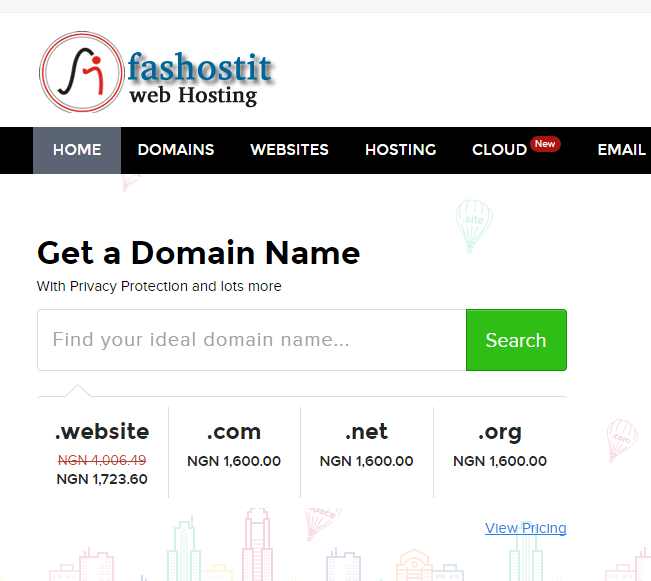

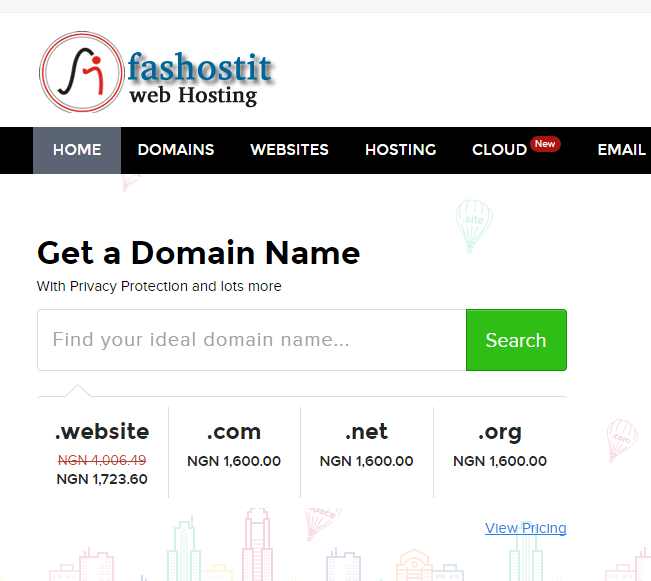

Get a domain name, just for N1,600. If you want to have it with domain hosting (unlimited emails, sub-domains etc), the total is N5,900. Click here right now.

Contact : sms@fasmicro.com

Get a domain name, just for N1,600. If you want to have it with domain hosting (unlimited emails, sub-domains etc), the total is N5,900. Click here right now.

Contact : sms@fasmicro.com

It was a magical moment to shake the hand of a man who has given the world his best. His Excellency Ban Ki-Moon served his world with honor and total dedication. I sincerely wish him a great retirement.

Ban Ki-moon is a South Korean diplomat and politician. From 2004 to 2006 he was South Korea’s Minister of Foreign Affairs and from 2007 to 2016 he was the eighth Secretary-General of the United Nations

Photo: Ndubuisi Ekekwe and Ban Ki-Moon

Prepare or gift a new career in 2017. Cybersecurity and digital forensics are careers in high demand and First Atlantic Cybersecurity Institute, Pittsburgh USA (Facyber.com) provides the education needed to enter these fields.

Our online learning programs are flexible and affordable and come with a (first week)100% money back guarantee.

Learn about:

– Cybersecurity Policy

– Cybersecurity Management

– Cybersecurity Technology

– Cybersecurity Intelligence and Digital Forensics

Each program category is independently phased as Certificate (online 12 weeks), Diploma (online 12 weeks), and Nanodegree (1 week live). Our programs are relevant for engineers, lawyers, policymakers, law enforcement, health professionals, students, investors, bankers,insurers, etc as they cover all areas of cybersecurity – from policy to technology to management.

Start today and you can finish your program in a few months with real world skills you can use on the job. Alternatively, gift it to someone you love (cousins, friends, students, children, etc). He/she can begin a new journey to a new career.

Winter Special!

Enroll or gift a certificate program for only $200! Paypal, debit & credit cards, and bank transfer supported across Africa.

The Program Catalog and detailed Table of Contents are well documented.

We’re looking for local partners across Africa to help promote our programs. For more, contact Audrey Kumar via info@facyber.com

2016 marked a challenging year for African equity markets in the wake of lower economic growth and political upheaval around the globe, largely as a result of the US elections cycle and the Brexit vote. African equity capital markets (ECM) broke a streak of three successive years of growth, recording a decline in overall ECM activity of 28% from 2015 in the number of transactions and 33% from 2015 in terms of capital raised.

PwC has issued its 2016 Africa Capital Markets Watch publication, which analyses equity and debt capital markets transactions that took place between 2012 and 2016 on exchanges throughout Africa, as well as transactions by African companies on international exchanges. ECM transactions included in the analysis comprise capital raising activities, whether initial public offerings (IPOs) or further offers (FOs), by African companies on exchanges worldwide, as well as those made by non-African companies on African exchanges. Debt capital markets (DCM) transactions analysed include debt funding raised by African companies and public institutions.

Darrell McGraw, PwC Capital Markets Partner based in Lagos, says: “Many African economies, in particular those dependent on resources suffered in a low growth environment, significantly reducing ECM activity, and a continued lack of clarity around foreign exchange risk in Nigeria further discouraged foreign investment.

“Although overall ECM activity decreased in 2016 in terms of both transaction volume and value as compared to 2015, there was a significant increase in ECM activity, particularly IPOs, in the second half of the year, indicating the cautious optimism of issuers and investors as the year progressed.”

Since 2012, there have been 450 African ECM transactions raising a total of $44.9bn, up 8% in terms of capital raised over the previous five year period 2011-2015.

African IPO Market

Overall, $1.5bn was raised in IPO proceeds in 2016, and while 2016 saw a decrease from the prior year, there has been an overall upward trend in IPO activity over the five year period.

Over the past five years there have been 110 IPOs raising $6.5 billion by African companies on exchanges worldwide and non-African companies on African exchanges.

In 2016, capital raised from IPOs by companies listed on the Johannesburg Stock Exchange (JSE) increased by 25% in US dollar terms as compared to 2015, mainly driven by a comparatively stronger rand and three large listings by Dis-Chem, the Liberty Two Degrees real estate investment trust (REIT) and one of South Africa’s largest private equity firms, Ethos. It was also a record year for the JSE’s AltX, which saw the secondary listing of the fledgling Mauritian private equity investor, Universal Partners, generate proceeds of more than five times greater than in 2015.

Capital raised from IPOs by companies on exchanges other than the JSE decreased by 22% as compared to 2015, largely driven by relatively smaller Egyptian IPOs in 2016. IPO activity on the Egyptian Stock Exchange (EGX) decreased significantly – by 72% in terms of value of IPO proceeds – as companies delayed listing plans in anticipation of an improved economic outlook following the August 2016 announcement of a potential stabilisation programme by the IMF and the free float of the Egyptian pound in November 2016.

Elsewhere on the continent, there were some significant increases in IPO capital raised on exchanges in Ghana, Morocco and Botswana compared to 2015, due to partial privatisations of state-owned entities.

Coenraad Richardson, PwC Capital Markets Partner based in Johannesburg, adds: “The JSE retains the leading position in the African capital markets, with capital raised from IPOs by companies on the JSE representing 42% of the total African IPO capital and 34% of the total number of transactions since 2012.” In terms of value over the past five years, the next-largest value of IPO proceeds raised was on the EGX at $1.1 billion, followed by the Nigerian Stock Exchange at $751 million.

On a sector basis, the financial services sector continued to dominate the African IPO market during 2016 with 45% of total value and 55% of total volume, followed by consumer goods and industrials with a total value of 31% and 13% respectively.

African FO market

Over the past five years, there have been 340 FOs raising $38.4 billion on both African and international exchanges. As was the case with the IPO market, FO activity was hit by a significant decrease in terms of transaction volume and value, down 27% and 34% respectively. Andrew Del Boccio, PwC Capital Markets Partner based in Johannesburg, notes: “The decline in FO activity after a period of sustained growth reflects many of the challenges and uncertainties in Africa and around the globe.”

In terms of geography, 85% of FO proceeds in 2016 were raised either by South African companies or by foreign companies listed on the JSE. However, the nature of these FOs shows a mixed landscape–a significant portion of funds were raised for business restructuring or divesture by foreign investors looking to monetise or exit their African investments, or by South African companies seeking to diversify their portfolios via acquisition of assets outside of Africa.

Both during 2016 and over the five-year period, the vast majority of FO activity was from sub-Saharan countries representing 78% and 81% in total FOs volume, respectively, and 96% and 95%, respectively of total FO value.

Between 2012 and 2016, FO capital raised on the JSE represented 87% of total African FO capital raised and 71% of total transaction volume. In terms of movements from 2015, Nigerian FO activity dried up, with no further offers in 2016, mainly as a result of the ongoing recession and exchange rate environment. Tunisia also saw a significant decline in activity based on value of proceeds raised.

On a sector basis, the financial services sector contributed 47% of total FO value, followed by the healthcare sector at 12%.

During the five-year period from 2012, average FO capital raised per transaction of $113 million remained well above the average proceeds raised from IPOs of $59 million, as a number of large, seasoned issuers, such as Naspers, Aspen, Mediclinic and Steinhoff, among others, tapped markets 17 times for proceeds in excess of $500 million; only one IPO, that of Seplat in 2014 exceeded the $500 million threshold.

African debt markets

Debt capital market (DCM) activity, in particular Eurobond activity, represents only a portion of the total debt raised in Africa, with a large component of debt funding sourced from traditional bank finance, other lending arrangements with investors or debt raised in local currency on local exchanges.

Eurobond activity by African corporates continued to decline in 2016, with investment grade and high-yield proceeds from Eurobond issuances falling by 21% to $4.5 billion, and the number of issuances by 53% to just seven, including some large issuances by South African telecommunications provider, MTN, and Nigerian telecommunications infrastructure company, IHS, which raised $800 million in sub-Saharan Africa’s largest-ever high-yield bond. Proceeds from all seven of these 2016 issuances were raised in US dollars.

Domestic debt markets also played a more significant role in the overall DCM story in 2016 than in previous years, particularly in Nigeria, as companies and governments across the continent retreated from risks related to foreign currency funding in 2016 and as global appetite for African debt securities declined.

Del Boccio concludes: “Despite challenging times, we expect to see improved conditions around capital markets activity in 2017, continuing the momentum built in the final two months of 2016, including an increase in ECM activity by companies on the JSE as well as by companies pursuing privatisation plans through the capital markets in Nigeria, Rwanda, Tanzania and the BRVM region.”

Co-author: John Azubuike (@jnazubuike), KEC Ventures.

Note: This article does not necessarily reflect the opinion of KEC Ventures, or of other members of the KEC Ventures team.

Supplying the world with nearly everything is an enormous and complex job: there are things to discuss.

– Rose George (2013-08-13). Ninety Percent of Everything: Inside Shipping, the Invisible Industry That Puts Clothes on Your Back, Gas in Your Car, and Food on Your Plate (p. 142). Henry Holt and Co.. Kindle Edition.

Although it is largely hidden from the day-to-day experience of most people, maritime shipping is central to the modern system of international trade and the way our world operates.

According to the International Chamber of Shipping, the international maritime shipping industry transports about 90% of all physical goods traded internationally. To give that some further definition, the World Trade Organization estimates that, in 2014, its members collectively exported merchandise worth $18 trillion.

The U.S. Census Bureau estimates that in 2015 seaborne trade in the United States amounted to $1.56 trillion, with imports accounting for about 67 percent of that total.

Despite its size and importance, the ocean freight shipping industry has remained largely untouched by the kind of transformation that software technology has imposed on other markets. That is beginning to change as a number of startups attempt to build products to serve that market. This post represents our attempt to understand the landscape within which such startups operate.

In the rest of this discussion, we will refer to “startups” as distinct from “companies”. To ensure we are on the same page;

KEC Ventures invests in early stage startups. Therefore our primary purpose in studying the ocean freight shipping market is to gain adequate context for the instances when we might assess pre-Series A startups trying to solve problems in this market. We have not yet made an investment in any of the startups in this market.

In the rest of this post we will attempt to;

Writing this post is primarily an exercise in learning more about the ocean freight shipping market in order to be better equipped for the conversations we are currently having, and conversations we may have in the future, with startups building products for this market. If we have missed anything please let us know – we lack the expertise and knowledge of industry insiders, but we are willing to invest time in learning. If you are building a seed-stage startup in this market we would love to hear from you. If there are startups in this market we have not heard of yet, we would love to know that too. You can leave a comment in the comments section below, or you can email us directly;

Lastly, we should point out that how we think about the market may not line up precisely with how industry insiders think about it. However, our purpose is to understand the landscape in sufficient detail to become intelligent investors in startups that have set out to solve problems for this market.

Ocean freight shipping comprises the complex set of activities involved in transporting goods of all kinds from producers in one country to consumers in another country, where the two countries are separated by an ocean or a sea.

We have previously discussed freight trucking, and so in this post, we will focus on the maritime-only portion of the activities that surround ocean freight shipping. In the discussion that follows note that there is a blurring of the lines, somewhat, between the categories . . . Sometimes one category can morph into another, and vice versa . . . For example, a containership might be used to transport a comparatively small amount of bulk cargo.

The market may be segmented as follows;

Container Ships: Most merchandise that is transported by ocean freight travels by container ship. Container ships carry their cargo in reusable, standardized 20- or 40-foot long containers that are designed to be easily transferred from the ship to a truck or train without the need to access the cargo directly. The freight capacity of a cargo ship is described in twenty-foot equivalent units (TEUs).

Liner shipping describes the portion of the maritime shipping market that adheres to fixed schedules on regular routes. According to the World Shipping Council there are 500 liner shipping services currently in operation, most in the form of container shipping, accounting for 60% or $4 trillion worth of goods each year.2

Container ships transport general cargo, or cargo which is poorly suited for bulk cargo shipping operations but which is well suited for containerization. Most general cargo is now transported by containerships.

The chart below shows that there has been relatively steady growth in the worldwide volume of merchandise transported by container ships since 1980.3

| Overview of Container Trade | Values | Statistic |

|---|---|---|

| Projected container market CAGR between 2015 and 2018 | 4.4% | Details ? |

| Quantity of loaded freight in international maritime trade | 10047.46 m t | Details ? |

| International seaborne trade carried by containers | 1,631 m t | Details ? |

| Container penetration in maritime transport | 66% | Details ? |

| Estimated value of international seaborne trade | $15tn | Details ? |

| Global Container Fleet | Values | Statistic |

|---|---|---|

| Capacity of container ships in seaborne trade | 228 m dwt | Details ? |

| Global cellular container ship fleet capacity | 15,406,610TEUs | Details ? |

| Germany’s share of the world container ship fleet | 6.5% | Details ? |

| Operators and Ports | Values | Statistic |

|---|---|---|

| Number of ships operated by APM-Maersk | 629 | Details ? |

| AP Møller – Mærsk’s revenue | $40,308m | Details ? |

| Port of Shanghai’s container throughput | 36.5m TEUs | Details ? |

Bulk Carriers: Bulk carriers transport merchandise that cannot be containerized – mainly raw materials like timber, coal, cement, grain, iron ore, etc. Bulk carriers are equipped with special machinery to aid in the handling of this type of merchandise.

Bulk cargo comes in the form of dry bulk or liquid bulk. Liquid bulk is transported using tankers. Often, bulk cargo is transported in full shiploads.

The chart below shows that there has been consistent growth in the worldwide volume of merchandise transported by bulk carriers since 1980.4

Tankers: Tankers are similar to bulk carriers, but are designed specifically for the transportation of crude oil and related products. Tankers are classified according to their deadweight capacity (DWT), with the smallest size group being 10,000 – 19,999 DWT and the largest being 200,000+ DWT. Tankers are also categorized according to the products they carry, crude or product. Based on The Tanker Register 2016 by Clarkson Research, the American Association of Port Authorities estimates that as of January 1, 2016;

The chart below shows the amount of crude oil that is transported by the world’s tankers.

Specialist Ships: These are ocean-faring vessels designed to function in support of other types of maritime vessels or to perform activities related to specific industries. For example, an ocean-going vessel that’s been equipped to transport entire shiploads of motor cars from Asia to North America would fit this category – ships designed to carry cars are described as roll-on/roll-off (RoRo) ships.

A Container Ship | Image Credit: Helmut Jungclaus via Pixabay

Decades later, when enormous trailer trucks rule the highways and trains hauling nothing but stacks of boxes rumble through the night, it is hard to fathom just how much the container has changed the world.

– Levinson, Marc (2016-04-05). The Box: How the Shipping Container Made the World Smaller and the World Economy Bigger (p. 1). Princeton University Press. Kindle Edition.

Taken together, bulk carriers, tankers, and some specialized ships comprise the tramp shipping segment of the market. The tramp trade describes cargo moved by ships that do not have fixed schedules or make planned port calls. These ships are usually engaged on a contract basis for the transport of commodities, namely crude oils, product (or refined) oils, major dry bulks (those comprising greater than two-thirds of the world dry bulk trade such as iron ore, coal, and grains) and minor dry bulk (those comprising the remainder of the bulk trade such as steel products, forest products, cements, and non-grain agricultural products like sugar).

The three types of charters, or contract under which a shipper can engage a tramp ship, in order of popularity, are;

The diagram below is a self explanatory depiction of the organization of the shipping market. It is taken from the 3rd edition of Martin Stopford’s Maritime Economics.

Shippers: Any entity that pays to have its cargo shipped.

Freight Forwarders: A freight forwarder functions as a consultant to shippers by arranging and taking care of the details related to the import and export of a shipper’s goods. A freight forwarder does not physically ship cargo. Instead, the freight forwarder is a broker who uses extensive industry knowledge, established relationships, knowledge of the law, and experience to get the best deal possible given constraints set by by the shipper. According to the October 2016 update of the industry profile of Freight Forwarding Services published by First Research, the industry generates annual revenues of approximately $260 billion.5

Non-Vessel Operating Common Carriers (NVOCCs): An NVOCC is similar to a freight forwarder. However, an NVOCC may go an extra step and physically handle cargo on behalf of shippers in the sense that they will load cargo onto containers that then get shipped by ocean carriers. NVOCC’s generally will accept partial container loads for shipping on the shipper’s behalf. An NVOCC may own or lease its own containers, but does not own any ships.

Ocean Carriers: These are the companies that actually own the ships in which cargo is transported from one place to another. The relationship between the carrier and the shipper is governed by the bill of lading (B/L), a contract that documents the composition of the cargo, the ownership of the cargo, the terms of the agreement to transport the cargo, and eventual delivery from the carrier to the shipper.6

The following chart outlines the world’s leading container ship operators.

Other participants in the wider maritime freight market include customs authorities, warehouse operators, freight trucking companies, and various entities that are the end customers of the shippers. For example, Best Buy might be the end-customer for shipments of Apple’s iPhones from Foxconn’s manufacturing facilities in China.

As we have stated previously, liner shipping describes the portion of the maritime shipping market that adheres to fixed schedules on regular routes. Charter shipping occurs on a just-in-time basis, usually brokered through the services of a freight-forwarder or an NVOCC on behalf of the shipper. The term “tramping” is used within the industry to refer to charter service.

Oil companies often own or lease the tankers that they use to transport their goods around the world. For example; BP Shipping was established in 1915, and now operates BP’s international fleet of 49 ships made up of tankers and liquid bulk carriers.7

One anecdote we heard suggests there may be at least as many as a dozen intermediaries involved in the process of getting one shipment of goods from one point to another. However, it is not clear if this is broadly true across the industry or of it applies only to certain segments of the market.

According to the United Nations Conference on Trade and Development (UNCTAD);8

“In general terms, the demand and the supply of maritime transport services interact with each other to determine freight rates. While there are countless factors affecting supply and demand, the exposure of freights rates to market forces is inevitable. Cargo volumes and demand for maritime transport services are usually the first to be hit by political, environmental and economic turmoil. Factors such as a slowdown in international trade, sanctions, natural disasters and weather events, regulatory measures and changes in fuel prices have an impact on the world economy and global demand for seaborne transport. These changes may occur quickly and have an immediate impact on demand for maritime transport services. As to the supply of maritime transport services, there is generally a tendency of overcapacity in the market, given that there are no inherent restrictions on the number of vessels that can be built and that it takes a long time from the moment a vessel order is placed to the time it is delivered, and is ready to be put in service.

Therefore, maritime transport is very cyclical and goes through periods of continuous busts and booms, with operators enjoying healthy earnings or struggling to meet their minimum operating costs.”

In Maritime Economics, Martin Stopford further illustrates the economic and financial challenges that shipping companies must contend with when he says;9

“. . . the challenge is to create sufficient financial strength when times are good to avoid unwelcome decisions such as selling ships for scrap when times are bad. It is the company with a weak cashflow and no reserves that gets pushed out during depressions and the company with a strong cashflow that buys the ships cheap and survives to make profits in the next shipping boom. It is not therefore the ship, the administration, or the method of financing that determines success or failure, but the way in which these are blended to combine profitability with a cashflow sufficiently robust to survive the depressions that lie in wait to trap unwary investors.”

In order to develop some insight on which to base our understanding of the economics of ocean freight shipping we have relied on the following sources;10

Shipping revenues are affected by the interplay between cargo capacity, productivity, and freight rates. Where revenue increases as each of these factors is maximized by the shipping company.

The costs of operating a shipping fleet are determined by the interaction between operating costs – including periodic maintenance costs; the costs of maintaining the sea-worthiness of the ships in the fleet according to regulatory requirements and the shipping company’s own policies, voyage costs, and cargo handling costs.

Lastly, ship owners have to worry about capital costs which are a function of the mechanism by which the fleet has been financed.

Stopford points out that the shipping industry has not adopted an internationally accepted standard classification of costs, making any discussion about costs in the shipping industry confusing and unnecessarily difficult.

The following variables also play a crucial role in determining the profitability of a shipping fleet operator;

To further ground our understanding of the economic realities of the ocean freight shipping market, the following data and diagrams from Stopford’s book are helpful.

By comparing average earnings per day with the standard deviation of daily earnings, we get a sense of the extreme economic and financial uncertainty that plagues operators of shipping fleets.

In the table below, notice that one way to guard against the revenue volatility that’s evident in the data above is for fleet operators to diversify the types of ships that they buy to compose a fleet. For example, one such fleet might be made up by combining VLCC, Panamax, Handymax, MPP 16kdwt, and Containerships in different proportions that add to 100%. Basically, the fleet operator has to invest in a diversified portfolio of ships in order to protect the fleet from the probability of failure or bankruptcy associated with any one specific ship or class of ships.

The diagram below outlines the macroeconomic factors that influence supply and demand in the shipping market. Note that there are several factors over which the fleet operator has no control.

The diagram below outlines the flow of cash and services between the 4 primary segments of the shipping market; The freight market, the shipbuilding market, the sale and purchase market, and the demolition market.

Sabeen Firozali (@sabeenfirozali) is a Vice President at Comerica Bank in New York, where she invests debt capital in technology and life sciences startups. Her experience as a debt investor spans both public and private markets and across many industries, including technology, healthcare, industrials, energy and consumer. She sent us the following comment, which provides additional context to the economics of the ocean freight shipping market;

“I used to cover shippers like Overseas Shipholding Group (OSG) back when I did distressed debt investing. These companies have pretty complex capital structures (For example; each ship is in a different entity). That required a thorough analysis of the assets and future earnings potential from those assets. In 2012 when I was covering this industry, we were really worried about low spot rates for everything from VLCCs to Panamaxes and also a deluge of fleet supply keeping prices low.

This is a double edged sword for startups selling into the market; on one hand shipping companies are highly motivated to find and pay for products that help them operate more efficiently. On the other hand, in the worst case scenario the ships might be scrapped in a desperate bid by some incumbents to avoid bankruptcy. This is not an uncommon occurrence since each ship is an independent entity onto itself, and can be allowed to fail without necessarily putting the holding company at risk.

As we alluded to in our post on freight trucking startups, supply chain and logistics is a big market . . . and there are many startups building products to serve that market. This market map by CB Insights lays out the landscape in sufficient detail to provide a sense of the breath of the market for supply chain and logistics software. You can find the accompanying blog post here.

Given how far removed ocean freight shipping is from the day to day experience of most people, it should not be surprising that there is a much smaller number of startups building products for the ocean freight shipping market.

Before we get to the startups, the following data and charts from CB Insights helps to paint of the level of interest among investors. Compiling data specifically focused on maritime startups would have been an incredibly tedious and time consuming process. So, we are using aggregate data as a proxy.

Investments in Startups Building Marketplaces

The next three charts focus on startups pursuing marketplace business models, and reflect investments by institutional venture capitalists and angel investors only. Corporate VCs are excluded, for the most part . . . The database query might have failed to pick up a couple. The data is as of Jan. 30, 2017.

As you can see, funding amounts peaked in 2015 while the number of discrete investments peaked in 2016. One way to interpret this is that, to some extent, the 2016 trend in number of deals may reflect a case of “me-too” investments driven by social-proof bias.

Investment Activity – Marketplaces – Venture Capital and Angel Investors ex Corporate VCs, Past 5 Years

Comparing measures of central tendency in the data, notice that there is dramatic jump in the average deal size in Q2 2015 and Q3 2015, but this trend is not reflected in the median deal size.

The deals below largely account for the spike in aggregate funding amounts, and correspondingly, in average deal sizes for Q2 2015 and Q3 2015, respectively, in the chart above.

The next chart gives you a sense of the investors who are most actively investing in startups that are building marketplace business models.

Investments in Startups in Supply Chain and Logistics

The next three charts focus on startups pursuing business models in the Supply Chain and Logistics market, and reflect investments by institutional venture capitalists and angel investors only. Corporate VCs are excluded, for the most part – you’ll notice that the query missed a couple. The data is as of Jan. 30, 2017.

Investment Activity – Supply Chain and Logistics – Venture Capital and Angel Investors ex Corporate VCs, Past 5 Years

Comparing measures of central tendency in the data, notice that there is dramatic jump in the average deal size in Q2 and Q4 of 2014, but this trend is not reflected in the corresponding median deal size in each period.

Investment Activity – Marketplaces – Venture Capital and Angel Investors ex Corporate VCs, Past 5 Years

The deals below largely account for the spike in aggregate funding amounts, and correspondingly, in average deal sizes for Q2 2014 and Q4 2014, respectively, in the charts above.

The next chart gives you a sense of the investors who are most actively investing in startups that are building products for the supply chain and logistics market.

Investment Activity – Marketplaces – Venture Capital and Angel Investors ex Corporate VCs, Past 5 Years

Below is a sample of some of the startups building technology products specifically for the ocean freight shipping market. You may recognize some of them in the market map from CB Insights. There is no particular rationale for the order in which we have arranged them here. Descriptive summaries are either copied directly, or based on information, from each startup’s website. Other data presented below is based on information collated by CB Insights, Traxn, Crunchbase, or Mattermark – with CB Insights being the source that appeared to have the most complete information, where it was available at all, and that data is current as of Jan. 25, 2017.

There are undoubtedly tech startups in this market that we have not yet heard about. Let us know about any we have omitted, but which you feel we should be aware of. Full disclosure, we have done some preliminary due diligence on a couple of the startups on this list.

Fleet

Xeneta

Holland Container Innovations

Kontainers

Flexport

iContainers

FreightOS

Cargohound

Haven Inc

CoLoadX

Octopi TOS

WindWard

Hive Maritime

SimpliShip

Shippabo

AlphaShips

New York Shipping Exchange

Nautilus Labs

MARSEC

ClearMetal

AKUA

Quotiss

Blockfreight

Navarick Corp

MainDeck.io

OpenSea Pro

Stage 3 Systems

eSSDOCS

PortCall.com

SailRouter

Shipamax

PortXL

While we believe there is a smaller number of startups building products for the ocean freight market, we almost certainly have missed more than we have been able to capture. We are eager to hear about startups we have missed, or to hear about the ideas that people are exploring and hope to launch in the near future.

Everyone loves containers. They see them. They get them. It makes sense. But when you look at number of vessels, container ships are only 10%. They’re inconsequential to bulk, crude, gas/chemical, and cargo. Much more interesting markets to be exploring in my personal opinion.

– Anthony DiMare, co-founder/CEO, Nautilus Labs (via email)

On a relative basis, if software and automation are “eating the world” as it were, one might argue that the ocean freight shipping market failed to read the memo. However, it ought to be evident from the preceding discussion that there is a small band of entrepreneurs out to change that state of affairs.

While they spare no effort to that end, market analysts at Lloyd’s Register, University of Strathclyde’s Department of Offshore, and QinetiQ have some ideas about what the industry might encounter between now and 2030. The Global Maritime Trends 2030 report is worth reading if this market if any interest to you at all. If that seems too much there’s a more easily digestible summary.11

The report considers three scenarios and how each might be affected by demography, the global economy, demand for resources, and disruptive events. While the rest of the report is very interesting, for the purpose of this study we will highlight the events that the report’s authors believe could be disruptive to the shipping market in general, and hence to the ocean freight market.

The technological disruptions that the authors worry most about are;

Before we get to 2030, however . . . There are more immediate issues startups and investors operating in this market have to be aware off. Below we highlight some of them.

We believe that entrepreneurs succeed when they take advantage of a threat or opportunity that others do not notice. Are there any we have missed? If yes, please tell us.14

The overwhelming majority of maritime carrier vessels have their positions, speeds, and trajectories tracked by Automatic Identification Systems (AIS). AIS systems are usually composed of Very High Frequency (VHF) transmitters and receivers, GPS receivers, maritime electronic links, vessel sensors and display systems. AIS systems are ubiquitous because of Regulation 19 of the International Convention for the Safety of Life at Sea (SOLAS) Treaty. SOLAS was enacted in 1974 by the International Marine Organization (IMO), the United Nations special agency tasked with regulating shipping for its 172 Member and three Associate countries. The purpose of AIS is to provide safety at sea by increasing visibility and capacity to plan around surrounding vessels. The regulation applies to any ship with greater than 300 tonnes of gross tonnage registered in an IMO country.

Traditional applications of AIS include collision avoidance, fleet monitoring, security, search and rescue, and cargo tracing. Should startups begin to experiment with ways to disrupt the maritime freight industry, AIS could prove to be a useful system on which they can build.

Transparency is the first step toward building a highly predictable marine shipping infrastructure. Transparency into a ship’s location allows carriers and brokers to more accurately estimate the arrival of cargo. There is still a ways to go towards that end. In 2013, annual container lines schedule reliability, a measure of the percentage of ships that arrive within their delivery window, fell between 67% and 83%.

Further, the effects of weather and ocean currents complicate the estimability of vessel arrivals. However, we believe that maritime freight would serve to benefit from;

AIS infrastructure can provide a foundation to future advances in cargo transparency and freight accessibility for shippers.

Writing this post was primarily an exercise in learning more about the ocean freight shipping market in order to be better equipped for the conversations we are currently having, and conversations we may have in the future, with startups building products for this market. If we have missed anything you feel is important please let us know.

We know how frustrated founders feel when early stage investors (a) do not know anything about a market in which they profess to wanting to make investments in, and (b) make no effort to learn enough about that market in order to have substantive discussions with the founders about what the founders hope to accomplish, and the merits of an investment in the specific startup that founder is building. We do not want to be that investor, we believe in doing our homework.

If you are building a seed stage startup in this market we would love to hear from you. If there are early-stage startups we have not heard about yet, we would love to know that too. If you invest in or have invested in seed-stage startups pursuing any of the opportunities we have described above, or others in the ocean freight shipping market, we’d love to collaborate with you on future investments. If you are a shipping industry insider . . . We’d love to hear from you as well.

You can leave a comment in the comments section below, or you can email us directly;

One last thing. We’d like to express our thanks and appreciation to Britie Sullivan and her teammates at CB Insights for all their help obtaining data that we could not easily gather on our own for this article, and also for the freight trucking article before this. She answers our questions patiently, and often gives us more than we expect. This article is much better because of the data and insights she helped us obtain.

Additional Reading

Industry Links

Update: February 8, 2016 at 19:47 to include comments from Sabeen Firozali, and to add footnote about IoT applications to engine Mx.

Update: February 9, 2016 at 05:19 to include Nautilus Labs and MARSEC to list of startups, comment from Anthony DiMare, and link in footnotes to IoT in transportation and logistics article from Deloitte University Press.

Update: February 9, 2016 at 11:16 to include AKUA and ClearMetal, also edit Nautilus Labs’ summary.

Update: February 9, 2016 at 18:51 to correct Sabeen Firozali’s comment. It originally referred to interest rates instead of spot rates. Spot rates were higher in 03-10 and they are directly tied to revenue; higher spot rates lead to higher revenues. When spot rates were high, lots of companies invested in building ships.

Update: February 9, 2016 at 19:31 to correct the aggregate funding amount raised by CoLoadX from $40,000 to $240,000 based on information provided by the co-founders.