A four-man armed robbery gang on February 22, 2017, stormed and attacked a Zenith Bank Owerri branch – Wetheral road Owerri, Imo state capital. The attack that left three police men and five bank customers injured and one of the armed robbers dead.

A four-man armed robbery gang on February 22, 2017, stormed and attacked a Zenith Bank Owerri branch – Wetheral road Owerri, Imo state capital. The attack that left three police men and five bank customers injured and one of the armed robbers dead.

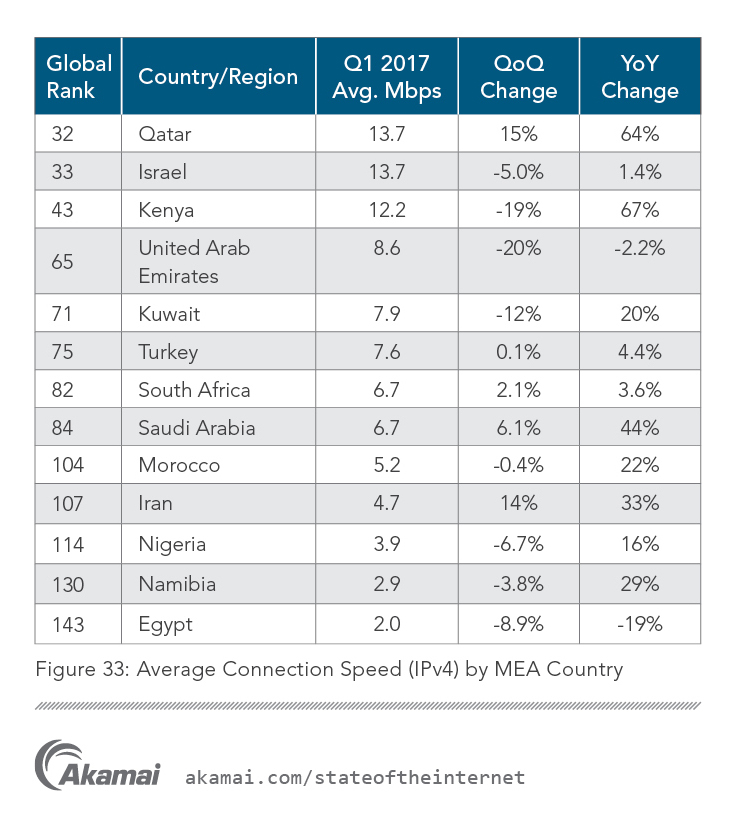

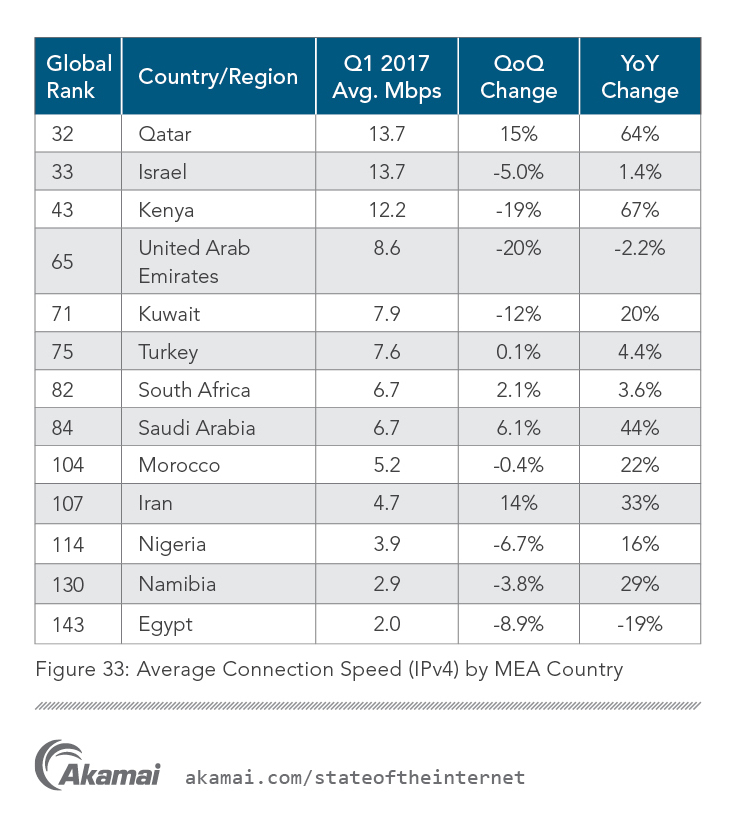

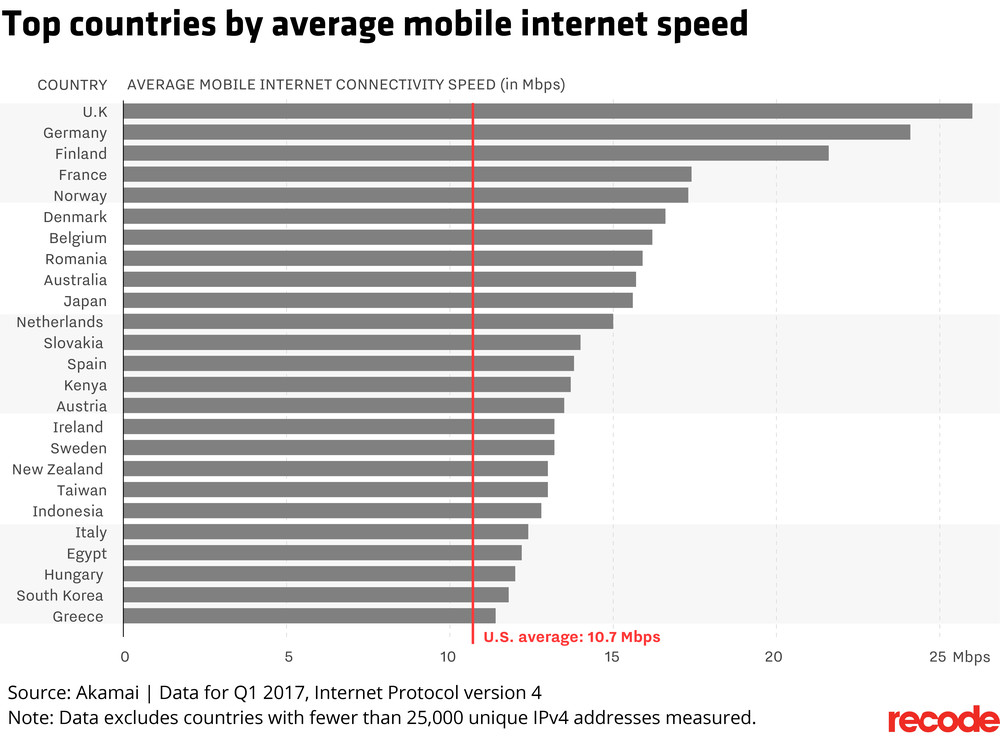

Akamai Technologies has announced the release of its First Quarter, 2017 State of the Internet Report. Based on data gathered from the Akamai Intelligent Platform, Nigeria is still not doing great. Kenya is miles apart from Nigeria. The report provides insight into key global statistics such as connection speeds, broadband adoption metrics, notable Internet disruptions, IPv4 exhaustion and IPv6 implementation across markets. The key notables.

Editor’ Note: Kudimoney is a fintech with a very bold vision – redesign the Nigerian banking sector and make it smarter. With Kudimoney, you earn 10% interest on your current account, and they will pay you even more on your savings account. Plus this fintech helps you manage your money, helps you save and budget, and tells you how much you can spend at any given time, based on your set goals. The Founder of Kudimoney, Babs Ogundeyi, shares what this is all about.

There is a digital storm brewing in the global banking marketplace – facilitated by mobile networking, social technologies, data analytics, and new disruptive customer experiences. Technology has transformed our way of life, from how we communicate, to how we travel, cook, book taxis, interact, and work, technology has truly permeated and impacted on every sphere of life changing it irrevocably.

Technology has also disrupted the finance industry, questioning the status quo and challenging archaic and inefficient operational norms. We have seen the scaling back of physical money transactions and bank teller-led withdrawals being replaced by online transfers, card transactions and automated teller machines (ATM).

All types of financial transactions from banking to payment to wealth management and beyond have benefited from this disruption, increasing the efficiency, speed and customer-centric nature of the financial industry, driven largely by consumer demand to be better connected to their money. As banks begin to focus more on what customers want from mobile, banking is starting to evolve into a very different business model from what exists today.

These technological advances and shifts in consumer behaviour are also weakening the heavy gravitational pull that traditional banks exert on their customers who are now technologically savvy and comfortable navigating the online landscape (89 million Nigerians have access to the internet either via their mobile phones or other devices). The rise of disruptive new age 21st century banks are moving above and beyond traditional online transactions to facilitate a comprehensive and fully digital banking service that is anticipated to firmly shift the emphasis away from physical branches and put the experience – quite literally – into the hands of the customer.

These disruptions, until very recent – at least in Nigeria, had little to no effect on the way we borrow money – a space largely dominated by brick and mortar banks with endless paper work and unbelievable lengthy approval processes. The monopoly banks have had on lending has finally been affected by the digital revolution and the microfinance sector is getting a digital makeover.

Today, dynamic and forward thinking start-ups and platforms are emerging – transforming the way we deposit, borrow and repay money completely. Paperless, online (or from an app) and speedy personal loans are fast replacing archaic practices that are out of place in a digital revolution. They are offering better value to savers and flexibility to lenders – a much needed balance for the two (and often overlapping) subset of customers. These new start-ups are also making it easy for people to borrow money – not a novel concept but one that offers customers a considerably better experience. Data is central to micro finance and Nigeria continues to champion centralisation and increase the quality and quantity of data available through the data policies introduced by the government over the last few years from BVN to sim-card registration to the increased interbank conversations and beyond.

A full serviced digital bank is now a more attractive option especially because by definition, these types of banks are more flexible and instantly responsive, focused on removing the bottlenecks in the existing experience, delivering increased convenience and a more humanised experience with the customer’s interest at its core. These start-up digital banks are likely to not only add competition into the marketplace but to disrupt the entire sector, forcing change with their greater focus on customer experience and satisfaction. Digital banks are more agile than established institutions and create a better user experience and more value for the customer. This value is not fiscal, but delivered through a more personalised experiences for each customer.

This revolution could not have come at a better time as in the wake of the most recent recession, we have seen the rise of innovative SMEs. This is good news for Nigeria as MSMEs contribute over 45 per cent to the economy’s Gross Domestic Product (GDP) and employs over 80 per cent of the economy’s total labour force, over 90 per cent of Nigerian businesses fall into the MSME bracket. SMEs are important drivers to a country’s economic development. They have the ability to create goods, innovations and employment accelerating the achievement of wider socio-economic objectives and development. It is therefore essential that these enterprises have access to financial services fitting their needs, in order to continue and expand their businesses. Across the emerging FinTech landscape, the customers most likely to engage the services of a digital bank are these SME’s, and millennial as they are particularly sensitive to costs and to the enhanced consumer experience that digital delivery and distribution afford.

Kudimoney.com aims to connect people to their money more quickly, accurately and efficiently than ever before. With innovative financial solutions, cutting edge banking technology and flexible loans with interest calculated per day and paid monthly coupled with easy-to-understand terms and access to customer service advisors 24 hours a day every day, Kudimoney.com is redefining the way people interact with their banks putting them firmly in the driver’s seat. It’s time to move into the present and become prepared for the future. That future is not just imminent, it’s here and now.

• Ogundeyi is the founder of Kudi Capital Management Ltd.

A new case study by the United Nations-based Better Than Cash Alliance shows how agriculture nonprofit organization One Acre Fund, in partnership with Citi Inclusive Finance, successfully digitised loan repayments for farmers in Kenya. This move significantly boosted transparency and efficiency, driving economic opportunity and financial inclusion for thousands of smallholder farmers and their families.

One Acre Fund, supported by Citi, enabled farmers to easily make loan repayments via mobile money instead of cash, reducing the uncertainty, inefficiency, insecurity and high costs previously caused by cash transactions.

Study findings include:

One Acre Fund is an example of the significant benefits and impact that digital payments and inclusive digital financial infrastructure, as developed in Kenya, can bring to agricultural value chains, contributing to a more sustainable and productive agriculture sector, a cornerstone of the UN’s Sustainable Development Goals (SDG). These learnings can easily translate to poor farming communities in other countries and One Acre Fund is working on plans to expand in Rwanda, Tanzania, and Zambia in the future.

In today’s videocast, I make a case that Africa will enter the era of affordable broadband internet in 2022. That will be the year we will begin a new dawn of immersive connectivity where you can eat and surf all you can. Industry players will take off the Internet meter and then focus on service, experience and quality. From satellite broadband vendors to the MNCs with balloons and drones, the sector will become very competitive and service will drive growth. This has happened in the past – every decade, Africa experiences a major industrial transformation. We saw that in banking and voice telephony. 2020s, starting at 2022, will be the decade of immersive connectivity.