Cryptocurrency is a growing technology, with new and innovative solutions constantly being built on the blockchain. Smart contracts play a key role in this progress by enabling the development of chains, protocols, apps, and other blockchain products that benefit both users and developers.

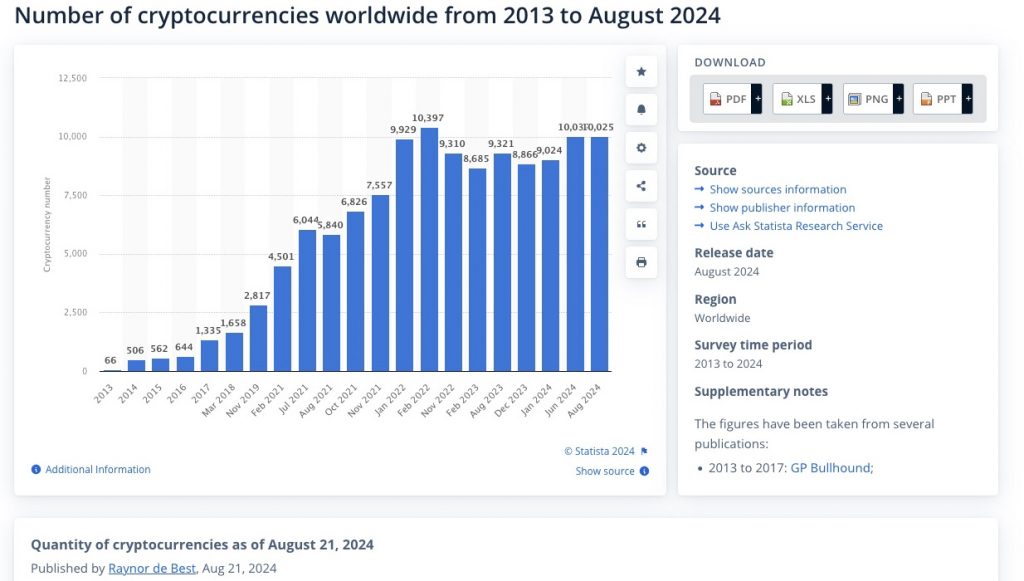

As of August 2024, Statista reports over 10,000 cryptocurrencies, highlighting a market with a global capitalization of $2.1 trillion. This expansion has led to a surge in cryptocurrency projects, with many innovators now exploring decentralized finance (DeFi) to offer new solutions.

However, despite the growth opportunities, there are still challenges. With so many projects entering the space, startups often struggle to stand out in the crowded blockchain market. At the same time, investors find it difficult to identify the right projects to invest in.

This is the problem that launchpads aim to solve. So, what are crypto launchpads, and how do they work? Let’s take a closer look.

What is a Crypto Launchpad?

Launchpads serve as incubators that guide crypto projects through the process of penetrating the market, gaining visibility, and raising funds to expand their business. They function like traditional incubators but are specifically focused on crypto. These platforms assist early-stage projects with marketing, fundraising, initial token launches, and distribution.

How Does a Crypto Launchpad Work?

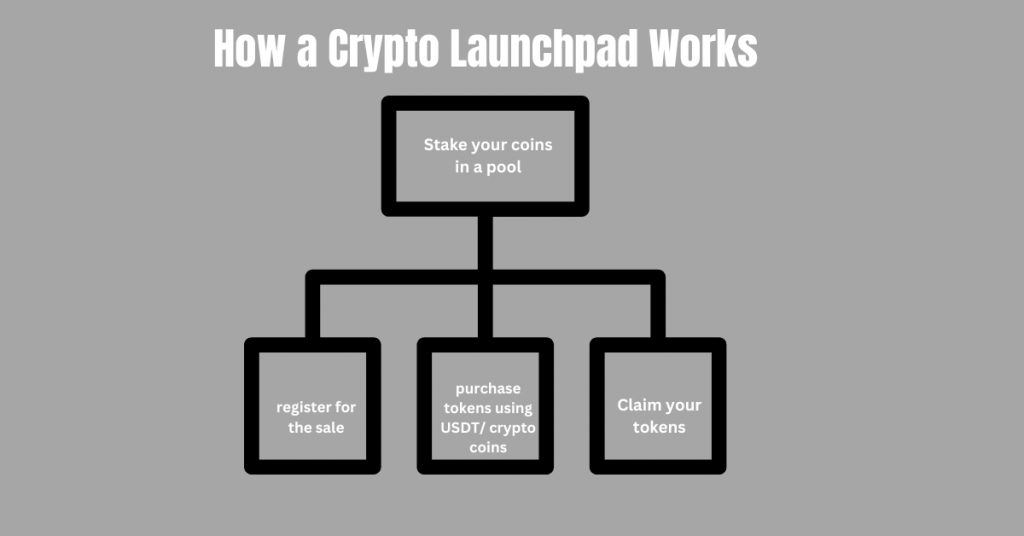

Launchpads make crypto fundraising easier by overseeing public sales, where users stake crypto to join an Initial Coin Offering (ICO). Your stake decides your tier, which affects how much of the sale you can access. Payments are usually made with stablecoins like USDT, USDC, or DAI, and there are often minimum and maximum limits for each investor.

Before the sale begins, you’ll need to register. If the sale is undersubscribed, meaning fewer tokens are claimed than available, extra tokens may be offered in a first-come, first-served phase.

Some sales also use a lottery system, where you stake tokens to enter, and winners are chosen at random. If selected, you can buy the tokens. After the sale ends, you can claim your tokens based on your tier and choose whether to hold, stake, or trade them.

Launchpads commonly utilize lockup periods and vesting schedules to ensure commitment and regulate price volatility. Additionally, many launchpads implement staking mechanisms where participants who stake more tokens may receive higher allocations or rewards during the token sale. However, the specifics of these rewards and staking benefits can differ between launchpads and projects.

Different Types of Launchpad Token Sales

Crypto launchpads help connect startups with investors in different ways. They offer crypto assets to early investors through various methods. Here are some common types of launchpad token sales:

Initial Coin Offering (ICO)

Cryptocurrency projects often crowdfund from early investors to enhance scalability. While ICOs are similar to Initial Public Offerings (IPOs) used by traditional companies, they differ because ICOs involve exchanging a portion of future coins rather than shares or equity for investment.

Projects running ICOs may use their own websites or third-party platforms like CoinList to offer investment opportunities. For example, Ethereum held its ICO in 2014, and Tezos held its in 2017.

Initial Dex Offering (IDO)

IDOs happen on decentralized exchanges (DEXs), where Automated Market Makers (AMMs) help with trades. Platforms like DuckDAO and Trustpad let projects launch tokens through IDOs. They use liquidity pools to release tokens, allowing investors to buy them by providing liquidity.

IDO processes are usually controlled by smart contracts, which automatically handle transactions and adjust token prices based on supply and demand. However, because trading within the liquidity pool sets the token’s price, there can be issues like low liquidity and price volatility.

Initial Exchange Offering (IEO)

Centralized exchanges (CEXs) handle Initial Exchange Offerings (IEOs). The exchange vets the project for credibility and potential success, then helps manage the token sale and listing process.

This allows projects to tap into exchanges’ credibility and wide user base to raise capital. As a result, users need to have an account with the exchange before they can participate in the investment process. Examples of such exchanges include Binance and Bybit.

Initial NFT Offering (INO)

Crypto projects use Initial NFT Offerings (INOs) to raise funds. They launch Non-Fungible Tokens (NFTs) on platforms like Magic Eden, OpenSea, Rarible, and NFTb. The INO price depends on the project’s mint price, and the collection is often limited in supply to create scarcity and value.

Projects can launch these NFTs by first creating a mintlist or an allowlist. This list works like a presale, giving early community members or investors the chance to buy at a lower price before the public mint opens. Investors can purchase the NFTs using the native coin of the blockchain the project is launching.

Initial Game Offering (IGO)

When a gaming project is nearing its launch, the team may conduct an Initial Game Offering (IGO) to secure funding. During an IGO, early investors support the project in exchange for valuable in-game assets such as characters, weapons, skins, or tokens that will be important for in-game purchases. Examples of such launchpads include Enjinstarter and xLaunchpad.

What are the Advantages of Crypto Launchpads?

Crypto Launchpads provide several benefits for projects and investors:

For Projects and Founders

Crypto launchpads provide a wide range of opportunities for crypto projects and founders. Below are some of the ways launchpads benefit them.

Streamlined Fundraising

Launchpads enable projects to crowdfund from early investors in a streamlined manner. The platform plays an important role in this process by allowing projects to tap into their existing user base to raise capital.

At the same time, launchpads offer a simple fundraising process that helps projects use funds to better scale their product, expand operations, and focus on other important parts of development.

Visibility Boost

Launchpads contribute to a project’s marketing and promotion efforts. They boost visibility by using their large user base and helping projects reach potential investors.

For instance, exchange launchpads like Binance and Bybit engage in various promotional campaigns to attract investors. They typically use content marketing through channels such as newsletters, social media posts, and banner ads. Additionally, they may employ other strategies like staking rewards, offering exclusive access, and hosting special events to further boost visibility and token appeal.

Trust and Community Building

Crypto launchpads help founders build a supportive community, gain investors’ trust, and establish credibility. Founders can rely on the reputation of an exchange or launchpad to earn the confidence of potential investors.

They can use Question and Answer (Q&A) sessions to address concerns, host webinars for project clarity, and use launchpad support services to build credibility before the launch.

Additionally, projects can use social media contests or offer exclusive access to token sales on launchpads to build community engagement before their official launch. These incentives encourage active participation, helping to attract and nurture potential users in the early stages.

For Investors

Crypto launchpads are beneficial to investors by providing them with access to several opportunities and rewards. Below are some of the advantages of crypto launchpads for investors:

Early Access to Investment Opportunities

Crypto launchpads allow investors to fund early-stage startups in return for future tokens or NFTs. This enables investors to fund promising projects and profit from them as they gain traction to maximize their return on investment (ROI).

Flexibility and Accessibility

The simplicity of launchpads, especially those on centralized exchanges, makes it easier for crypto investors to support high-potential startups and potentially earn future rewards. To participate, investors must stake a specified amount of cryptocurrency, complete KYC (Know Your Customer) verification, and then receive tokens after the launch. Although this process may be unfamiliar to new investors, centralized exchanges help simplify the investment experience.

Additionally, launchpads simplify the vetting process for investors. Since projects are pre-evaluated, it’s easier for investors to find promising opportunities. This reduces the need to research many projects, although investors should still perform their own due diligence.

Reduction Of Price Volatility

Crypto launchpads use vesting and lock-up periods to prevent investors from selling off their assets all at once. These mechanisms require investors to lock up their stakes for a specified period, which can range from a week to several years. This helps to ensure price stability and promotes long-term holding among investors.

Safety and Security

Crypto launchpads strengthen security for investors through smart contracts and multi-signature wallets. Smart contracts automate various processes, including vetting projects, managing token sales, tracking investor contributions, and ensuring fair distribution of tokens, whether through level or lottery systems.

While centralized exchanges like Binance and Bybit provide these benefits, decentralized launchpads such as TrustPad and Polkastarter might offer additional advantages due to their decentralized nature. This further increases transparency and trust.

Furthermore, launchpads employ multi-signature wallets to strengthen security. These wallets require multiple keys to authorize transactions, which helps to protect against fraud and unauthorized access.

Disadvantages of Crypto Launchpads

While launchpads are highly beneficial, they also pose some risks for both founders and investors:

For Founders

Although founders get access to key project opportunities through launchpads, they are not excluded from risks. Below are some of the disadvantages of crypto launchpads for founders:

High Competition Rate

Cryptocurrency launchpads feature many different projects, so each project must compete for visibility to stand out. Because of the large number of projects, raising funds can be highly competitive. Launchpads offer investors a wide variety of options, which may lead them to spread their investments across several projects rather than committing heavily to just one.

Legal or Regulatory Risks

Since cryptocurrency is still growing, projects sometimes face legal scrutiny from financial authorities and the government if they’re unable to adapt to new regulations. Meanwhile, this ensures that projects meet legal requirements, which differ across regions.

At times, legal non-compliance issues may arise, which may result in team penalties. In cases where projects fail to fulfill their promises to investors, it may lead to legal prosecution or a fine.

For Investors

While investors may benefit tremendously from crypto launchpads, there are also challenges. Here are some disadvantages of launchpads for investors:

Project Failure

In cryptocurrency, nothing is fully guaranteed. Although launchpads provide vetting systems before approving projects, the success of these projects cannot be ascertained. Volatility and market manipulation may impact tokens, causing prices to plummet and affecting liquidity.

Non-Compliance Risks

If a project fails to meet legal requirements, it may face legal challenges that could harm its growth. This can also affect the token’s value by causing speculation among investors.

Additionally, legal cases may cause projects to divert funds meant for operational efficiency into fines and other legal settlements.

Lanchpad vs. Launchpool: What Is the Difference?

Launchpads and launchpools both allow investors to stake crypto to earn token rewards for future sales. However, a launchpad is a platform that helps projects raise funds and lets investors support crypto startups, while a launchpool is a feature on such platforms that enables investors to stake crypto specifically for token sale rewards. Examples include Trustpad Launchpad and Binance Launchpool.

FAQs

How can I get my project on a crypto launchpad?

To get listed on a crypto launchpad, you must first submit your project details, whitepaper, and team information for evaluation. After due diligence, including background checks and technical verification, you will set up fundraising goals and token sale parameters.

The launchpad then handles marketing, promotion, and the execution of the sale while managing investor contributions.

How can I invest in a token sale?

To invest through a crypto launchpad, start with registration and complete the identity verification process (KYC). After verification, research the listed projects, focusing on the team’s background, technology, and market potential.

Once you’ve made your assessments, participate in the token sale, staking your stablecoin or other crypto assets for the required duration.

After investing, monitor your token’s performance regularly, access your tokens, and explore available trading options to maximize your investment.

What is the Best IDO Launchpad?

Several IDO launchpads are available today, including Trustpad, Polkastarter, DuckDAO, and BSCPad, among others. While these launchpads have received positive reviews over the years, always conduct due diligence and choose a platform that aligns with your goals.

Bottom Line

In summary, crypto launchpads play a key role in helping projects gain visibility, raise funds, and build communities. Besides that, they also offer investors early access to promising opportunities.

Despite the pros, both founders and investors are prone to regulatory risks and unguaranteed project success.

Additionally, the industry is growing, and in the coming years, launchpads may offer more opportunities along with potential risks. Always stay alert for new ecosystems and updates. Also, be sure to research thoroughly before launching or investing in any project.

Disclaimer!: This article is solely for educational purposes, and no piece of information should be considered financial advice. Always do your own research (DYOR) before investing in any aspect of crypto.