With just days to go before sweeping tariffs are set to take effect, U.S. Commerce Secretary Howard Lutnick says there is still a strong possibility of securing a trade agreement with the European Union, signaling cautious optimism despite growing global trade tensions.

In an interview on CBS’ Face the Nation on Sunday, Lutnick said he had just spoken with EU trade negotiators and believes there is “plenty of room” to strike a deal before the August 1 deadline set by President Donald Trump.

“These are the two biggest trading partners in the world, talking to each other. We’ll get a deal done. I am confident we’ll get a deal done,” he said.

However, he emphasized that the August 1 date remains a “hard deadline,” after which new tariffs will automatically kick in if no agreement is reached.

“Nothing stops countries from talking to us after August 1, but they’re going to start paying the tariffs on August 1,” Lutnick warned.

Trump’s Tariff Ultimatum

On July 12, President Trump announced a sweeping plan to impose tariffs on several major U.S. trading partners, including the European Union and Mexico. The proposed levies include a 30% tariff on most EU and Mexican imports, as well as blanket tariffs ranging from 20% to 50% on other nations like Japan, Brazil, and Canada. The president also threatened a steep 50% tariff on imported copper.

In a formal letter addressed to European Commission President Ursula von der Leyen and similar communications to other leaders, Trump outlined his administration’s intent to rebalance what he described as “deeply unfair” trading relationships. He accused some partners of exploiting U.S. markets and failing to match America’s openness with reciprocal treatment.

Trump’s move comes amid mounting frustration over the slow pace of trade negotiations and growing concerns about the U.S. manufacturing sector, which has struggled to regain momentum despite the administration’s earlier tariff rollbacks.

Pressure on the EU

While the European Commission has not publicly disclosed the details of ongoing talks, sources in Brussels told Politico Europe that officials are working around the clock to broker a temporary understanding before the deadline. European leaders are particularly concerned about the potential fallout of tariffs on the automotive, agricultural, and aerospace sectors — all of which would be significantly affected if the U.S. measures go into effect.

Some EU members are also pressing for the bloc to prepare retaliatory tariffs should Trump follow through. Germany, in particular, which relies heavily on car exports to the U.S., is reportedly urging a more conciliatory approach to avoid an escalation that could harm its already weakened economy.

USMCA May Also Be Reopened

In a notable shift, Lutnick also indicated that Trump plans to reopen the United States-Mexico-Canada Agreement (USMCA), the signature trade deal from his first term. Although the agreement currently exempts most North American goods from tariffs, Lutnick suggested a renegotiation could begin “a year from today.”

Lutnick said the president is absolutely going to renegotiate USMCA without providing further details on what changes the administration may seek. While goods currently compliant with USMCA rules of origin are exempt from the looming tariffs, that protection could be short-lived if Washington reopens the pact.

Bracing for the Potential Impacts

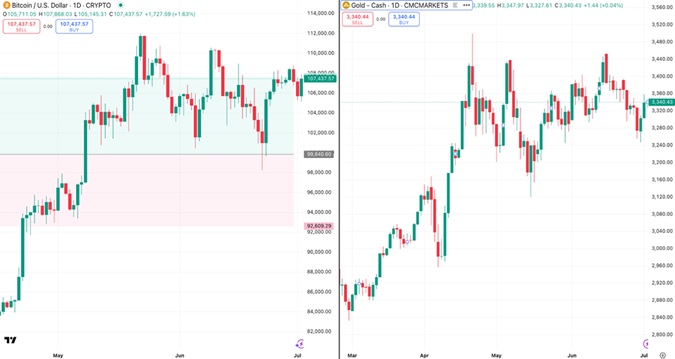

Wall Street and industry leaders have warned that a new wave of tariffs could deliver a major blow to global markets. Analysts at Goldman Sachs noted in a research note that increased duties could stoke inflation and disrupt supply chains already strained by post-pandemic dislocations and geopolitical conflicts.

The U.S. Chamber of Commerce has urged the administration to delay the implementation of tariffs, arguing that “negotiations should not be conducted under threat.” Meanwhile, European business associations say the uncertainty is already affecting investment decisions.

Despite the warnings, Lutnick insisted that Trump’s tough stance is already bearing fruit. He had emphasized the president’s belief in using leverage, noting that it’s working and countries are back at the table.

With time running out, the coming days could determine whether the U.S. and EU can salvage a deal or whether the global economy will be plunged into another trade war. If no agreement is reached by August 1, many European goods entering U.S. ports will be subject to steep duties, potentially setting off a retaliatory cycle with wide-ranging economic consequences.

However, Lutnick’s optimism, though reassuring to some, does little to calm the nerves of exporters and manufacturers who now face the prospect of higher costs, delayed shipments, and possible job cuts if the tariffs go into effect.