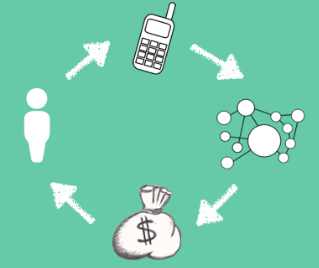

PayPal has ranked Nigeria as the 3rd highest mobile shopper worldwide. We indeed are masters in spending!

The online payment giant is the most popular medium among Nigerian cross-border shoppers, and estimated 55 percent of all oversea online purchases in the past 12 months were done via PayPal.

Nigerian mobile shoppers reportedly spent N128.1 billion ($610 million) in 2015 using PayPal, and on target for N172 billion ($819 million) this year.

The General Manager of PayPal Africa and Israel, Efi Dahan, said Nigerian online shoppers have realized the world is their shopping mall and as such shop wherever and whenever using their mobile devices.

It should be recalled that Facebook Inc. in February also affirmed Nigeria as its biggest market in Africa, with 97 percent of its 16 million Nigerian users accessing the platform through their mobile devices.

“Nigerians are generally sophisticated mobile users and this sophistication is aiding small businesses,” said Nunu Ntshingila, head of Africa for Facebook.

While China still remains the global leader of mobile shopping nations, with 86 percent of all its online shoppers using smartphone. Nigeria’s 72 percent is third after India’s 82 percent.

Since PayPal commenced business in Nigeria, Nigerians are no longer limited to what they can purchase locally, but they now search the globe for better deals.