The Trump administration is moving to redraw the balance of power costs in the U.S. electricity market, pressing the nation’s largest grid operator to make technology companies shoulder a greater share of the burden created by the AI boom.

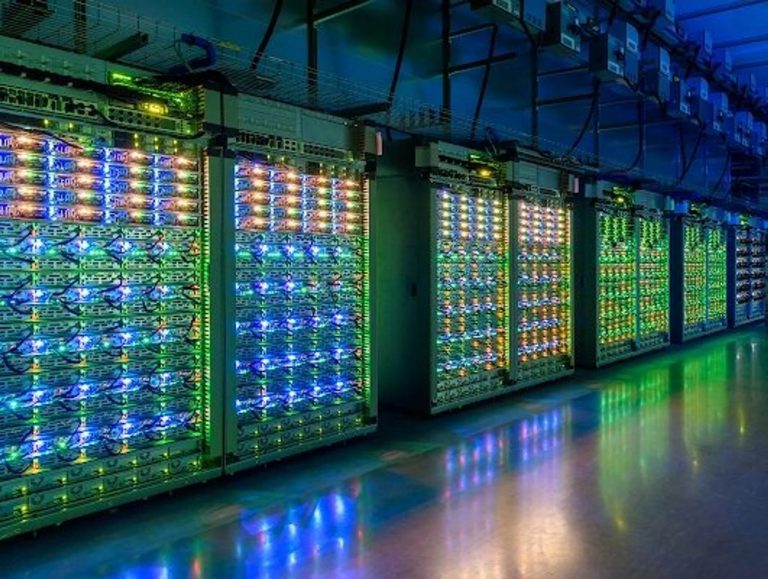

At the center of the push is PJM Interconnection. This vast regional grid supplies electricity to more than 65 million people across 13 states and Washington, D.C. PJM also happens to sit at the heart of the global data center industry, with northern Virginia alone hosting the largest concentration of facilities anywhere in the world. Those data centers, built to train and run artificial intelligence models, are now reshaping the economics — and the politics — of power.

According to a White House official cited by CNBC, President Donald Trump wants PJM to hold an emergency auction that would force large technology companies to bid directly on contracts for new power plants. The administration is seeking roughly $15 billion in new baseload generation, capacity designed to run around the clock, not just when the sun shines or the wind blows. At the same time, Trump wants limits placed on what existing power plants can charge in PJM’s capacity market, a move aimed at protecting households already grappling with rising utility bills.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Energy Secretary Chris Wright, Interior Secretary Doug Burgum, and governors from the mid-Atlantic region are expected to announce a joint agreement on Friday, urging PJM to adopt these measures. The White House framed the effort as a corrective to years of underinvestment and policy drift.

“Under President Trump’s leadership, the administration is leading an unprecedented bipartisan effort urging PJM to fix the energy subtraction failures of the past, prevent price increases, and reduce the risk of blackouts,” spokeswoman Taylor Rogers said.

But behind the rhetoric sits a stark reality. Electricity prices across the PJM region have surged in recent years, and watchdogs say data centers are a major driver. Monitoring Analytics, which oversees PJM’s markets, estimates that about $23 billion in capacity costs can be traced directly to the explosion of data center demand. Those costs are ultimately passed through to consumers, a dynamic the watchdog has described as a “massive wealth transfer” from households to large power users.

In its most recent capacity auction, PJM came up six gigawatts short of its reliability requirement for 2027. That shortfall is equivalent to the output of six large nuclear plants. Without a new generation, the margin for error shrinks dramatically.

“Instead of a blackout happening every one in 10 years, we’re looking at something more often,” said Abe Silverman, a researcher at Johns Hopkins University and former general counsel to New Jersey’s public utility board.

The political stakes are rising alongside the technical risks. Trump campaigned on a promise to lower energy costs, yet utility bills have continued to climb in many parts of the country. High power prices were a major undercurrent in the landslide victories of Democrats Mikie Sherrill and Abigail Spanberger in the recent governors’ races in New Jersey and Virginia, two states deeply tied to the PJM grid.

By pushing PJM to make tech companies pay directly for new generation, the administration is signaling a shift in how it views the AI economy’s infrastructure needs. For years, data centers have been welcomed as engines of investment and tax revenue, often receiving favorable treatment from states and local governments. Now, as their electricity consumption rivals that of entire cities, the question has become who pays to keep the lights on.

Capping capacity prices would also mark a significant intervention in PJM’s market design, one that power producers are likely to resist. Generators argue that high prices are necessary to attract investment, especially as older coal and gas plants retire and new projects face regulatory and supply-chain hurdles. The administration, however, appears willing to test those arguments as it seeks to blunt the impact on consumers.

The outcome will shape not just PJM but the broader U.S. power system, as grids nationwide confront the same challenge: an AI-driven surge in demand colliding with aging infrastructure and years of underbuilding. Whether emergency auctions and price caps can deliver new power quickly enough — without triggering unintended consequences — remains an open question.

What is clear though, is that electricity, once a quiet background issue, has become a frontline political and economic battleground. And in Trump’s view, the era of ordinary ratepayers quietly subsidizing Big Tech’s power hunger may be coming to an end.