Canada avoided a technical recession this quarter after GDP rebounded by 2.6 percent annualized. But behind the numbers lies a deeper tension: a country straining to shield itself from a sweeping U.S. tariff campaign that has already shaken exporters, households, and investor confidence.

The shock came from broad government action and a surge in crude oil exports. Crude oil and bitumen shipments jumped 6.7 percent, while government capital investment rose 2.9 percent — reflecting spikes in spending on weapon systems and large non-residential projects such as hospital infrastructure. Residential resale activity and renovations also added to demand.

Thanks to that boost, Canada’s economy managed to escape the downturn that followed a revised 1.8 percent contraction in the previous quarter. Monthly GDP growth, based on industrial output, matched expectations in September with a 0.2 percent rise, largely on a 1.6 percent manufacturing expansion.

Still, signs of fragility remain as business capital investment flat-lined in the quarter. Household consumption — the usual backbone of growth — slipped 0.1 percent. New residential construction fell 0.8 percent. And early estimates for October point to a possible 0.3 percent GDP decline, hinting that the fourth quarter may begin on uncertain footing.

Statistics Canada cautioned that the third-quarter numbers may be revised when foreign merchandise trade data becomes available, delayed by the recent U.S. government shutdown.

Economists such as Doug Porter of BMO Capital Markets believe the rebound may be temporary.

“This should quash recession chatter for now,” he wrote.

But he added that the broader economic landscape remains fragile, especially under the weight of trade uncertainty.

The strength of the report has already strengthened expectations that the Bank of Canada will not cut interest rates when it meets on December 10, after having held its key rate at 2.25 percent.

The U.S.–Canada Tariff War: A Shockwave Still Rippling Through the Economy

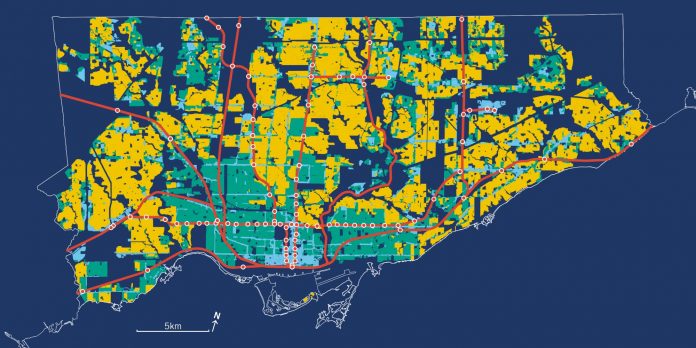

To understand the fragility behind Canada’s rebound, one must see it against the backdrop of an escalating trade confrontation with the United States. Revived in early 2025 under new U.S. leadership, tariffs of 25 percent on most Canadian goods and 10 percent on energy imports have disrupted decades of tightly integrated commerce between the two neighbors.

Canada is among the most exposed nations in the world: in 2023, roughly 77 percent of its merchandise exports went to the U.S., and trade-sensitive industries accounted for a meaningful share of GDP.

Industries such as automotive, manufacturing, oil and gas, metals, and agriculture have taken the hardest hits. The tariff shock threatens supply chains that span multiple border crossings just to complete a single product. Analysts warn that a sharp disruption to exports could reduce national GDP by as much as 1.5 percent below baseline in 2026, along with substantial job losses in manufacturing and export-heavy provinces.

Metal producers, auto-parts manufacturers, plastics, chemical, and equipment suppliers — all tied to cross-border supply chains — are scrambling to absorb higher costs, rework sourcing, or risk shuttering operations.

Sectors such as agriculture, forestry, and energy are also vulnerable. In many cases, Canada relies heavily on U.S. markets for exports or imported inputs — meaning the tariff war risks raising domestic costs even while reducing export income.

Beyond the direct cost pressures, the tariff environment has injected pervasive uncertainty. Firms reluctant to commit to expansion or new hiring, households uncertain about job security and income, lenders growing cautious — the macroeconomic ripple remains under the surface even if headline GDP grew this quarter.

What the Q3 Surge Reveals — and What It Masks

The rebound shows two things clearly: first, Canada retains structural buffers — diversified income streams beyond manufacturing exports, a robust energy sector, and the capacity for government-led fiscal support. Second, it reveals how precarious the recovery remains when core drivers of long-term growth, business investment, consumer spending, and construction, are still under pressure.

The increase in oil export revenue and government capital spending helped boost headline growth this quarter. But such support is, by nature, temporary and tied to global commodity prices and political will.

Business investment remains flat, suggesting firms remain wary of long-term commitments until trade uncertainty clears. Household consumption shrinking hints at caution among consumers who face inflationary pressures from tariffs and rising costs of goods. Falling residential construction suggests the housing market is not immune either.

Economists note that the rebound may not be enough to change the underlying structural risks posed by an aggressive and geo-politically driven tariff war. A revised trade flow, weakened industrial base, and fragile consumer confidence could keep GDP growth volatile.

Where Canada Goes from Here — A Tightrope Between Resilience and Risk

At least for now, the Q3 data gives the government and the central bank breathing room. With the Bank of Canada unlikely to cut rates soon, there is some stability in financial conditions. The Canadian dollar responded positively, strengthening to 1.3982 against the U.S. dollar, while two-year government bond yields jumped as markets repositioned.

But structural fixes are not easy. To avoid slipping back into economic contraction, economists expect Canada to:

- Find new export markets and reduce over-dependence on the U.S.

- Incentivize domestic manufacturing and supply-chain diversification to shield vulnerable sectors.

- Support households and businesses coping with inflation and tariff-related cost pressures.

- Ensure that public spending — which helped this quarter — is sustainable and not a one-off fix.

Some in Ottawa believe the tariff war may accelerate long-discussed shifts: deeper trade ties with Europe and Asia, new investment in energy and resources, and rebuilding manufacturing around new global supply chains.

Still, many warn that the risks remain high. Tariffs on steel, aluminum, autos, and other sectors continue to bite. Private investment remains cautious, and consumer and business sentiment remain under pressure.

While the 2.6 percent rebound defuses recession talk for now, it leaves Canada on a tightrope. Some analysts believe that unless trade tensions ease or Canada succeeds in reorienting its economy quickly, future quarters could deliver more shocks than rebounds.