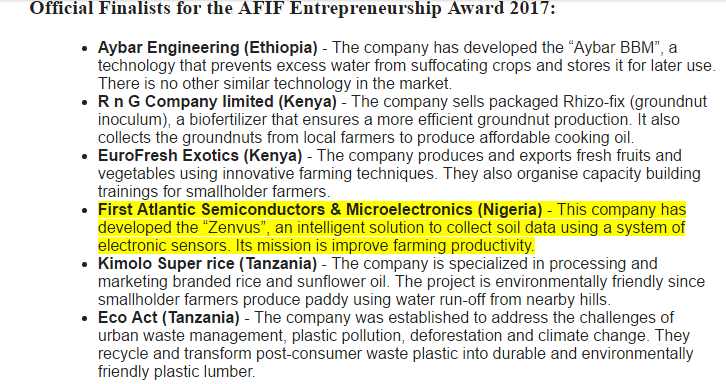

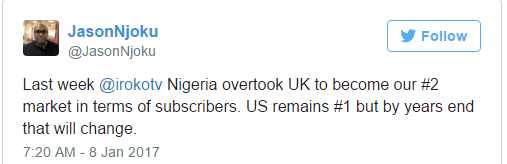

Over series of tweets, the founder of iROKOtv, Jason Njoku, informed the world that his company is outperforming in Nigeria as the country has overtaken UK in subscriber base. He also noted that U.S. has the #1 position in subscriber base, and he expects Nigeria to overtake U.S. in coming years.

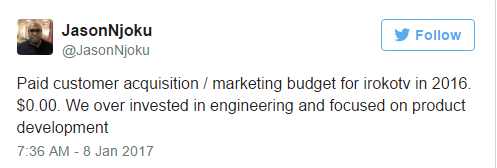

But the most amazing feat is that he was able to execute his strategy without committing a lot of money in advertising. This is where Jason has shown a good mastering of digital business in Nigeria.

The reality is that paid customer acquisition is ephemeral especially in Nigeria where you build up traffic only for it to fizzle when the campaign ends. By then Google and Facebook had taken their payments.

Konga, Jumia, and Lyf had used the paid customer acquisition strategy. The results have been missed. The key is focusing on product development, and relying on that build customer growth in an organic word-of-mouth way. It takes more time but it is more durable.

In the tweet, Jason noted that he had achieved this new milestone by investing in innovation and retooling his products.While those are critical like the N100 per week payment plan, N3,000 yearly plan and kiosk delivery, the key one is what Jason has no control.

Notice that N3,000 yearly subscription is a good pricing point in Nigeria as that is less than $7. Largely, most people can afford that. We are not sure the UK subscribers are on the same payment plan. So that means, the UK subscribers may be paying more to have the same service in Nigeria. The implication is that the strategy is biased to have more Nigerian subscribers.

That is not a bad strategy, considering purchasing power parity (PPP), as it is far easier to make, say, $10 in UK, than make $7 in Nigeria.

Sure, iROKOtv has done well in strategy as here in Owerri we do enjoy it. But the biggest reason for the success is that the cost of broadband has gotten cheaper. That is the main reason why Jason’s strategy is working. Right now, one can load a N500 Glo plan and binge for a decent amount of time on iROKOtv.

As meters are running both for telcos and iROTOtv, people are conscious of the cost of broadband before watching videos in Nigeria.

iROKOtv can see 2000% growth in 2017 if it can pay for MTN to remove metering in its platform. Then, the only cost becomes the subscription fee. Of course, the subscription cost may not cover any contract iROKOtv will sign with MTN.

In corollary, if the price of broadband rises, very unlikely because of Moore’s Law, the the portal subscription growth can fluctuate.

As we move into 4G and then 5G, iROKTOtv will continue to experience higher growth in Nigeria and indeed across Africa. We think 2019 will be the breakout year as our internal data shows that Nigeria will be at parity with some leading economies on broadband cost, using PPP, when you look at the trajectory over the last five years. When that cost of broadband becomes marginal, digital ecosystems like iROKOtv will flourish.