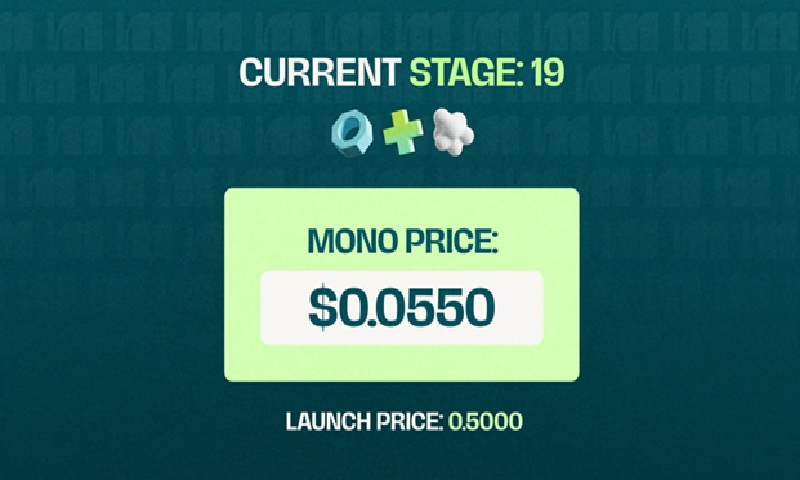

December is showing renewed strength across the crypto presale landscape, and Mono Protocol continues to gain momentum as one of the most followed projects in this segment. The team reports that Stage 19 has now reached $3.71 million of the $3.80 million target, with the token price holding at $0.0550. This steady progress comes as early-stage market activity increases and users shift toward infrastructure platforms offering clear utility.

Mono Protocol’s consistent updates, unified balance system, and recent development improvements are supporting this uptick in visibility. As participants monitor the progress of ongoing crypto presales, Mono’s focus on cross-chain functionality continues to position the project at the center of December’s attention.

Rising Participation Driven by Infrastructure Demand

The broader Web3 sector is entering a period of heightened interest in utility-focused projects. Mono Protocol benefits directly from this trend. Its cross-chain execution framework addresses long-standing friction points, including fragmented balances, unreliable routing, and multi-step transaction processes.

As users evaluate entries in the best crypto presale category, they are prioritizing platforms that provide practical systems rather than speculative promises. Mono’s architecture offers a developed foundation that supports this shift, helping attract steady participation as Stage 19 moves toward completion.

The presale’s structured model—combined with transparent funding milestones—continues to resonate across the presale crypto environment. December’s growing activity is reinforcing this momentum and helping drive Mono’s visibility across multiple channels.

Development Updates Build Confidence as December Activity Climbs

Mono Protocol has continued publishing routine development reports covering website fixes, dashboard updates, routing refinements, and interface adjustments. These improvements have contributed to smoother participation flows and stronger user retention during the presale round.

This level of communication remains critical for users tracking cryptocurrency presales that prioritize active development. With December bringing increased market research and presale monitoring, consistent transparency has strengthened Mono’s position among early-stage Web3 infrastructure projects.

The team’s timely updates also support confidence in the long-term roadmap. As users explore options across crypto pre sales, Mono’s continuous refinements offer a clear signal of ongoing progress.

Unified Balance System Lifts Visibility During the December Cycle

The unified balance system remains a major factor in Mono Protocol’s growing December momentum. By consolidating user balances across all supported chains, the system removes the need for bridges, repeated approvals, and network switching. This feature is receiving increased attention as users look for simplified multi-chain experiences.

With more investors examining multi-network infrastructure in December, Mono’s unified balance design is emerging as a key differentiator. It places the project alongside presales that center on real-world utility, positioning it strongly within web3 crypto presale discussions.

This model is especially appealing to users who want familiar workflows, predictable execution, and reduced complexity during high activity periods.

Automated Routing Engine Supports Reliability During Market Surges

December’s increase in multi-chain activity often leads to congestion and unstable routing conditions across networks. Mono Protocol’s automated routing engine has become a core advantage during this period. It evaluates chain conditions in real time and selects the best execution path to reduce failed transactions.

This capability reinforces Mono’s standing in pre sale cryptocurrency research lists as participants pay closer attention to reliability during periods of elevated traffic. The routing system remains a central part of Mono’s infrastructure proposition as December interest expands.

Conclusion

Mono Protocol continues to build strong momentum as December drives renewed interest across the crypto presale market. With $3.71M raised in Stage 19 and a price of $0.0550, the unified balance system, routing engine, and consistent updates support its growing visibility. As this round approaches completion, Mono remains one of the most active and utility-based entries of the month.

Learn More about Mono Protocol

Website: https://www.monoprotocol.com/

X: https://x.com/mono_protocol

Telegram: https://t.me/monoprotocol_official