Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Mr. Taiwo Oyedele, says Nigeria could have been a $1 trillion economy today if it had embraced key economic and fiscal reforms a decade ago.

Speaking at PwC’s Executive Summit on Nigeria’s Tax Reform in Lagos on Monday, Oyedele said the country’s past missteps in foreign exchange management and subsidy spending nearly derailed its financial stability and economic potential.

He warned that without the fuel subsidy removal and other reform decisions taken by President Bola Tinubu since May 2023, Nigeria could have headed the way of Zimbabwe and Venezuela, where uncontrolled economic distortions triggered systemic collapse.

“If some of these reforms done in the past two years ago were implemented, I tell you authoritatively that Nigeria’s $1 trillion economy is guaranteed and the price of PMS will be under N300 per liter because the foreign exchange rate will be under N300 against the dollar,” Oyedele declared.

He said analysis of Nigeria’s balance of payment trends over the last 10 years compared with Kenya and South Africa showed the naira had depreciated more than six times the rate of Kenya’s shilling and South Africa’s rand.

“If only we had maintained that level of stability as those two other countries, Nigeria will be a $1 trillion economy. What that means is that the size of the middle class will probably be 10 times what it is and every single investor will take us seriously,” he said.

According to Oyedele, the Tinubu administration’s reforms—though painful—are already yielding macroeconomic dividends. He noted that Nigeria’s tax-to-GDP ratio has risen from under 10 percent to 13.5 percent within two years, and that the country’s debt servicing burden has dropped from 97 percent to below 50 percent. He also added that the government no longer relies on printing money, claiming that nearly half of the “Ways and Means” advances from the last administration have now been paid down.

“In Nigeria, we have what it takes in terms of human capacity, knowledge and skills. We’re missing the political will, until we found it,” he said.

The Reforms Were Opposed by Tinubu in 2012

Many Nigerians have pushed back—pointing out that such efforts were, in fact, made over 10 years ago but actively sabotaged by the same political forces now in power.

Nigerians recall the fuel subsidy removal attempt in 2012 under President Goodluck Jonathan—a reform plan that was met with fierce resistance by then-opposition figures, notably Bola Tinubu, who is now president and executing the same policy.

Jonathan’s government had removed fuel subsidy on January 1, 2012, sparking nationwide protests tagged #OccupyNigeria. It led to mass demonstrations in major cities, including Lagos, Abuja, Kano, and Port Harcourt. Then-civil society groups, labor unions, and opposition parties staged marches against the policy. Tinubu, then the National Leader of the Action Congress of Nigeria (ACN), publicly condemned the subsidy removal, joining forces with NLC, TUC, and various civil groups to pressure the government into reversing the decision.

The pushback forced Jonathan to partially reinstate the subsidy—bringing petrol prices back down from N141 to N97 per liter—effectively derailing what was arguably the country’s most serious effort at subsidy reform in the Fourth Republic.

Against this backdrop, many Nigerians believe that Tinubu deserves no praise for the reforms because he largely contributed to setting the country back.

Is $1tn Economy Possible by 2030?

While the reforms have been touted to accelerate Nigeria’s $1 trillion economic plan by 2030, economists have raised doubts over the feasibility. The 2024 rebased GDP put Nigeria’s economy at N372.8 trillion—roughly $243 billion at the prevailing exchange rate—making it the fourth largest economy in Africa, behind South Africa, Egypt, and Algeria.

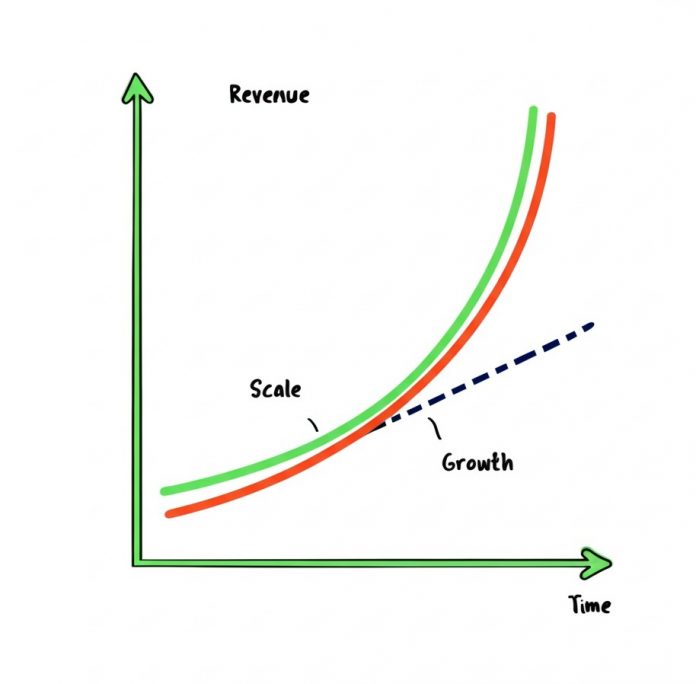

Analysts say achieving a $1 trillion GDP by 2030 would require Nigeria to post a nominal growth rate of at least 13 percent every year for the next six years—far above the federal government’s own projection of 4.6 percent growth by 2025. The World Bank’s estimate is even steeper, suggesting that Nigeria would need nearly 19 percent annual growth to hit the $1 trillion milestone by the end of the decade.

Further compounding the skepticism is the government’s reliance on tax reforms as a major lever for economic expansion. Oyedele maintained that the tax overhaul was not just about boosting government revenue, but about incentivizing broader economic activities. But some analysts argue that the reform’s expected outcomes may be limited by the country’s income demographics.

A 2023 report by Lagos-based research firm Intelpoint revealed that only 10 percent of Nigerians earn above N100,000 monthly—or N1.2 million annually. This suggests that the vast majority of Nigerians would fall below the new personal income tax threshold and thus be exempt from taxation. That’s good for equity but problematic for revenue generation.

With much of the economy still informal, and only a small portion of the population earning enough to be taxed, experts say significant gains in revenue will only materialize if job creation, productivity, and income levels increase markedly.

However, the reforms mark a major overhaul. PwC’s Regional Senior Partner for West Market Area, Mr. Sam Adu, noted that Nigeria had just undertaken the most ambitious revamp of its tax system in decades, if not ever.

“This is significant, not just about compliance, it’s about creating a fairer, more transparent and more growth-oriented tax system for businesses and individuals,” he said.

Adu also pointed to global trends shaping taxation—such as technology, sustainability, geopolitics, and cross-border cooperation—and highlighted the importance of smarter taxation systems in line with modern economies.

While the Federal Government hopes its reforms can reposition Nigeria’s economic future, the path to a $1 trillion economy is fraught with hurdles. Without faster GDP growth, which translates to more taxable demographic, the goal may remain aspirational—at least for the near future.