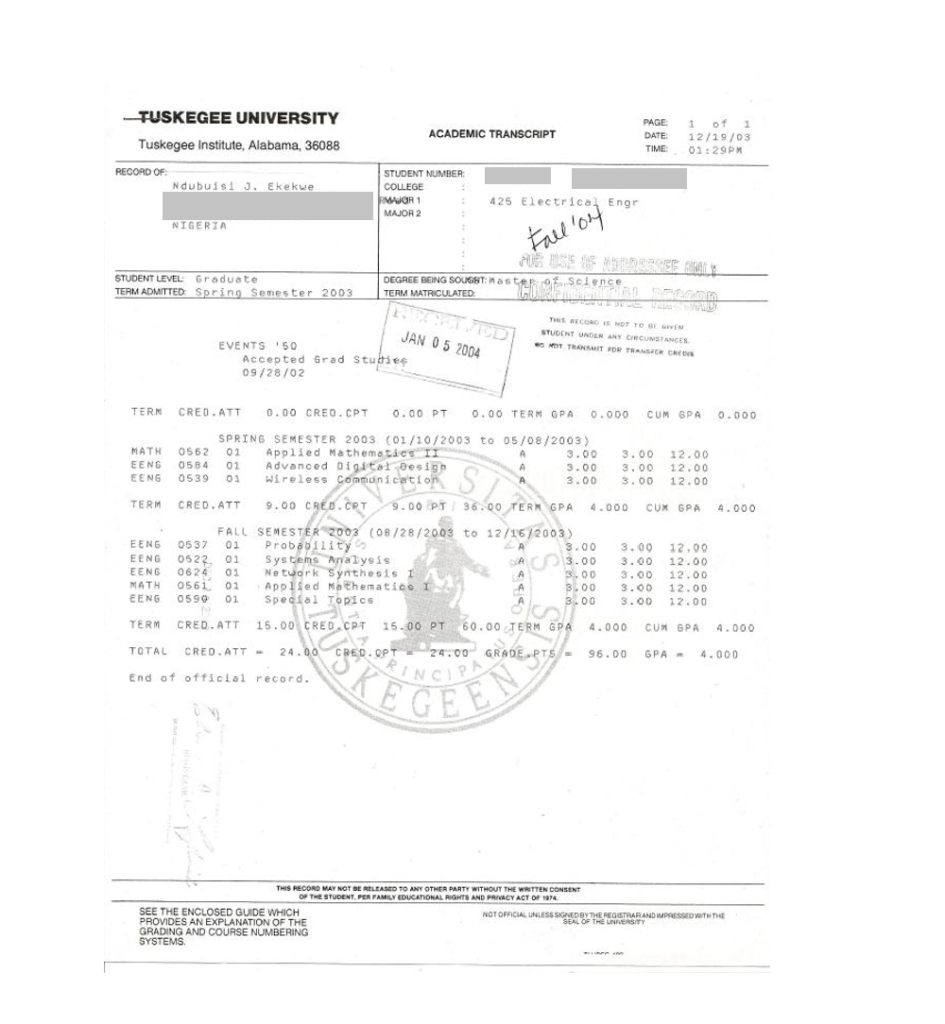

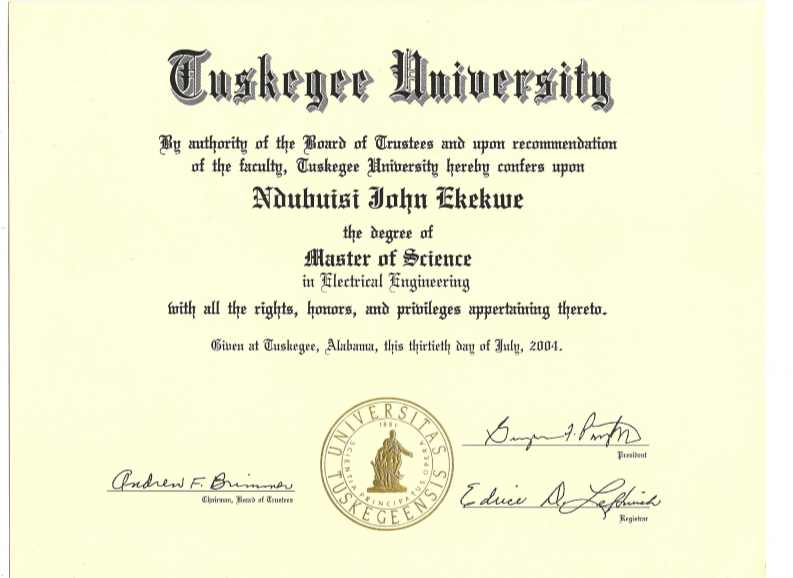

I resigned from Diamond Bank on January 7, 2003. I flew Nigerian Airways direct to New York on the same day. I had come for a master’s program, in electrical engineering, in Tuskegee University, USA.

Few weeks ago, I had applied for a study leave with Diamond Bank. The bank declined my application. It was very painful, but I respected the decision because Diamond Bank had been supremely good to me. With no study leave, I was leaving Nigeria with no hedge – succeed in America or come back, to Lagos, to look for a new job.

At the end, I made the decision to travel despite the bank’s decision. I wanted to return to electrical/electronics which I enjoyed while in Federal University of Technology, Owerri (FUTO), as an undergraduate. I had taken two master’s degrees and a correspondence doctoral program within three years I was employed, full time, in Diamond Bank. It was a very intense lifestyle which saw me one day flying into University of Calabar, from Lagos, for an MBA exam, and returning same day to work night shift in the bank’s IT organization. Everything was planned because I always had exams or certifications to prepare. Call it No Life: It was very intense.

Why this torture? Diamond Bank was paying for everything. They paid for the Cisco and Microsoft certification exams. They paid for the ICAN Intermediate exam which I had added in case I had to remain in Nigerian banking. (My matrix of Nigerian bank executives showed most had ICAN; so, I assumed, to get to the top, it made sense to get mine. I never completed ICAN before I left Nigeria. But I did well in the Foundation and Intermediate phases.) Diamond Bank HR people liked me. I had my nickname “Prof” which Ohis Ohiwere (now an Executive Director with GTBank) gave me while in the training school.

My goal of traveling to U.S. was to learn as much as possible, become a thought-leader, and then possibly start my own electronics design company supported with technology advisory services. The dotcom burst had taught me a big lesson: IT is a vulnerable career. I figured that electronics was higher up in the pyramid, making the systems, which anchor IT applications. And consulting could be exciting, because I would be forced to know many things, at deeper level. I decided that a PhD in electrical electronics would be catalytic in the process.

A classmate during my Master’s program in Federal University of Technology, Akure (FUTA), who left for a Master’s program in U.S., handled all aspects of the admission process. I just sent my transcripts to the school and within weeks, the admission letter came. The visa process went smoothly. UK had issued me one few weeks before for my convocation ceremony in the correspondence school. I was ready for America.

The Special Day in Diamond Bank

On the D-Day to resign, I typed my letter, which I had worked for more than three weeks. I wanted to use the opportunity to thank the bank and especially our Founder (legendary banker Paschal Dozie). Mr Dozie had a huge influence in my life. When I joined his bank, I did not know how to sign a cheque. Yes, I opened my first bank account, savings in Union Bank, few days after I started work. (Diamond Bank opened a staff account by default.) But through Diamond Bank Apapa Training School, one of the best training programs, in Nigeria, I became a banker. The transformation was iconic.

That was my memory including an insane compensation where just working for weekends and nights, I made what my non-IT colleagues in the bank would struggle for a month-long salary. Largely, I earned nearly twice my non-IT colleagues in the same level. I enjoyed Diamond Bank; it was a bank with limitless opportunities. They paid every training invoice I sent to them and the bank was awesome. There was no boss; we were all comrades serving Nigerians. In short, I never saw my supervisors as bosses; they were colleagues and they made spending 48 hours at work normal. (We liked those marathons because that was the only way to enjoy one of the top Ikoyi hotels and eat awesome meals, free.)

But I had to leave, for America. And now, it is my turn to show the love, to the beautiful bank, named Diamond.

On the day of resignation, Diamond Bank paid tons of money into my account. Money everywhere with the computer screen showing useful digits. That was the annual upfront which was always the bulk of the salary. When I logged into the system and saw the money, I simply updated the resignation letter. I added an instruction that the bank should reverse the transaction as I was leaving the country, and would not be around to earn it. I dropped the letter. Most of my supervisors were genuinely impressed. Most people that resigned and traveled abroad usually clear-up. In minutes, I was off the building. My eyes turned red. I had to pay school fees in coming days in America and had not really developed a strategy than simply planning to meet the University President to award me scholarship. It was totally reckless as I practically invested all money I had in Treasury Bills and left with $400 cash and $2,000 Travelers Cheque.

At JFK, New York

I arrived JFK Airport, New York, without a sweater or any winter cloth. I came with my friend Kunle. As we exited the airport, I asked him “Okemadu, what is going on? Why so much cold here?” We went back to the airport hoping the cold will subside. No way. (Blame my geography; you could read all you can about weather; experiencing winter was more than any words any teacher in Nigeria could have impacted in a Geography class. Winter was ferocious, on blood stream, unprecedented on the first day I experienced it. )

Then, we got confidence to attack the cold with our t-shirts from Lagos (we flew direct from Lagos to New York). The problem was we could not pronounce “Tuskegee” in the Tuskegee University with our nice Nigerian accent. We asked more than three people, no one could understand what we were talking about.

We then met one African American and asked him how we could get to Tuskegee University. I was so frightened that I could not say anything audible. The guy said “talk to me, dude. Talk to me”. Then he walked out. I was wasting his time. People, the cold had gone because something more than cold had arrived. Accent playing us here!

An idea came – why not write it down and show it to people to assist on how to get to the school. Quickly, somebody told us to go to Greyhound, a bus line. I paid $103 from New York and spent about 3 days to Tuskegee on the road. It was really good except when they stopped in a cheese-eatery. I saw the thing, paid $4, and put it in my mouth. I never tasted it again. From Charlotte ( North Carolina) via Richmond, (Virginia) connecting Atlanta (Georgia) we made it to Tuskegee, Alabama.

But there was a miracle: at Richmond where we changed bus, a conductor, who loaded my luggage (those good days you could carry you life) asked for a tip. People, I had no idea you needed to give somebody something for doing his job. Even if I knew, I had none, to give the guy. Unbelievable, the guy dropped one of my bags, out of the bus, at the last phase of the loading. It was when the bus was making a turn to leave that my friend Kunle shouted ‘Driver stop”. One of my bags was outside. He rushed out and put it back. That was my first lesson in America: shine your eyes. This is not Hollywood with all the smiling celebrities living in splendor and wealth. I was educated to know that Hollywood was a screen set, but I did not expect the level of poverty I saw in New York Greyhound bus station – beggars in abundance.

When we entered Tuskegee, I quickly noticed one thing: every human element visible was black. I said to my friend: “boy, are we in Lagos? What is happening? I thought we came to America?” It turns out that Tuskegee is a black community with excess of 95% black population. The university is a historically black school. People, the campus is beautiful and a national historic site, meaning, the U.S. government turned the school, into a national museum. Tuskegee has history – the Tuskegee airmen, Washington Carver genius lab, and more.

Ndubuisi, my friend that managed my admission had visited Nigeria and gave instructions that we should move into his apartment. I had my Ikeja CDs which I had used to setup/configure/clone computers for people, in Lagos. I explained to my friend that I would start the business immediately. Quickly, he reminded that Ikeja Computer Village CDs would send me to jail. Just like that, I was empty. No hustle. He reminded me that my visa noted that I could not work outside the campus. That was the first time I cared to check what was written in the visa about working. Just like that, the expertise from banking was muted.

NASA Scholarship

When I made it to Tuskegee University, I had school fees of about $9,000 to settle. I scheduled an appointment to meet the Chair of the department. I explained to him that I needed his support. He told me: “You need to get the bucks from Lagos and pay this school fees”. I left. The next day, I returned to meet him again. He told me to wait at the door. I told him that I wanted to negotiate how this could be managed: I wanted a job to teach so that he could pay. At the end, nothing worked.

Then an idea came to me: what could I do in this school to add value to the department. At the end, I decided to craft an IT Policy with Physical & Cyber Security Manual for the department IT infrastructure. It was a huge coincidence. They were about awarding a contract on that because some people have been stealing their equipment and corrupting the PCs with viruses. In Diamond Bank, at a time, I was responsible for protecting all the PCs from virus and I knew the work very well. I spent two days working on the document, asking current students on what they knew about the systems.

I went back to the Chair and told him that I had a gift for the department: he looked at me as I handed him a document. He smiled. A professor and eminently a nice guy: he asked, how long did this take you? I explained that it took me two days but noted that my career had focused on developing this type of document. I showed him a copy of my old Diamond Bank business card to give him confidence – if a bank could depend on me, the department should be fine. He offered me a seat and then asked me to drop my contacts. I did and left.

As I was going back, I saw a poster for NASA scholarship. I applied. Few days later, I got it. Also, I was offered a graduate teaching assistantship. The NASA scholarship became a turning point for me in America. It opened so many opportunities. I was working on modeling high frequency and high voltage in the space environment with direct support from NASA engineers in Huntsville, Alabama. I designed a transformer that could work in the space, with the help of the research team.

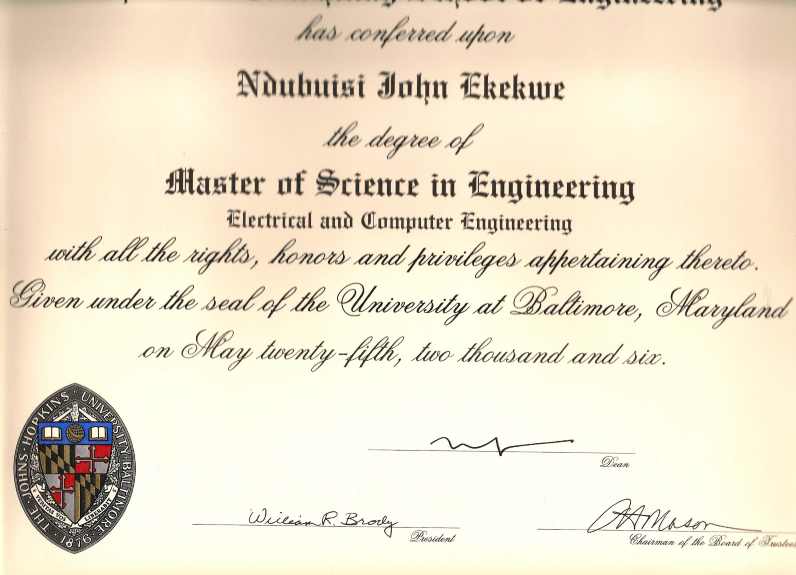

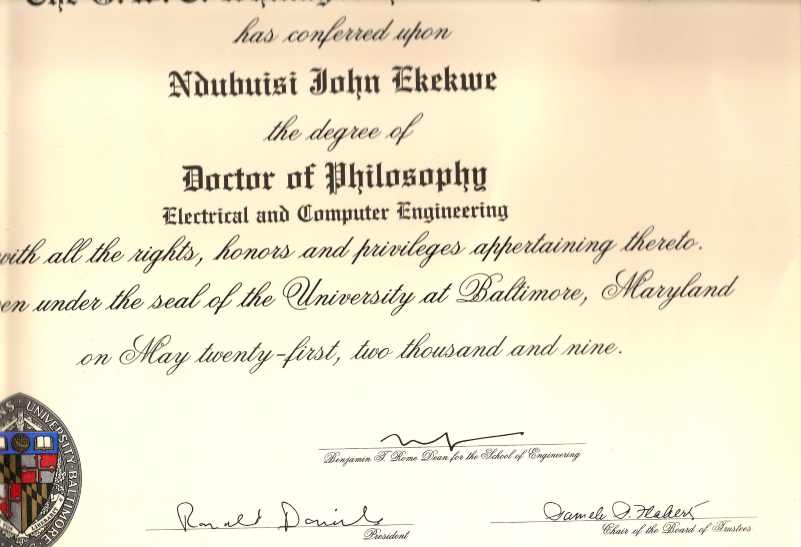

America is now paying the school fees. They will forever be doing because when I later moved to the Johns Hopkins University for my PhD, I got many multiples, in fellowships and scholarships.

The Reward from Diamond Bank

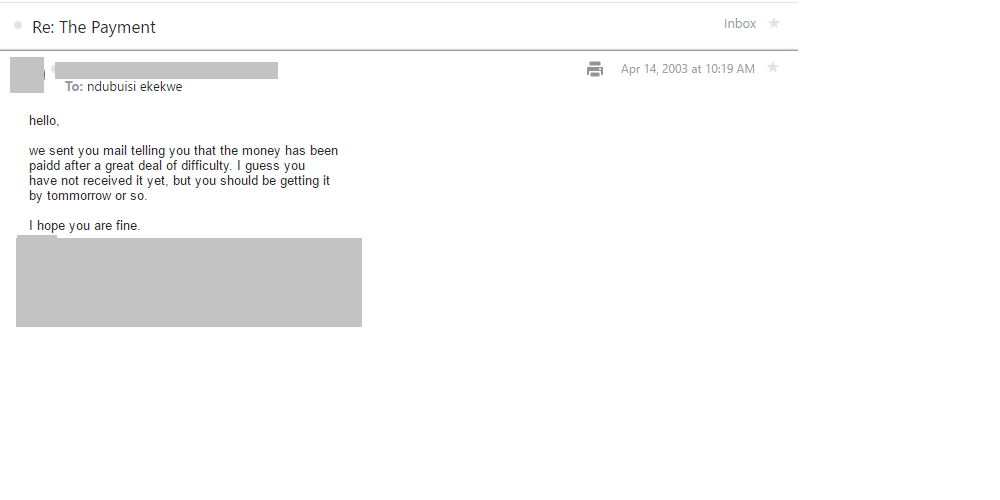

One afternoon, in Tuskegee, I received an email. The bank was looking how to send me some money and they needed a current account. I told them that I have none in Nigeria. The only bank account I maintained in Nigeria was a Union Bank Savings Account. They requested the details.

Two weeks later, they sent me DHL that they could not pay into the Savings Account (that time only the account owner could pay money into Savings). They now asked me for permission to use Money Market to send that money. Of course, I gave that via email.

But why send me money? Pascal Dozie, the Founder and then CEO of Diamond Bank, on reading my resignation letter, approved for the bank to allow me keep the upfront. A friend told me that he was very happy that he had trained a young Nigerian with the integrity Diamond Bank should be proud of. My GM, who was on vacation when I left, also sent his own goodwill.

Connecting to my Executive Director

In 2015, my U.S. firm was invited to make a presentation in a Strategy Session. In that meeting was my former Executive Director in Diamond – Phillips Oduoza, then CEO of United Bank for Africa Plc. When I took the podium, I greeted him, and thanked him for a favour many years ago. He was the ED, Operations & Technology, when I was in Diamond Bank; he ran IT where I was one of the foot soldiers. He asked one question and quickly recollected that he got my letter and he pushed for me to keep the money. Seating not far from him was Mr. R. Awo-Osagie, my former Diamond Bank boss, now the CTO of UBA. Right there, they praised my integrity and all the Directors in UBA quickly had a positive view of my person. As I left that day, many came and commended that spirit for Nigeria. Needless to say that I received the consultancy job,despite the presence of many MNCs that competed along with me. I am truly honored.

Lessons in Life

Life revolves around. You cannot afford to lose your integrity despite any situation or condition. All my colleagues in bank trust me and they continue to assist my business. I walk into offices; people that knew me will say “If he says YES, believe it”. And to Lagos banker, Pascal Dozie, he is a legend to me. I pray for him. He built a generation of people through Diamond Bank. He taught me humility in life. He was a man so exalted, and yet humble. The Diamond Bank training school is the best training I have ever attended. The recommended books, including The Richest Man in Babylon, shaped the core of my personal financial strategy. He invested so much to have leaders in banking and community. I admire him. And in all, thank God.