Tesla stock has clawed its way back from a painful decline in recent months, but the company now finds itself on even shakier ground following the passage of a controversial tax bill by the U.S. House of Representatives on Thursday.

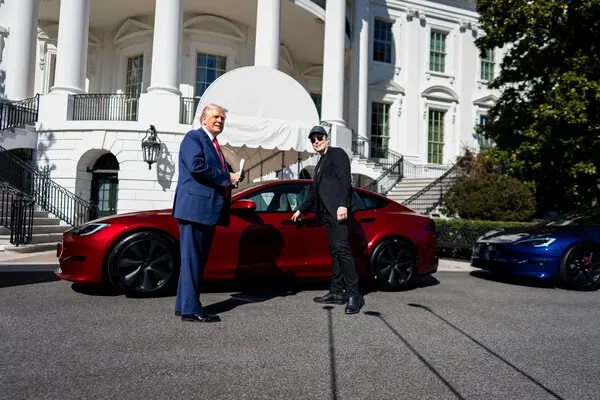

The legislation, championed by President Donald Trump, rolls back critical incentives for electric vehicles, effectively shutting Tesla and other major EV players out of future tax credits. This move adds fresh pressure to a stock that has already weathered political headwinds, extreme volatility, and waning investor patience.

For long-term investors, the question now is not just whether Tesla remains a good company—but whether it’s still a good stock to hold.

Register for Tekedia Mini-MBA edition 20 (June 8 – Sept 5, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

A Long-Term Play With a Short Fuse

Charles Harris, portfolio manager at O’Neil Global Advisors, remains invested in Tesla but is candid about the stock’s punishing swings and how they’ve forced a rethink of strategy.

“I still have a large position in Tesla – particularly in my non-margin accounts – which I’m just holding,” Harris said on the Investor’s Business Daily podcast “Investing with IBD.”

“I really got killed holding Tesla,” he added, describing the fallout of holding an oversized margin position during Tesla’s steep 2022 downturn.

After reaching an all-time high of $488.54 in December 2024, Tesla shares tumbled nearly 47% within just four months. The plunge was fueled by a combination of factors: CEO Elon Musk’s close political alignment with President Trump, which sparked protests and investor anxiety; a broader market selloff in February; and fears about weakening global EV demand as tariffs loomed.

Harris, like many investors burned during the slide, now focuses on managing risk and position size—especially avoiding margin when holding high-volatility names like Tesla.

“When you enter a bear market, regardless of the conviction you have in a stock or how well you’ve done, if you’re going to hold through a base or hold a long-term stock, you can’t do it on margin,” Harris warned.

Trump’s Tax Bill Pushes Tesla Into a Tougher Spot

The situation for Tesla worsened this week with the House’s passage of President Trump’s new tax bill, a sweeping reform that dismantles several clean energy incentives aimed at boosting electric vehicle adoption.

While the bill preserves IRA (Inflation Reduction Act) tax credits through 2026, it limits eligibility to automakers that haven’t sold 200,000 EV units by the end of 2025. That automatically disqualifies Tesla, along with General Motors and Ford, which have already passed the threshold.

This leaves Tesla at a competitive disadvantage compared to smaller, newer EV players like Lucid (LCID) and Rivian (RIVN), who now gain a runway to capture more price-sensitive buyers. Analysts say this change could reshape the EV market, effectively stalling growth for established brands that once benefited heavily from federal support.

The market reacted swiftly with shares of GM, Ford, Rivian, and Lucid all declining on Friday following the bill’s passage. Tesla, despite the broader concerns, managed to inch upward—rising 46% from its April lows to trade around $342 by midday Friday. Still, it remains 30% below its December peak.

Analysts Still See Long-Term Upside

Despite the regulatory shake-up and ongoing volatility, not all analysts are bearish on Tesla. Some believe the company’s next phase—centered around autonomous driving and AI—could usher in a powerful growth era.

“We believe the golden age of autonomous is now on the doorstep for Tesla with the Austin launch next month kicking off this key next chapter of growth for Musk & Co.,” said Dan Ives, managing director at Wedbush Securities.

“We are raising our price target to $500 reflecting this massive stage of valuation creation ahead.”

Ives and others remain bullish on Tesla’s potential to dominate the future of autonomous transport and robotaxi networks—markets that could dwarf today’s EV business in scope and profitability. Musk has teased a major rollout event for Tesla’s long-promised robotaxi initiative next month at its Austin, Texas facility, a move that could revive investor sentiment and expand the company’s appeal beyond just car manufacturing.

Margin, Myth, and the Apple Comparison

Harris cautions investors not to assume Tesla will follow the same trajectory as other tech giants like Apple. Although often compared in terms of innovation and brand loyalty, the two companies have charted vastly different paths.

“I was using Apple as a precedent for Tesla, but they’re not the same thing,” Harris said. “Apple never saw a three-year consolidation period.”

Tesla’s corrections have been far more severe and frequent, often triggered by Elon Musk’s unpredictability, shifting political alliances, or the company’s dependency on future technologies that remain unproven.

“You can’t have too much faith in a precedent,” he added. “Following risk management rules should supersede one’s conviction in a stock’s fundamental story.”

Tesla remains one of the most watched and debated stocks in the market—an icon of both innovation and controversy. For every analyst projecting $500 price targets based on robotaxis and AI, there’s another warning about political fallout, regulatory pressures, and uncertain demand.