to be seen. It cannot truly afford this strategy when it does not run any major platform which can cover the cost of the small margin from hardware. It needs to fund growth and it needs to improve margin, across board.

But no one can discount Tecno which relies on its fan base to design the excitement and the hype for its products. It is very good at that in Africa and especially in Nigeria. Being close to the fan, using word-of-mouth recommendations on social networking sites, is something we cannot take away from it. But will that be enough? I do not know, but one thing I know: Tecno has many things going positively for it, and it innovates, but until it can lock some of its fans, it will remain vulnerable. That offers a future for the brand.

Thinking of Xiaomi

The paradigm of Tecno success mirrors that of Xiaomi. What we witness in Africa was the same that Xiaomi enjoyed until the global players took notice.

Xiaomi’s meteoric rise was based on one simple fact: It was able to produce smartphones with premium hardware and features which cost a fraction of those on sale from Apple or Samsung. However that advantage rapidly ebbed away when multiple manufacturers followed suit and produced their own smartphones which offered premium specs at low prices.

Tecno understands this problem and that is why it is moving its product categories upside while making sure the price is not lost in the strategy. Affordability of the phone cannot be the only strategy. It must have many elements of other things to compete. It will need to continue to expand its product lineup and most importantly find a way to own a platform: I have recommended the acquisition of iROKOtv to merge its hardware with a platform that can help boost the low margin it present commands on the hardware.

All Together

Tecno can be the heart of connected everything but the problem is that Africa is not matured for that type of business. Even the content business will be hard for a place where data is a premium. But this company has built a business with good mastering of how the mobile business can be done in Africa and other developing parts of the world.So, I will like to believe it has a plan when more global players take more interests in the continent. If it does, it will continue to score more goals on its bank statements with more wins across Africa.

Mechanics Of Startup Product Pricing

Congratulations! You have built this awesome company. You have products and services, and now you want to price them. The pros discuss the constructs of cost-based pricing and value-based pricing: “Value-based pricing is the setting of a product or service’s price based on the benefits it provides to consumers. By contrast, cost-plus pricing is based on the amount of money it takes to produce the product”. Deciding the model to adopt for the optimal value creation, in your startup, is the next level as you fix the launch date.

You possibly have some marketing guys to assist. Marketing is a great profession. The bests in the field understand how to present their product offerings to customers to get them to open their wallets. Irrespective of the quality of the product or service, a very poor marketing campaign could be very disastrous. This field is full of psychology. They focus on mastering the behavior of man under his limited scarce resources. He must make choices and bring that concept of opportunity cost in action; and making sure your product wins in this choice makes a star marketer.

The Pricing Options

The best marketing strategy begins with pricing. Pricing is such a very huge aspect of microeconomics and the all important topic of demand and supply. Depending on products and markets, a manufacturer could go with value-based pricing or cost-based pricing. In most cases, I prefer the former as the seller could win big provided he understands the potential customers very well.

Under value-basing pricing, you are examining the ability of the customer to pay, focusing on the value you are creating for the customer. So, it opens the door to super high profits or possible losses just to keep your market share. For instance, you want to introduce a new brand in a market and your feasibility studies show that your customers cannot pay more than a certain amount that will enable you to break even. Yet, you move ahead because presence in that market provides future prospects for growth and profitability.

Pharmaceutical companies do that a lot when they are moving into developing economies. The prices they ask for their products are aligned with the power of the patients to pay than what the products cost them. Through that, they increase market share as more patients buy their products. This implies that a drug that sells $200 in Florida could be sold for $50 in Botswana by the same company. Simply, it is using the purchasing power of the market to drive the marketing dynamics.

The other one- cost based pricing- looks at setting price that will give you a certain profit level. You look at your fixed and variable costs and based on those arrive on the price of the product. This method may not be ideal in most cases and I think it is a weaker strategy. Marketing is a behavioral science and having rigidity could hurt you in the market. It is better to know your break even point and possibly ascertain if you can take advantage of the purchasing power of your customers.

In a commodity market where differentiation is very limited, cost-based pricing could win. Irrespective of your pricing technique, it is vital you know your production cost before you map how to market your products. Some markets command great mark-ups while some do not. If your product is elastic, you must approach the market, understanding the behavior of price to your customers.

Similarly, for high entry barrier markets like pharmaceuticals, cost-based pricing will never win. The products are so important that consumers rarely have choices than to buy within the industry. That is why the Big Pharma could make profits in excess of 2000%.

The Pricing Psychology

First, you need to examine how you actually get to buy things. Marketers work our brain. Look at it this way with basic examples. You visit a grocery store and see a big markdown in price; say 60% off. The reality is that there may not be a markdown. The seller simply understands that you will think of a bargain when you see big markdowns and then open your wallets.

In short the propensity to pay $20 for a trouser after the original price was marked down by 80% is higher than paying $18 for a similar trouser without a markdown. The latter does not communicate winning in our brain, while the former gives a feeling of success and win. But in reality, you lost, financially, in the former by $2. Have you ever wondered why a grocer is stocking a product for the first time and immediately marking it down by 30%? They also try to give a relative time stamped pricing like “was $200, now $50” or they yanked a product very high, mark it down immediately and use that old price to give an impression that price was cut.

That brings another point where some airlines will tell you that bags could be transported free and then charge high ticket fees to cover that cost of bag. Others will charge for bags, but their ticket fees are lower. Which one is better? It depends if you carry checked bags when you travel. The one that charges for bags could be more efficient as the price is not shared by all customers. So if you carry checked bag, you pay for it; otherwise, no worries. The other one distributes and subsidies the costs of the bags for those that carry bags and then make ticket fees more expensive for those that don’t. However, you may be stuck with the theme that your bags were not paid in one without realizing that your ticket fee was higher.

Psychology of pricing is in everything we do. Government, especially in U.S., wants our taxes to be withheld and then at the end of the year, they send us tax refunds. Though this is really a very inefficient system to us, the payers, since the government is not paying interest on the money we have “loaned” it, we tend to think we made a gain. Simply, any time you get a tax refund (i.e. if you overpaid your taxes, not for social benefits), it means you have not invested your money very well. You gave government free loan accumulated over one year; that money might have yielded some interests if invested. But what can you do? Nothing, because it is government and in most cases, it can be designed to look like government just did you a great deal while in reality they used your money for free and not paying any interest.

Your Strategy

Pricing is very important and making customers to feel like winners is very important. If you know how to do that, you will have a great product launch. That is why understanding your customer matters. If you do not understand them, you will be leaving money on the table. If your business is selling digital products, the best strategy is value-based pricing since cost-based model does not make a lot of sense: in a perfect market, the marginal cost of a digital product, under most scenarios, is zero. I am confident you will not give out the product for free, unless your business model is freemium, since theoretically the price should be zero.

All Together

A startup must invest efforts to understand its customers towards having the optimal pricing strategy. You cannot afford to leave money on the table by pricing timidly. The ability to ascertain value created by your company is the foundation that will help you model how much customers will pay while considering many other factors like growth, product penetration and competition. As always, it is easier to reduce price than to raise it, in a digital product, especially when you do not have a highly differentiated product. This means you may begin high, and after checking the market dynamics, you will adjust accordingly. You must make pricing a science.

The Amazing Flutterwave

Flutterwave is exciting, not just for its vision, but also for the speed it is pursuing it. The firm provides technology, infrastructure and services which help global merchants, payment service providers and African banks process and accept payments on any channel including web, ATM, POS and mobile. It simplifies the process of managing the African problem – many small nation borders – by building infrastructure for modern trade. From outside looking in, Flutterwave connects the world to Africa, and from inside Africa looking out to the world, Flutterwave can power unbounded opportunities, smoothing the exchange of funds in excess of 150 currencies.

Flutterwave was founded in May 2016 by a team of African ex-bankers, engineers and entrepreneurs. Flutterwave’s award-winning payments infrastructure for banks and businesses helps to drive their growth across Africa. In just over a year since its launch, Flutterwave’s technology has been responsible for processing over $1.2 billion dollars across 10 million transactions. Headquartered in San Francisco with offices in Lagos, Nairobi, Accra, Johannesburg, the company is eliminating barriers to the digital economy for African consumers and businesses.

The company is still a toddler – just about a year old – but it already has a history. It is indeed one of the finest startups operating in Africa today. If it succeeds in its mission, it will be a key entity in modern Africa with the capacity to drive trade drivers in the continent and beyond. Payment business is about the movement of funds and anyone that does that efficiently will be rewarded.

The world believes Flutterwave. It just raised $10 million for “rapid expansion”.

Greycroft Partners and Green Visor have led a Series A funding round of over $10 million in Flutterwave. They will be investing alongside existing investors like Y Combinator and new investors like Glynn Capital. The new capital will be used to hire more talent, build out our global operations and fuel rapid expansion of our organization across Africa.

Make no mistake, Flutterwave Managing Director and co-Founder Iyinoluwa Aboyeji and his team are on a mission. They have a war chest of about $10.17 million, from four funding rounds, to battle in the African payment sector . This battle will be across Africa because other fintechs and local banks understand the competitive implications and their possible existential threats.

The Vision: A Single African Currency

Flutterwave wants to build the real African currency. Sure, it is not a currency in the typical way, with the heads of dead presidents. It is a currency in the sense that commerce can happen within a system that simplifies the movement of funds, agnostic of location and time, across Africa. In other words, making sure that transfer of funds from one part of Africa to another will be so seamlessly done that a man in Cape Town sending money to another man in Lagos will have the same level of friction as though he is sending that money to a woman in Johannesburg. Most friction will be gone, with technology hiding all of them from the users. And when the merchants in Paris, London and New York see Africa, they will see one system – the Flutterwave system. The system becomes the currency of trade because it will be irrelevant where your bank bank is domiciled within Africa. You can pay a man in Cedi in his Accra bank account from a Nigerian naira bank account, in Lagos, and you will not even blink, provided both accounts are in Flutterwave ecosystem.

Once that happens, reducing the constructs of Rand, Naira, Cedi, etc into the background, what will matter is if a merchant, consumer or business is connected into Flutterwave. You can sell to someone in Ghana from Nigeria and he pays you in Cedi but the money shows in your bank account in Naira, in real-time. All the regulatory, cross-border issues, are all complied with, but importantly invisible to you.

There is no ambiguity on this vision, if you read carefully the press release: “Flutterwave’s global payments solutions will make it easier for Africans to participate in the digital economy so you can make and accept payments for whatever you want, in whatever currency or payment method you want, across the globe.”

The Laurels

Flutterwave is a beacon of excellence. For just about a year, this company has built a top-grade technology business that executes at high level. When you mix technology and efficiency, at scale, solving a huge problem, great things happen. For all the Africa-focused Y Combinator alumni, Flutterwave is already one of the great stories. It will open doors that will help on how the world sees new generation of African entrepreneurs. I am so happy that our Iyin is driving this. He has validated many young people before the world, beyond what any conference, promoting Nigerian entrepreneurs, will do in the next few years. And when you know that this young man is just starting, you will be marveled.

The key win for Flutterwave will be becoming the entity of choice at scale in the continent. It may become a very important banking institution even though it is not a bank. The consequence could be huge across African banking markets. The disruptive impacts of simplifying payments especially from the lens of foreign corporation cannot be underestimated. Apple can decide to open a one-African store where all currencies across the continent are accepted; Flutterwave will be a natural partner to it. From Spotify to Netflix, they will see huge value in this firm. There is no need of playing dozens of currencies when one can handle most things efficiently.

Over a year ago today, we founded Flutterwave to build underlying payments infrastructure for African businesses to accept card, mobile money, and bank account payments in a single place. Without this payments infrastructure it was impossible for African businesses to scale acceptance of digital payments.

The Numbers

Good numbers make entrepreneurs good presenters. Flutterwave has processed a total of $1.5 billion worth of translations since founding. This number, I expect, will triple by next year, because they generated it in just few of the countries. When they scale with this new war chest of $10 million, they can put many more things in their views.

Source: Flutterwave

The Challenge Ahead

Flutterwave has solid engineering. But others will not just wait for it to eat their lunch. I expect the local banks and other competitors like Paystack, Interswitch, Remita and amalgam of Kenyan and South African companies to prepare for battle. Unlike most competitors, Flutterwave is pursuing a pan-African strategy from day one and that is what makes it extremely disruptive. Once it achieves network effect, the rest will be history. The local competitors may see increasingly high level of defection because it will create more value with more people in its ecosystem.

Flutterwave must win the battles against competitors and those that will come via technology including blockchain/bitcoin-enabled variants. But looking at it, if there is any firm that can scale the competition, I expect it to be among the league.

The Sound of Exit

Flutterwave will be acquired within the next five years. The trajectory is very obvious. Once they fix the African payment infrastructure challenge, they will depart. How? The people funding it are the same people that funded Stripe, Xoom, etc

The next chapter for us at Flutterwave is building a global payments technology company that changes how the world does business with Africa. This is why we have partnered with Greycroft, Green Visor, Glynn Capital and Y Combinator?—?the same teams that helped fund and build global payments giants like Braintree, Stripe, Xoom, Square and Visa.

If you are an investor, the best way to create more value is to connect the firm with others. I expect Stripe to be the company that will acquire Flutterwave.

All Together

Flutterwave is amazing and it is a new generation company which will do so much good for the continent. By removing the friction that exists in payment, African companies will have expanded markets. Similarly, global merchants can reach us more efficiently. How everyone wishes Flutterwave is a Lagos business instead of the beautiful America owing another good one, to forever enjoy the taxes, this firm will generate. That is the Nigerian burden, which must be fixed. It remains easier to build a business with this scale of vision from America. And that is why it is operating from there. Iyin said it clearly when CNN asked him why San Francisco, he responded: “We’re trying to connect Africa to the digital economy — there’s no other place that exemplifies the digital economy than San Francisco.”. Irrespective of location, we celebrate Flutterwave for scaling brilliance.