President Donald Trump has stirred financial markets and ignited legal debate after threatening to fire Federal Reserve Chairman Jerome Powell—an unprecedented move that would shake the foundations of U.S. monetary policy.

During a closed-door meeting at the White House on Tuesday night, Trump reportedly told House Republicans that he was prepared to remove Powell from his post. The session, originally convened to discuss stalled cryptocurrency legislation, veered into explosive territory when Trump presented a draft termination letter and sought lawmakers’ opinions on firing the Fed chair, according to sources who were in the room, quoted by Bloomberg.

The president allegedly received unanimous approval from the GOP lawmakers present. “He said he was ready to do it,” one official confirmed anonymously, adding that Trump accused Powell of mismanaging the economy and slowing down growth with “deliberate rate tightening.”

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

But hours later on Wednesday, Trump dialed back publicly. “We’re not planning on doing it,” he told reporters at the White House. Still, he added a caveat: “I don’t rule out anything. But I think it’s highly unlikely—unless he has to leave for fraud.”

The president’s caveat has done little to ease the growing tension between the White House and the central bank. At the center of Trump’s latest grievance is a $2.5 billion renovation of the Federal Reserve’s headquarters in Washington, which he has called “wasteful” and “suspicious.” Powell has already called for an internal investigation by the Fed’s inspector general to address the concerns.

Markets whipsawed in response to the revelation. The S&P 500 opened lower but recovered after Trump appeared to step back. The Dow rose 0.5% and the Nasdaq closed at a new high, up 0.3%, as investors tried to gauge whether the president was posturing or genuinely preparing for a legal and political showdown.

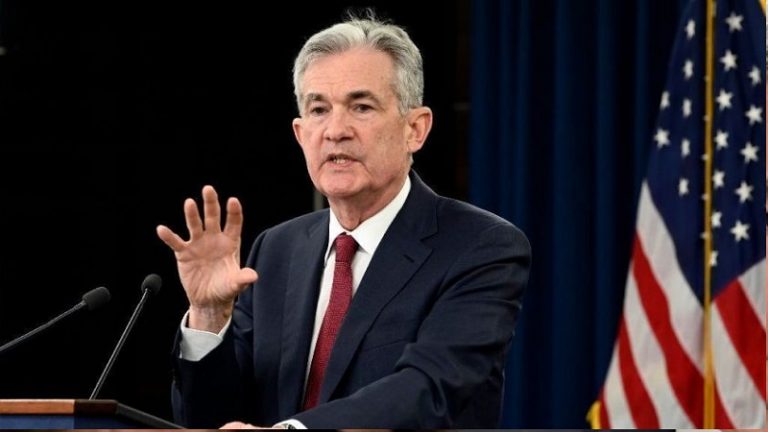

Powell, who was nominated by Trump in 2018 to lead the central bank, has clashed repeatedly with the president over interest rate policy. Trump has pushed for deep rate cuts—up to 300 basis points from the current 4.25%–4.5% target range—accusing Powell of stalling economic growth and jeopardizing his second-term agenda.

The Fed chair has largely refrained from public spats but has consistently defended the institution’s independence. Under U.S. law, Federal Reserve governors, including the chair, can only be removed “for cause,” typically involving proven legal or ethical violations. Mere disagreements over policy or performance do not qualify.

Still, Trump has tested the limits of executive power before. He has already succeeded in ousting leaders of independent regulatory agencies like the Consumer Financial Protection Bureau and the Federal Housing Finance Agency after securing favorable court rulings. However, those agencies have different statutory protections than the Federal Reserve, and legal scholars warn that firing Powell could result in a prolonged constitutional battle.

“This would be a five-alarm fire for global markets,” said Tobin Marcus, an analyst at Wolfe Research and a former Biden economic adviser. In a client note, Wolfe said the move could trigger equity selloffs, a spike in bond yields, and loss of confidence in U.S. economic management. “It would make the Fed look like just another political tool,” Marcus said.

Some GOP lawmakers are trying to calm tensions. Treasury Secretary Scott Bessent told Bloomberg that a firing was “very unlikely,” while Rep. French Hill, chair of the House Financial Services Committee, said he didn’t expect Trump to follow through.

But others are amplifying the speculation. Florida Rep. Anna Paulina Luna, an outspoken Trump ally, posted on X that Powell’s dismissal was “imminent,” citing what she described as “credible insider confirmation.”

“Hearing Jerome Powell is getting fired! From a very serious source,” she wrote, later adding, “I’m 99% sure firing is imminent.”

Powell’s term as chair ends in May 2026, but the growing feud highlights a stark challenge: whether a sitting president can unilaterally remove the Fed chair without triggering a constitutional crisis.

The Supreme Court has yet to rule directly on the specific protections for the Fed, but in a recent decision upholding the president’s power to fire heads of independent agencies, it hinted at limits when national economic stability is at stake.

CNBC’s Jim Cramer, a longtime market analyst, warned against what he called a “reckless campaign” to undermine Powell.

“I hope today is the last day that Trump goes after Jay Powell, whose term ends in ten months anyway,” he said. “Gunning for Powell will only hurt Trump, the same way it hurts the markets, and I don’t think the President’s a masochist.”

Although for now, Powell remains in place and has not commented publicly on the matter, the episode has cast a long shadow over the central bank’s perceived neutrality and its ability to function in a politically volatile environment.