Flutterwave is exciting, not just for its vision, but also for the speed it is pursuing it. The firm provides technology, infrastructure and services which help global merchants, payment service providers and African banks process and accept payments on any channel including web, ATM, POS and mobile. It simplifies the process of managing the African problem – many small nation borders – by building infrastructure for modern trade. From outside looking in, Flutterwave connects the world to Africa, and from inside Africa looking out to the world, Flutterwave can power unbounded opportunities, smoothing the exchange of funds in excess of 150 currencies.

Flutterwave was founded in May 2016 by a team of African ex-bankers, engineers and entrepreneurs. Flutterwave’s award-winning payments infrastructure for banks and businesses helps to drive their growth across Africa. In just over a year since its launch, Flutterwave’s technology has been responsible for processing over $1.2 billion dollars across 10 million transactions. Headquartered in San Francisco with offices in Lagos, Nairobi, Accra, Johannesburg, the company is eliminating barriers to the digital economy for African consumers and businesses.

The company is still a toddler – just about a year old – but it already has a history. It is indeed one of the finest startups operating in Africa today. If it succeeds in its mission, it will be a key entity in modern Africa with the capacity to drive trade drivers in the continent and beyond. Payment business is about the movement of funds and anyone that does that efficiently will be rewarded.

The world believes Flutterwave. It just raised $10 million for “rapid expansion”.

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register to become a better CEO or Director with Tekedia CEO & Director Program.

Greycroft Partners and Green Visor have led a Series A funding round of over $10 million in Flutterwave. They will be investing alongside existing investors like Y Combinator and new investors like Glynn Capital. The new capital will be used to hire more talent, build out our global operations and fuel rapid expansion of our organization across Africa.

Make no mistake, Flutterwave Managing Director and co-Founder Iyinoluwa Aboyeji and his team are on a mission. They have a war chest of about $10.17 million, from four funding rounds, to battle in the African payment sector . This battle will be across Africa because other fintechs and local banks understand the competitive implications and their possible existential threats.

The Vision: A Single African Currency

Flutterwave wants to build the real African currency. Sure, it is not a currency in the typical way, with the heads of dead presidents. It is a currency in the sense that commerce can happen within a system that simplifies the movement of funds, agnostic of location and time, across Africa. In other words, making sure that transfer of funds from one part of Africa to another will be so seamlessly done that a man in Cape Town sending money to another man in Lagos will have the same level of friction as though he is sending that money to a woman in Johannesburg. Most friction will be gone, with technology hiding all of them from the users. And when the merchants in Paris, London and New York see Africa, they will see one system – the Flutterwave system. The system becomes the currency of trade because it will be irrelevant where your bank bank is domiciled within Africa. You can pay a man in Cedi in his Accra bank account from a Nigerian naira bank account, in Lagos, and you will not even blink, provided both accounts are in Flutterwave ecosystem.

Once that happens, reducing the constructs of Rand, Naira, Cedi, etc into the background, what will matter is if a merchant, consumer or business is connected into Flutterwave. You can sell to someone in Ghana from Nigeria and he pays you in Cedi but the money shows in your bank account in Naira, in real-time. All the regulatory, cross-border issues, are all complied with, but importantly invisible to you.

There is no ambiguity on this vision, if you read carefully the press release: “Flutterwave’s global payments solutions will make it easier for Africans to participate in the digital economy so you can make and accept payments for whatever you want, in whatever currency or payment method you want, across the globe.”

The Laurels

Flutterwave is a beacon of excellence. For just about a year, this company has built a top-grade technology business that executes at high level. When you mix technology and efficiency, at scale, solving a huge problem, great things happen. For all the Africa-focused Y Combinator alumni, Flutterwave is already one of the great stories. It will open doors that will help on how the world sees new generation of African entrepreneurs. I am so happy that our Iyin is driving this. He has validated many young people before the world, beyond what any conference, promoting Nigerian entrepreneurs, will do in the next few years. And when you know that this young man is just starting, you will be marveled.

The key win for Flutterwave will be becoming the entity of choice at scale in the continent. It may become a very important banking institution even though it is not a bank. The consequence could be huge across African banking markets. The disruptive impacts of simplifying payments especially from the lens of foreign corporation cannot be underestimated. Apple can decide to open a one-African store where all currencies across the continent are accepted; Flutterwave will be a natural partner to it. From Spotify to Netflix, they will see huge value in this firm. There is no need of playing dozens of currencies when one can handle most things efficiently.

Over a year ago today, we founded Flutterwave to build underlying payments infrastructure for African businesses to accept card, mobile money, and bank account payments in a single place. Without this payments infrastructure it was impossible for African businesses to scale acceptance of digital payments.

The Numbers

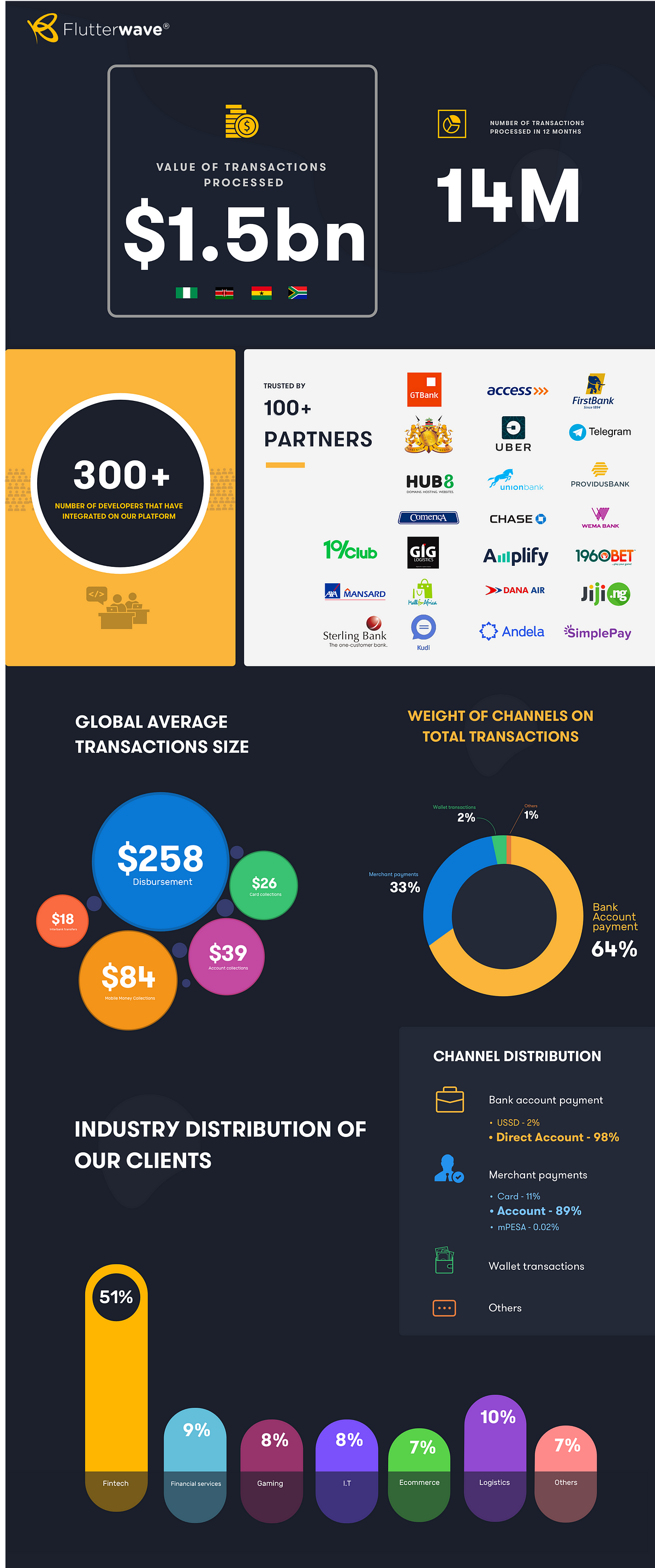

Good numbers make entrepreneurs good presenters. Flutterwave has processed a total of $1.5 billion worth of translations since founding. This number, I expect, will triple by next year, because they generated it in just few of the countries. When they scale with this new war chest of $10 million, they can put many more things in their views.

Source: Flutterwave

The Challenge Ahead

Flutterwave has solid engineering. But others will not just wait for it to eat their lunch. I expect the local banks and other competitors like Paystack, Interswitch, Remita and amalgam of Kenyan and South African companies to prepare for battle. Unlike most competitors, Flutterwave is pursuing a pan-African strategy from day one and that is what makes it extremely disruptive. Once it achieves network effect, the rest will be history. The local competitors may see increasingly high level of defection because it will create more value with more people in its ecosystem.

Flutterwave must win the battles against competitors and those that will come via technology including blockchain/bitcoin-enabled variants. But looking at it, if there is any firm that can scale the competition, I expect it to be among the league.

The Sound of Exit

Flutterwave will be acquired within the next five years. The trajectory is very obvious. Once they fix the African payment infrastructure challenge, they will depart. How? The people funding it are the same people that funded Stripe, Xoom, etc

The next chapter for us at Flutterwave is building a global payments technology company that changes how the world does business with Africa. This is why we have partnered with Greycroft, Green Visor, Glynn Capital and Y Combinator?—?the same teams that helped fund and build global payments giants like Braintree, Stripe, Xoom, Square and Visa.

If you are an investor, the best way to create more value is to connect the firm with others. I expect Stripe to be the company that will acquire Flutterwave.

All Together

Flutterwave is amazing and it is a new generation company which will do so much good for the continent. By removing the friction that exists in payment, African companies will have expanded markets. Similarly, global merchants can reach us more efficiently. How everyone wishes Flutterwave is a Lagos business instead of the beautiful America owing another good one, to forever enjoy the taxes, this firm will generate. That is the Nigerian burden, which must be fixed. It remains easier to build a business with this scale of vision from America. And that is why it is operating from there. Iyin said it clearly when CNN asked him why San Francisco, he responded: “We’re trying to connect Africa to the digital economy — there’s no other place that exemplifies the digital economy than San Francisco.”. Irrespective of location, we celebrate Flutterwave for scaling brilliance.

---

Register for Tekedia Mini-MBA (Sep 15 – Dec 6, 2025), and join Prof Ndubuisi Ekekwe and our global faculty; click here.

Nice and thorough overview of the strategy Flutterwave is playing