Solana (SOL) is flashing one of its most convincing bullish signals in 2025 so far, and crypto traders are taking notice. A breakout above a multi-month cup and handle formation, combined with soaring trading volume and spiking open interest, has a trader eyeing a surge that could lift SOL toward $400 in the coming weeks. But while Solana’s rally dominates headlines, another explosive crypto is preparing for its own parabolic run: Little Pepe (LILPEPE), a meme coin with a game-changing twist. These two tokens, though fundamentally different, are united by one thing: momentum. Solana’s technical breakout is textbook bullish, and LILPEPE’s Layer 2 meme blockchain is generating serious presale hype, potentially setting it up as the top meme coin gainer of the year.

Solana Breaks Out With Conviction: $400 in Sight?

As of writing, Solana trades at $189, continuing its bullish ascent after closing above the key neckline resistance at $176. This breakout completes a textbook cup and handle pattern on the daily chart, which is one of the most reliable technical formations for upside continuation. Open interest surged to $9.66 billion (+8.80%), volume spiked 7.64% to $26.52 billion, and short liquidations exceeded $46 million, clear signs that the market is aligned behind the move. Further strengthening the case is Solana’s exit from the Ichimoku Cloud and bullish crossovers on the 20/50 EMA. The $157–$160 zone, which previously served as resistance, now acts as confirmed support. On Binance, the long/short ratio stands at 2.42, with top trader bias even higher at 2.79. Simply put, bulls are firmly in control. The measured move from the breakout puts Solana’s next logical target at $230–$250. However, analysts now suggest that $290—and even $400—are within reach this quarter, especially as ecosystem tokens like BONK, FLOKI, and PENGU explode higher and funnel more attention into the Solana network.

Little Pepe (LILPEPE): Parabolic Setup on the Verge of Ignition

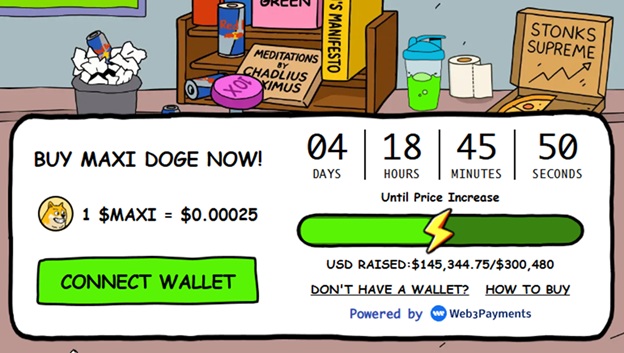

While Solana impresses with its institutional momentum, Little Pepe (LILPEPE) is captivating retail investors and early-stage believers with a completely different value proposition. As of writing, LILPEPE is in Stage 8 of its presale, priced at $0.0017 with over $12.6 million raised and 93.16% of tokens sold. The next stage will raise the price to $0.0018, moving closer to the official listing price of $0.003.

What makes LILPEPE different from other meme coins like DOGE or SHIB is its infrastructure. It’s not just a token—it’s a full Layer 2 blockchain designed exclusively for meme coins and meme-driven applications. It aims to solve some of the meme coin sector’s biggest issues:

- Sniper bot protection during launches

- Ultra-low fees and fast finality

- A built-in meme coin Launchpad for new projects

- No transaction taxes or stealth dev wallets

Little Pepe’s Layer 2 chain offers the speed and scalability of modern blockchains while being tailor-made for meme culture. It also provides meme creators with a safe and efficient ecosystem to build, trade, and grow communities without the usual risks of rug pulls, contract exploits, or unfair launches.

CoinMarketCap Listing and $777,000 Giveaway Fueling Buzz

Adding more fuel to the fire, Little Pepe was recently listed on CoinMarketCap, giving the project significant visibility and establishing trust with early adopters. With thousands now tracking the token and a growing waitlist forming on top centralized exchanges, market watchers are calling it one of the most anticipated meme coin launches of the year. Even more enticing is the ongoing $777,000 giveaway, where 10 lucky participants will win $77,000 worth of LILPEPE tokens each. To qualify, users must contribute at least $100 to the presale on LittlePepe.com and complete simple promotional tasks. This incentive structure is attracting a wave of new participants eager to lock in early gains while maximizing their exposure to the upcoming listing.

Could LILPEPE Be the Next DOGE or PEPE, on Steroids?

If Dogecoin, with no real utility, hit a $90 billion market cap, and PEPE surged to a multibillion valuation just off meme power, LILPEPE’s potential looks even stronger. It’s launching with infrastructure, security features, fair launch standards, and a utility-focused ecosystem for meme developers. Once it lists at $0.003, even a move to just $0.03 would deliver a 10x return for Stage 8 participants. And in a viral bull market where meme coins trend again, a move beyond $0.10 isn’t out of the question, especially with institutional support rumored for upcoming CEX listings.

Conclusion: Two Different Paths, Same Destination, Massive Gains

Solana demonstrates specific technical indicators alongside institutional adoption which suggest a short-to-medium term price target of $400. It seems as though the ecosystem is flourishing; the breakout is underpinned by strong volume as well as sentiment metrics. Meanwhile, Little Pepe is the sleeper hit preparing for liftoff. With over $12.6 million raised, a growing ecosystem, and CoinMarketCap validation, this project could be the meme coin moonshot of 2025. Serious investors are watching closely, and those who act before the listing may be among the biggest winners of the next meme season.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken