As market volatility continues, early-stage participants are shifting attention toward infrastructure projects that provide clear functionality. Mono Protocol is gaining momentum in the crypto presale landscape with a unified balance model and consistent development updates. Stage 19 continues to advance as the raise approaches its next milestone.

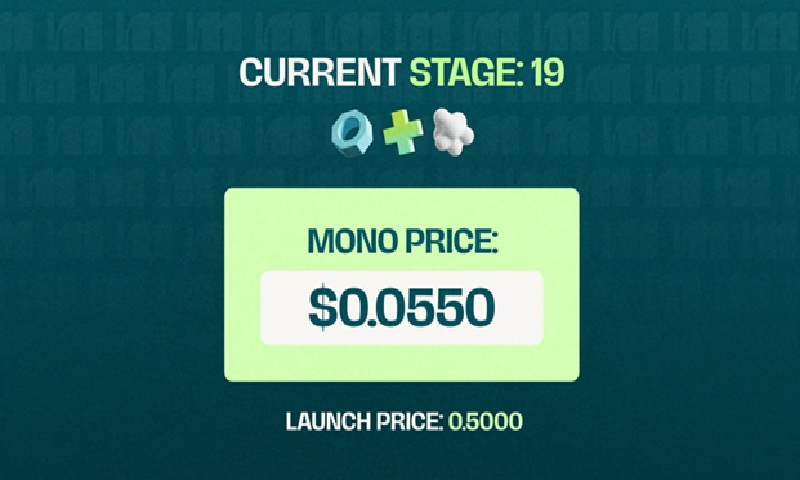

Stage 19 Shows Stable Participation With $3.71M Raised at $0.0550

Mono Protocol reports steady progress as Stage 19 moves closer to completion.

The presale coin price remains at $0.0550, and the round has raised $3.71 million out of the $3.80 million target. This performance keeps Mono among the most active cryptocurrency presales as December activity increases.

The team continues sharing weekly updates, noting improvements in website stability, dashboard responsiveness, and platform performance. These steps support onboarding and reflect the consistent development pace that users expect from presale crypto projects focused on long-term execution.

This steady communication pattern remains important across crypto pre sales, especially in market conditions where reliability plays a central role in user decisions.

Why Infrastructure Projects Are Gaining More Attention

Recent market trends show increased interest in infrastructure-driven platforms. These projects aim to solve longstanding issues in multi-chain environments such as fragmentation, manual network switching, and transaction failure risk.

Users following web3 crypto presale opportunities are paying closer attention to ecosystems that offer practical solutions rather than speculative appeal. Mono Protocol fits this category with a design focused on unified cross-chain balances and automated routing.

As more networks emerge, infrastructure becomes difficult to manage for average users. Mono’s approach reduces these layers by offering a single environment for interacting across chains, which continues drawing interest in coin presale evaluations centered on functional utility.

Unified Balance System Simplifies Multi-Chain User Experience

Mono Protocol’s unified balance model converts complex multi-chain activity into one accessible workflow. Instead of tracking multiple wallets or bridging assets repeatedly, users maintain one balance per token across supported networks.

This removes several manual steps and reduces user error. It also gives developers a simpler design framework because applications no longer require separate deployments for each chain.

This design direction supports Mono’s visibility across pre sale cryptocurrency research lists, where simplicity and execution reliability are primary evaluation points.

Routing Engine Ensures Smooth Execution Across Networks

The platform’s routing engine automatically selects the best available path for each transaction.

During periods of congestion, traditional cross-chain systems often fail or revert. Mono aims to reduce these issues by scanning network conditions and choosing a stable route.

This supports consistent execution and reduces failures that often cost users time and capital.

Such features have become key discussion points across crypto presales where performance and reliability matter.

The routing engine, combined with unified balances, positions Mono as a system capable of supporting both everyday users and application developers.

Rewards Hub Keeps User Activity Consistent as Updates Roll Out

Mono Protocol’s Rewards Hub remains active with participation tasks, social missions, and referral incentives. These tools support community involvement during the raise and provide structured engagement as the project advances toward future stages.

The combination of routine updates and community tools continues increasing visibility inside cryptocurrency presales where user involvement often reflects long-term growth potential.

Mono’s transparency and consistent progress remain central factors in why many early participants continue monitoring Stage 19 closely.

Conclusion

Infrastructure is becoming a stronger focus for early-stage users, and Mono Protocol stands out with its unified balance system, routing automation, and active communication. With $3.71 million raised at the current presale coin price of $0.0550, Stage 19 remains on track as interest grows across the presale crypto environment.

Learn More about Mono Protocol

Website: https://www.monoprotocol.com/

X: https://x.com/mono_protocol

Telegram: https://t.me/monoprotocol_official