The Organization of the Petroleum Exporting Countries, OPEC, is becoming increasingly irrelevant. And it is asking America for help.

The unusual plea was issued Thursday in the cartel’s closely-watched monthly report, which found that global markets are still suffering from too much supply. The report noted that balancing the market would “require the collective efforts of all oil producers” and should be done “not only for the benefit of the individual countries, but also for the general prosperity of the world economy.”

OPEC and allied producers agreed in November to slash production, a move designed to rid global markets of excess supply. For a while, the strategy appeared to be working, with prices drifting north of $54 earlier this year. Now, the magic appears to be wearing off.

The cartel has responded to the sharp decline in prices by suggesting that the agreement could be extended far beyond its original mid-year deadline. But that won’t help OPEC solve its American problem. The U.S. did not join its agreement, and the number of rigs in operation there has doubled over the past year.

So in practice, OPEC needs U.S. to get prices high. That will not happen because cartel is not allowed in U.S. laws.

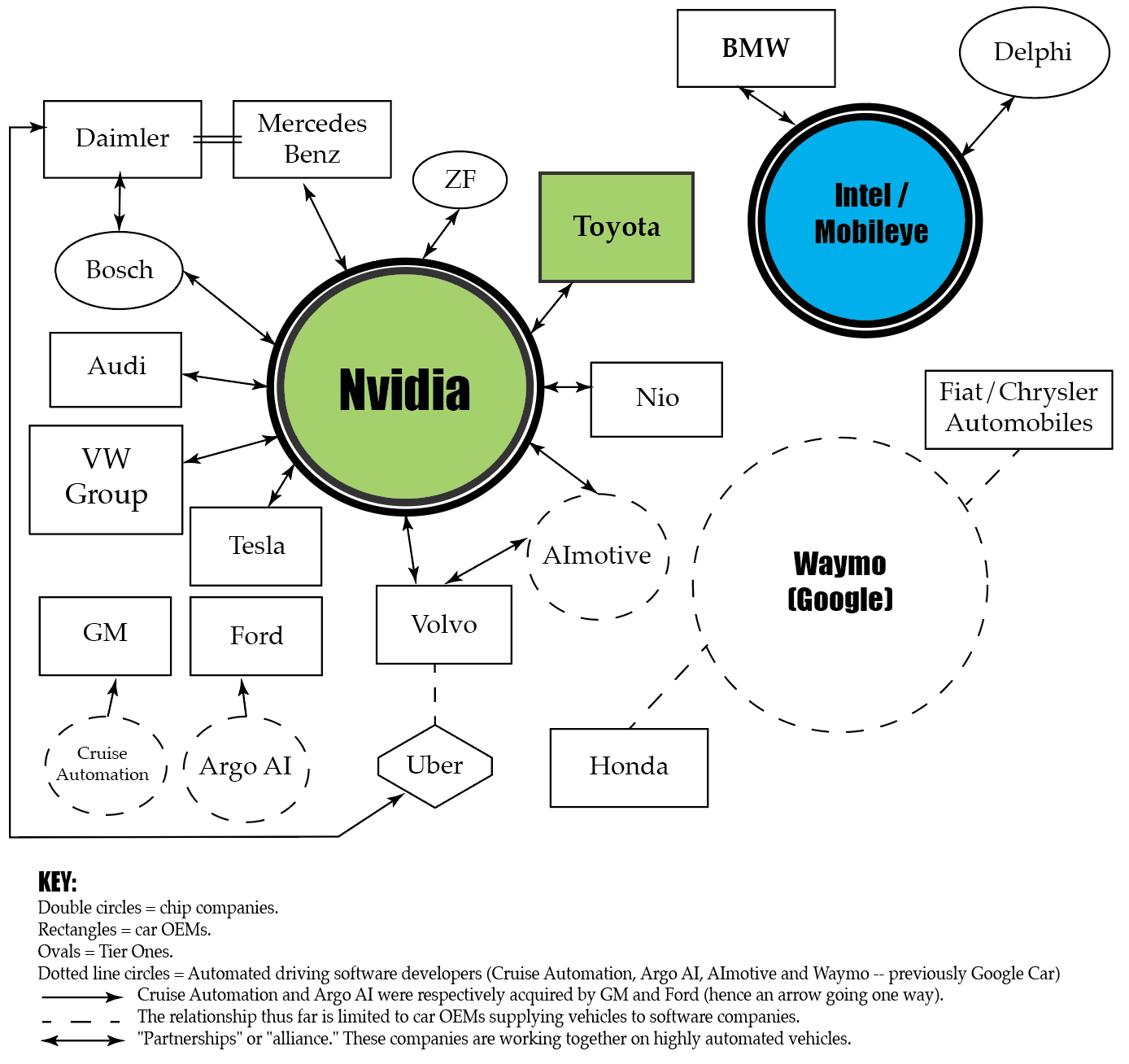

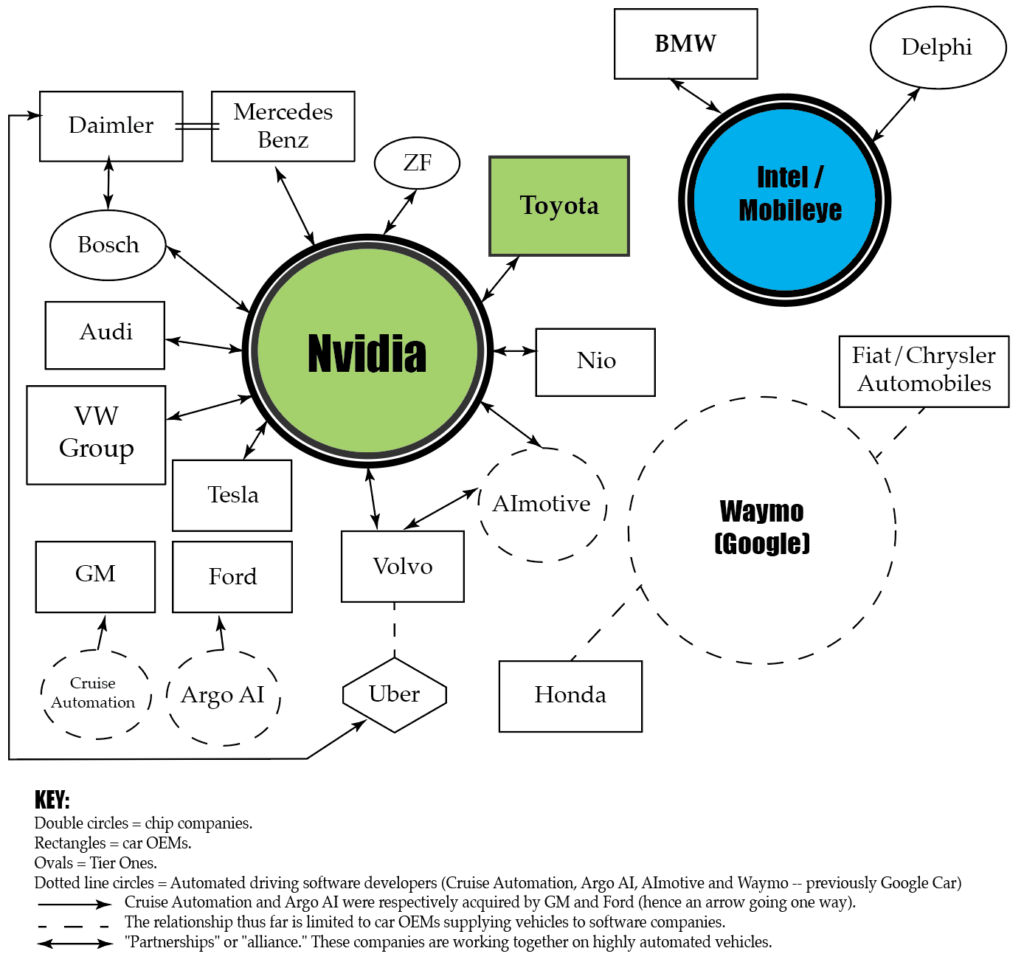

Nigeria Needs Technology and not OPEC

Within 10 years, there may not be OPEC as it will be highly irrelevant. That means Nigeria cannot count on OPEC to boost revenue. Now is the time to redesign the economy with technology and knowledge.