I checked in, and then got some coffee.

I rarely like to travel; I hate having to go through security. I hate going to conferences. Most of the time I come away feeling I did not accomplish what I set out to accomplish. On Wednesday morning I left NYC on a JetBlue flight. I was heading to New Orleans for the 2nd annual PowerMoves.NOLA conference. I had to change my plans to attend the 1st installment of the conference last year at the last minute. I am glad I was able to attend this year.

In this post I will highlight the work that PowerMoves.NOLA is doing, the startups that were at the conference as part of the program, and some of the conversations I had with founders, and other investors while I was there.

About PowerMoves.NOLA

PowerMoves.NOLA is a national initiative to deploy innovative ideas, fresh approaches, and an overall commitment to equity and diversity as a growth strategy to address the generational obstacles that prevent minority entrepreneurship. Leveraging the thriving entrepreneurial ecosystem, resources, and culture of New Orleans, PowerMoves.NOLA’s mission is to increase the number of venture-backed minority-founded companies locally and nationally.

Through its fellowship program, pitch competitions, and boot camp, PowerMoves.NOLA acts as a catalyst, providing early-stage and high-growth minority entrepreneurs with access to capital, advisors, and the support they need to succeed. The national conference events showcases some of the top minority entrepreneurs from around the country.

PowerMoves.NOLA’s objective is to make the national conference the premier event for minority entrepreneurs to support their companies, learn from experts, and build visibility of their products, and attract early stage investors.

PowerMoves.NOLA is an initiative of the New Orleans Startup Fund (NOSF), sponsored by Chevron, and in a promotional partnership with ESSENCE Festival™ presented by Coca-Cola®.

While there is danger in the venture business in getting too far away from the crowd, it can often pay to be unconventional. Don Valentine, the founder of Sequoia Capital, told me to trust my instincts, which lets you avoid getting dragged into conventional thinking and trying to please others.

In order to outperform any given market, it is mathematically true that you must not essentially be that market. In other words, a venture capitalist can’t outperform other venture capitalist if they act just like them. This may seem like common sense but you would be surprised how much herding happens anyway, since many people would rather fail conventionally than succeed unconventionally.

– Tren Griffin, A Dozen Things I’ve Learned From Michael Moritz About Venture Capital. Accessed on Jul 5, 2015 at http://25iq.com/2014/06/07/a-dozen-things-ive-learned-from-michael-moritz-about-venture-capital/

Day 1 – Wednesday, July 1

The flight from JFK was shorter than I had thought it would, I did not realize New Orleans is that close. I arrived in the morning, and had a bit of time to catch up on work before activities related to the conference began.

The conference began with a networking reception and dinner at the New Orleans Museum of Art. I spent my bus ride from the hotel to the museum chatting with Rachelle Oribio who runs the Techstars++ Mayo Clinic program. Before Techstars Rachelle worked at Defy Ventures, and before that she helped convince communities in the Amazon to give up cultivating coca and instead to grow coffee and cocoa. We had a great conversation about early-stage investing, and startups. Our conversation got most animated when we were talking about startups we both got to see up-close, but in which KEC Ventures did not make an investment. It was interesting to hear what they are up to now, after going through Techstars++ Mayo Clinic and how the vision has evolved into what I assumed it would become.

I also ran into Chinedu Echeruo. He is the founder of HopStop, which was bought by Apple in 2013. We have been corresponding by email for about 3 years, but have never met or spoken on the phone. It was great to finally meet him in real life. Also, I always have a lot of fun when I meet a Nigerian or a Ghanaian . . . They get my jokes about Nigerians and Ghanaians.

Before that I had been chatting with Nnamdi and Aaron from 645 Ventures and also with Karl Bell and Adrian Ohmer from Invest Detroit. During dinner we listened to a presentation by LISNR’s Rodney William’s. LISNR is a high frequency, inaudible smart-tone technology; a new communication protocol that sends data over audio. LISNR aims to eventually be a technology standard for user authentication, peer-to-peer communication, and secure data transfer for connected devices in the evolving internet of things. I had seen him pitch in NYC about 9 months ago, so it was great to see how much progress LINR has made since then. It is in the midst of raising a Series B Round of financing.

Next time I visit New Orleans, I will try to visit the New Orleans Museum of Art again.

New Orleans Museum of Art – Jul 1, 2015

After dinner I went back to my room, did some work, and then went to sleep around midnight.

There’s nothing more invigorating than being deeply involved with a small company and everybody’s betting against us.

Great venture capitalists love the process of creating companies and more importantly creating customer value. Venture capital is a service business. Making others successful is the driving activity in the work. Finding vicarious joy in the success of others is essential.

– Tren Griffin, A Dozen Things I’ve Learned From Michael Moritz About Venture Capital. Accessed on Jul 5, 2015 at http://25iq.com/2014/06/07/a-dozen-things-ive-learned-from-michael-moritz-about-venture-capital/

Day 2 – Thursday, July 2

I was up early. At 4:00 AM. So I did some work, showered, and then I emailed the attendees around 5:30 AM to say I’d be down at Starbucks between 6:00 AM and 8:45 AM, if anyone wanted to chat. The response was overwhelming. I got to chat with about 20 of the founders who were attending the conference during that time as they stopped by to chat for a few minutes each. Through out the rest of the day, and the rest of the conference founders identified me by my obnoxious neon orange sneakers, and my puma t-shirt and my black baseball cap. I got to chat with lots of people I might not have met otherwise.

My Uniform – Orange sneakers + jeans, puma t-shirt, black cap

Some of the people who stopped by that morning to chat; the ones with whom I had conversations that went a bit in-depth on a specific question they wanted to talk through; Edward Morgan of Revitalize Charging Solutions – he has a sales pipeline of about $8.7M and described his revenue model to me. Of course, I immediately suggested he run an experiment to see if the market will embrace another revenue model that would make his business model more attractive to investors. He currently has a payback period of two months on each device, I suggested he should see if he could reduce that to zero. I made the suggestion based on what I have learned from a startup I have been working on since August 2010, and in which KEC Ventures is an investor. I also chatted with Rudi from Joicaster, K.G from Quarrio, Craig Lewis from Visage Payroll, Larry Lawal from HealthFundIt, and Toni Okolo from PracticeGigs. I also had a long conversation with Harold Jean-Louis from SmartCoos about the market for business-to-consumer apps designed to help parents educate their young children. We spent a lot of time chatting about opportunities abroad, especially in China.

I bet the baristas and other folks at SBUX must have wondered what was going on . . . Our table was packed, some people had to pull up more chairs from other tables because the 6 at our table were taken. I’m glad I hit send on that email instead of deleting it for fear of pissing people off. There was a lot of laughter. That’s always a good sign.

Around 8:45 I walked over to Champion Square with Aaron Holiday of 645 Ventures. He was a judge for the #EntergyAngelPitch so he wanted to get there a little early.

These are the startups that pitched – 3 of the 5 are startups I had not heard about before.2

- bluField is an interconnected system of Bluetooth® beacon networks, which creates a high-resolution grid of a real-world geographic area.

- FoodTrace is a powerful software platform providing food businesses with tools for next-level sourcing management. We help farmers and artisans sell more and buyers buy better. A platform built on proven solutions for businesses to locate and attract new customers, utilize data as insights and food trends for better strategy, and increase revenue with sharing tools for the value-added marketability of quality sourcing.

- Joicaster is a video syndication platform that enables content creators to schedule, manage, and distribute live content across multiple platforms to yield larger audiences in a simpler cost effective manner. JOICASTER simplifies the process of syndicating live video to multiple online streaming platforms.

- Lineapple turns smart phones into a mobile buzzer which in turn helps businesses increase profits by converting lost shopping time into new opportunities to increase and close sales. Lineapple is unique because it works inside the micro sales and non-revenue producing windows that are generally controlled by wait-times not during the already profitable active shopping time.

- [N]tensify provides a branded in-app merchandise store as an additional revenue stream for mobile app developers, integrated via a software development kit (“SDK”). Ntensify creates apparel, plush, and other unique merchandise based on app designs. Ntensify provides a full service production chain, handling all customer data, payment processing, design, manufacturing, and fulfillment.

The #AngelPitch was followed by the #SeriesAPitch – 3 of the 5 are startups I had not heard about before.

- Maker’s Row is an online B2B marketplace that connects brands with US-based factories. Maker’s Row was founded in November 2012 and currently hosts over 75,000 brands and 6,000 US-based factories. For brands, Maker’s Row provides a transparent community for any size brand to connect with US manufacturers by viewing their factory profile and messaging directly through the Maker’s Row platform. For Factories, Maker’s Row provides a platform for factories to showcase their capabilities and generate inquiries and leads in our community of brands and designers

- Quarrio is Conversational Analytics. Users ask questions in ordinary English and the system answers instantaneously in plain English with auto-generated graphs and charts. More importantly, the user can then ask follow-up questions and quickly drill down to the important information they seek. The software is a broad artificial intelligence platform that works with any enterprise data source, launching first to sales managers using salesforce.com. Quarrio has created a Learning Natural Language Interface to Databases delivered as a SaaS platform that enables ordinary people to do advanced reporting and analytics.

- Upswing partners with colleges to provide an easy-to-use virtual learning center for students (for free) and a real-time comprehensive analytics for administrators. Each day, over 200,000 students have access to live, 24/7 tutoring via Upswing. Each student can choose which tutor to connect with among both their college support staff and Upswing’s coaches. Sessions take place online within Upswing. Each session is recorded, aggregated, and reported back to administrators so they can become equipped with the tools necessary to fight student attrition.

- Partpic is an enterprise software solution that simplifies the search and purchase process of replacement parts using visual recognition technology. It’s as simple as 1. Snap 2. Discover 3. Purchase with Partpic’s API integrated on your retail website or mobile application. Partpic simplifies the part-search process by allowing a purchaser to simply snap a picture of the part she is looking to replace. Using a collection of visual recognition algorithms, Partpic matches the user-generated image with a part in our extensive database. It then returns the name of the part and its specifications. Partpic makes it easy. Consumers upload a picture of a part either via the company’s Partpic powered mobile application or the company’s website. Partpic handles identifying the part and only leaves the sales rep with the responsibility of confirming and processing the order for the consumer, eliminating purchase errors in the process.

- Nexercise is a digital health company with the goal of disrupting the exercise industry with the only platform that provides personalized on-demand video workouts for any need to any screen anywhere. Sworkit, which is the consumer facing brand, has achieved over 1 million monthly active users with a 5X growth since January 2015 and see over 15K downloads per day. Nexercise is the first all African American leadership team to graduate from the TechStars accelerator in Chicago 2013. Sworkit is currently available on iOS and Android for both phones and tablets. They offer a “lite” version that is free and ad-supported, and a “pro” version costing a one-time fee that delivers an ad-free experience and enhanced customization. In Q2 2015, they are introducing subscriptions for both professionals and general users. Don’t quote me, but my sources tell me Sworkit hit the $100K revenue milestone for monthly revenue in June, last month.

I have been tracking Partpic since March/April 2013 when I saw Jewel pitch at NYC Seed. So I was not surprised when I heard the judge’s decision.

View image on Twitter

We had lunch after the #SeriesAPitch . . . I ate a lot – I usually do not eat very much, if at all. Shrimp and grits, more shrimp and grits, blackened pork chop with rice and beans, beef brisket sandwich, more beef brisket sandwich. I also talked with Nnamdi and Aaron about some of the startups, and possibly tag-teaming on due diligence in anticipation of their next round. I also caught up with Rudiger Ellis from Joicaster, he had come down for coffee at Starbucks early in the morning, so it was great to reconnect and chat about his experience attending the conference. It was his first time too. Danielle from Lineapple talked us into getting snowcones . . . shaved ice with syrup drizzled over it, helps cool down from the heat.

I decided to head back to my hotel room in order to make sure nothing work-related was falling through the cracks. Also, my wife decided to come down from NYC for one day, and I had not yet seen her since she arrived early that morning.

So, I did some work. Showered, and got ready for the cocktail reception that evening. It was hosted by Liberty Bank. On the bus ride over I sat next to Uchechi Kalu Jacobson of Wedocracy – before that I would never have thought I would be chatting with anyone anywhere about the logistical challenges involved in planning and having a Nigerian-American-Jewish wedding in Mexico. But, we did talk about that and it was helpful that I have been following “WeddingTech” for some time. Later that evening I met Peter, Uchechi’s husband at the cocktail party.

I went back to the hotel after the cocktail party – on the bus ride back to the hotel I got to catchup with Candace Mitchell from Techturized/Myavana who I have known since October 2014 when we met at Digital Undivided’s FOCUS100 in NYC. I told Candace about Indie dot vc when it launched. Techturized/Myavanna is in the 1st Indie.vc cohort. It was my first time seeing her since the program began and so I was eager to hear about the kinds of issues she and her co-founder are wrestling with now that fundraising is not as much of the desperate emergency it used to be.

Once at the hotel, I did some work and then went to sleep around 10:30 PM.

Day 3 – Friday, July 3

I woke up at 1:00 AM and did some work, mainly responding to emails . . . . and trying to fix appointments that had somehow fallen through the cracks because of a misunderstanding between me and Amy, my assistant. I also got caught up on news, and did a bit of reading. I emailed the #PowerMoves.NOLA attendees again, around 3:00 AM that morning. It had occurred to me that since it was Friday, and since I usually would be holding @KECVentures Investor Office Hours if were home in NYC, I ought to do the same @PowerMoves.NOLA. So I decided to hold @KECVentures Investor Office Hours @PowerMoves.NOLA, fuelled by Starbucks, from 6:00 AM – 9:00 AM. I had a large coffee with 3 shots of espresso. The barista thought I was crazy.

The most fascinating conversation I had during office hours was with Candace from Myavana. They are grappling with a problem that I think could form a great foundation for a ph.d thesis in combinatorial analysis – this would combine math, economics, finance, and business strategy. I suggested she chat with some of the graduate students in the Mathematics, Statistics, and Economics departments at Georgia Tech. There may be a ph.d candidate in one of those departments looking for an interesting problem to study who is also interested in this specific class of problems.

I also chatted with Sterling Smith. He and his team at Keystoke are building Sandbox, which is a system they believe will enable anyone anywhere in the world to build a mobile app to accompany an ecommerce store on the web. I expect to follow up with him when he visits NYC to try to meet investors, he’s raising a seed round.

Kofi Frimpong from Branslip also stopped by . . . I later remembered that I had read about him in 2012, and tried to connect with him then. At the time he was working on a different idea, mentoring high school students in the Philadelphia area to help them complete the journey from high school to college. Brandslip is different. It’s a social network for social media influencers and content creators.

Craig Lewis from Visage Payroll, and Samuel Lemu-Johnson from Sein Analytics also stopped by, though we could not chat for long because they were headed to an invitation only FinTech event from 8:30 AM to 10:00 AM. I was not invited to the FinTech showcase so I decided to use that time to try to catch up on some work in my hotel room between 9:00 and 10:00. That was a bad idea because I missed the bus to the next event, so I had to catch a cab. Fortunately I made it there on time.

These are the startups that pitched at the Morgan Stanley Fintech Showcase – 4 of the 5 startups that pitched are startups I had not heard about before.

- eMoneyPool is an online community where members pool funds to borrow and save together. The concept is based on a centuries-old financial practice where your reputation within a community is your credit. Millions of people in the United States, and billions worldwide rely on money pools because they don’t have access to traditional credit, so they instead turn to each other and leverage the capital resources of a community. eMoneyPool has formalized this practice and created a high-tech solution that is efficient and familiar to our target market.

- The municipal bond industry has grown significantly over the past 30 years, but the technology to support the industry has not kept pace. Munivestor offers financial software that tracks news, trades, and market events for more than 2 million individual municipal bonds. The information that we collect informs investors and assists them with maintaining their portfolio value.

- Visage Payroll is a SaaS payroll startup established on the belief that small businesses shouldn’t have to pay to pay their employees or their taxes. There are 28 million small businesses in the US and 4M of those have less than 4 employees. We can help owners save an average of 10 hours/month and $1,800/year. Using back of the napkin math, that’s $50.4B in US small business savings and 280M hours a month being lost.

- LendStreet combines credit counseling and distressed debt buying in a social lending platform to help distressed debtors proactively refinance existing debt into a low interest loan. Borrowers on our site do not receive cash; instead, the money invested by investors goes directly to paying the existing creditors at an agreed-upon discount. The discount is shared with the debtor in the form of lower debt, a reduced interest rate, and monetary incentives for financial literacy.

- Sein Analytics helps investors, advisory firms, and issuers accurately value credit securities. Sein has developed a scalable cloud infrastructure specifically designed to manage complex mortgage and asset-backed securities (ABS).

You are the asshole who added me on LinkedIn and then did not respond to my follow up email!

– Toni Oloko, founder & ceo at PracticeGigs. PracticeGigs is in the current cohort of the MassChallenge Accelerator Program. Toni deferred starting his freshman year at Wharton in order to build PracticeGigs. We connected on LinkedIn in May. He joined me and other #PowerMoves attendees for coffee on Thursday. I responded: “I can tell we’ll get along really well.”

Time for the start of PowerUp Demo Day presented by #IberiaBank. @guydon is warming up the crowd with funny intros pic.twitter.com/JC3XsNjmZk

— PowerMovesNOLA (@PowerMovesNOLA) July 3, 2015

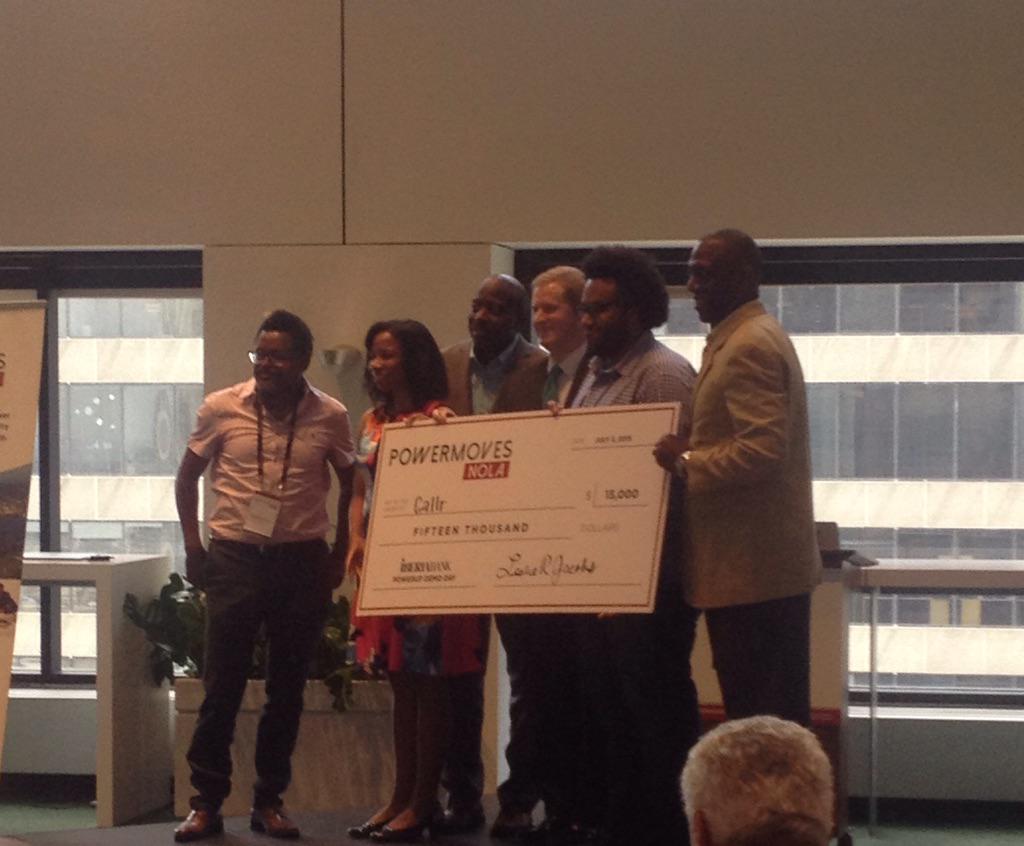

These are the startups that pitched at the PowerUP Demo Day, it was the culmination of the PowerUpBootcamp, which is part of PowerMovesNOLA programming. PowerUp is administered by PowerMovesNOLA in partnership with Startups Illustrated.

- BIOEYE – puts a mass spectrometer in your smartphone.

- Black&Sexy.TV – building the “Netflix + HBO” for the global black diaspora.

- BrandSlip – a marketplace for social media stars to connect, collaborate, succeed and make money.

- Callr – AI for connecting to every conference call you ever have to participate in, never dial into a conference call again. Ever. Techcrunch wrote about Callr.

- Drivio – makes it less of a hassle for you to pay fines, and makes it easier for the government to collect fines.

- HealthFundIt – improving the world’s collective health by connecting the people most passionate about a health condition with the scientists studying it so that people can directly support medical research in which they have a vested interest.

- InstaSneaks – a social marketplace for the $100B+ street wear market. It enables peer-to-peer and business-to-consumer transactions.

- Sandbox.io by Keystoke – build an ecommerce store on the web, then create a mobile version of your ecommerce store in about 10 minutes. Pay nothing, unless you actually sell stuff through the mobile app.

- Legasyst – make interacting with the legal system as easy and seamless as using a mobile app.

- NetworkingOut – a social networking platform that acts as a virtual athletic club for professionals.

- Nomsy – food curation and discovery, to enable people with food allergies easily find food that suits them while on the go.

- Paver – helps restaurants create, manage, and track their specials.

- PracticeGigs – enables people to discover players and schedule practice sessions through a mobile social network. Initially focused on tennis in the Boston area.

- ProSquire – a platform that enables small law firms to operate as if they have the infrastructure of their much larger peers.

- RawShorts – a DIY builder for explainer videos, no need for a studio. If you know how to use powerpoint you know how to use RawShorts.

- Revitalize Charging Solutions – is building a network of charging stations for electric vehicles. The charging stations also act as an advertising platform. Pilots underway with cities in Texas.

- Roho – a media company that curates and distributes religious content. The initial product is focused on sermons for Black-American Christians.

- RxCUE – enables patient savings through electronic medical rebates.

- Solace – a seamless search and customization experience for home decor, initially focused on bedding, pillows, tapestries etc.

- The Dime – makes local buying, selling, and promotion safer and more interactive with unedited video ads.

- WedOcracy – a social wedding planning platform built by an engaged couple while they were planning their own wedding. The wedding hub of the future, today.

View image on Twitter

I spent some time chatting with Nichelle McCall, founder and ceo of BOLD Guidance. We first met at FOCUS100 in NYC, but never had a chance to chat at any length. So it was great to hear about what she’s trying to accomplish over the next 12 months. She’ll be fundraising soon. I wolfed down some lunch, and I am sure a few people must have thought I was scarfing down the food like there’s no tomorrow. I tend to eat very fast . . . I’d rather not waste time eating. I went back to the hotel and checked out. Then we headed to the Center Stage at the Ernest N. Memorial Convention Center for the #BigBreak Power Pitch – I arrived just as Dawn from Flat Out of Heels was wrapping up. These are the contestants.

- Flat Out of Heels, LLC is the creator of the Flat Out rollable flat and the Flat Out shoe vending machine. Their rollable flats can be discretely carried for emergencies or worn all stay for stylish, durable comfort. Flat Out of Heels rollable flats are the solution to stiletto sore feet. Placed in venues like airports, nightclubs, malls, and hotels, where many women are wearing heels, the vending machines make it convenient to get emergency shoes when needed.

- GemPhones is a fashion focused, jewelry inspired electronic accessory company that provides the most beautiful product designs in the consumer electronic industry. Every aspect of its product design is dual purpose, providing the look of a necklace and function for the usability of the device.

- SmartCoos helps young children take advantage of their first 2,000 days and learn Mandarin, Spanish, French or English through 1:1 language sessions with a native speaker, e-books, and text nudges. Its product provides children with four critical web-based tools to learn Mandarin, Spanish, French, or English. Each child follows a tailored language curriculum based on the child’s age (0-2; 3-5; 6-8) in order to effectively use, coach, and reinforce the second language. Each child 1) Interacts with a native speaker on a weekly basis 2) Is provided with quality read-aloud eBooks 3) Learns the 200 most common words with baby sign language (“BSL”) 4) Are given daily text nudges, which increase the use of the language.

- FashionTEQ manufactures a collection of smart jewelry for women. Its first product, Zazzi, keeps the user connected to her smartphone all day by notifying her of incoming texts, calls, emails, and more in a discreet and private display attached to a bracelet, pendant, or ring. The display provides imagery that lets the user know exactly what the notification is without having to access her phone.

I ran into Dawn Dickson, founder and ceo of Flat Out of Heels at the hotel when we went back to pick up our bags enroute to the airport. It was great to run into her since I had previously corresponded with her by email about a year ago through AngelList. We got to chat for about 10 minutes or so.

With Dawn Dickinson, ceo and founder of Flat Out of Heels, at the Hyatt Regency in NOLA after she won the #PowerMoves #BigBreak Pitch at #EssenceFest. Image Credit: Tasha Kersey Aoaeh

To close, for every founder who was at #PowerMoves.NOLA and any founder who was not there, but wishes they could have been . . . This is one of the songs I listen to when I need to refuel my spirits after encountering obstacles that would otherwise knock me off my stride.

- Source: PowerMoves.NOLA website. Accessed on Jul 5, 2015. Slightly edited.

- Source: PowerMoves.NOLA website. Accessed on Jul 5, 2015. Slightly edited.

- Source: PowerMoves.NOLA website. Accessed on Jul 5, 2015. Slightly edited.