In the restless pursuit of growth and market relevance, many startups fall into what I call the value paradox. They build, they hustle, they sweat under the scorching sun of effort, yet the margins remain thin and true wealth creation stays far from their fingertips. The issue is not effort; it is positioning. And when positioning is flawed, no amount of brilliance in execution will rewrite the trajectory.

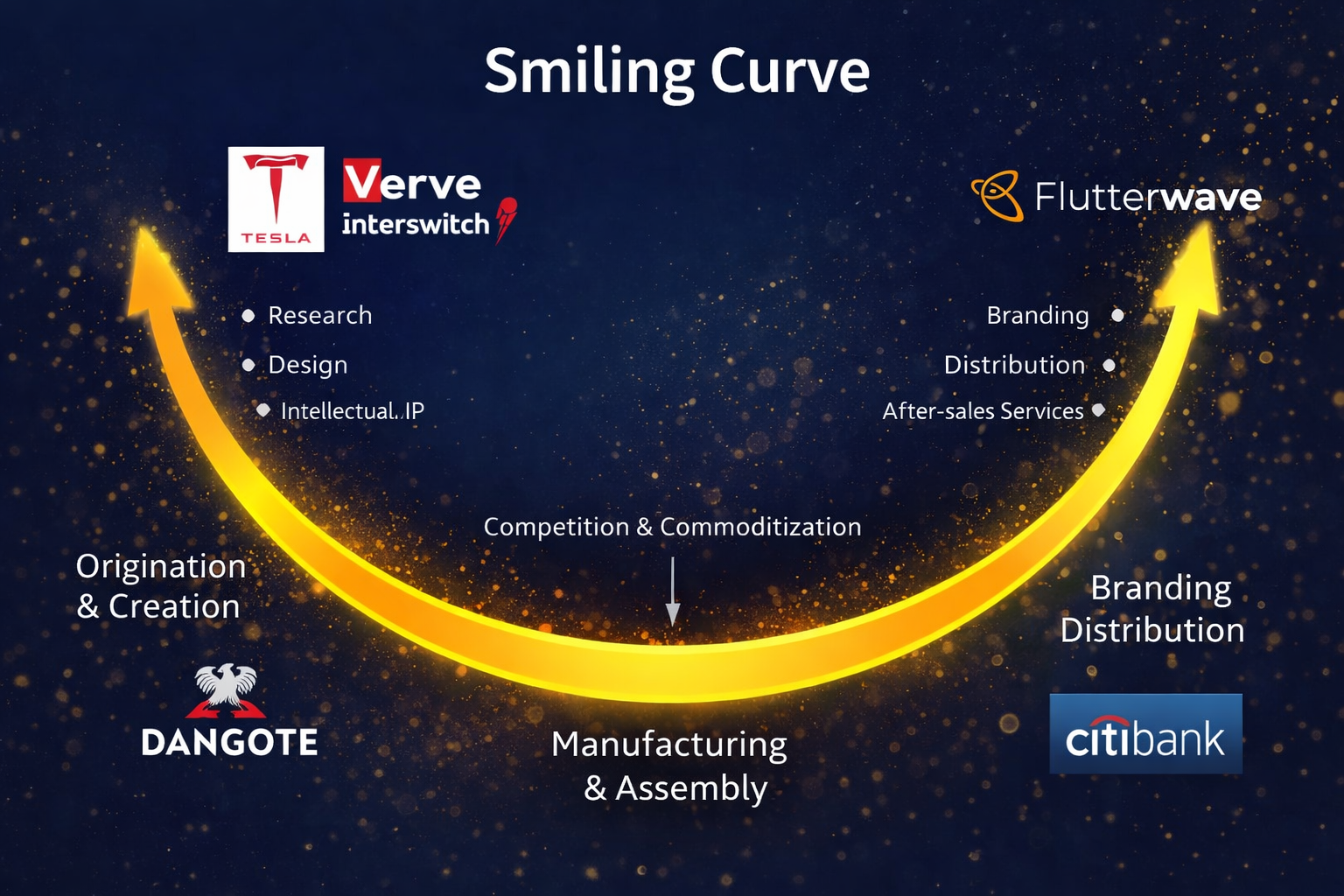

This takes us back to a powerful construct in the physics of markets: The Smiling Curve. It is a simple diagram but a deep thesis. At the center (the bottom of the smile) sits traditional manufacturing, assembly, delivery, and operational centralization. At the edges, both upstream and downstream, sit the domains where asymmetric value is created and captured: origination, creation, discovery, aggregation, branding, distribution, and IP.

In other words: Where you play in the value chain determines how much of the value you capture. If you remain at the center of the curve, the world forces you into commoditization. Competition becomes rabid. Margins evaporate. You are easily replaceable. But when you move to the edges, where ideas are conceived or where customer relationships are owned, you begin to touch the golden reservoirs of value.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Yet, you can build a business to cover all domains on the curve. For example, Dangote Cement plays everywhere and Elon Musk’s Tesla captures value from R&D, software, batteries, branding, distribution, and after-sales data, not just the car factory. These category-kings understand a core equation of modern markets: value = f(position, control, IP, distribution), not just effort. (In engineering, “f” is a function as used therein).

Consider a bank. It holds the accounts, deploys huge capital, and carries the regulatory burdens. It operates at the center. But a card network like Interswitch Verve, sitting at the origination edge of payments, captures asymmetric value without carrying the full burden of the ecosystem. Meanwhile, a fintech aggregator like Flutterwave sits at the opposite downstream edge, aggregating demand through APIs. Both capture superior value relative to the bank because they hold leverageable positions along the curve. Of course, innovative banks now play at the center and at the edges at the same time.

Good People, in the physics of business, just like in physics I first learned in Junior Secondary in Integrated Science class, where you apply force determines what you move! Position well.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

It’s why the conglomerate approach makes more sense, some enterprises run on infrastructures that if they are not built, no much value can be unlocked. A conglomerate allows you to own and control the entire value chain, and that is when you become fully in charge. A startup with long-term vision will still later become an incumbent, that doesn’t mean it will forget how to capture large value, rather a case of owning the reservoir, pipes and valves.