You run a business in Nigeria, and the company also operates and earns revenue in the United States. You pay American tax. Then you also pay Nigerian tax. How do you use the tax treaties between Nigeria and the USA to reduce your tax burden?

Your company is based in London and you also have a branch in Lagos. You pay Nigerian taxes. How do you use the tax treaties between the associated respective countries to reduce your taxes?

Nigeria and most African countries have tax treaties with leading economies we do business with across the world? Are you utilizing those tax treaties to deepen competitive advantages? Are you even aware of them?

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

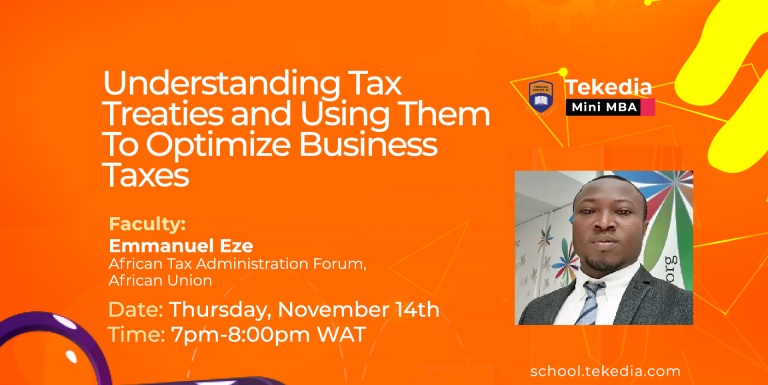

Join us tomorrow at Tekedia Mini-MBA as a zen-master in this business teaches us. Emmanuel Eze, formerly of Nigeria’s FIRS, the tax agency, and now in the nucleus of tax policies and evolutions at the continental African level will explain why you must not be wasting money because of your ignorance of tax treaties.

Tekedia Mini-MBA >> our product is knowledge; pick your seat for the next edition here

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube