Market systems are inherently imperfect because information asymmetry makes it difficult for demand and supply to naturally converge at an optimal equilibrium. To correct this imperfection, societies create companies. Companies serve as organizing platforms that bring demand and supply together so that transactions can happen efficiently.

When you are hungry, you do not go from house to house hoping to find someone with food to sell. You go to a restaurant. Likewise, the person who has food to sell does not sit at home waiting for a knock; they bring the food to the restaurant. The company exists to reduce friction and eliminate uncertainty on both sides of the market.

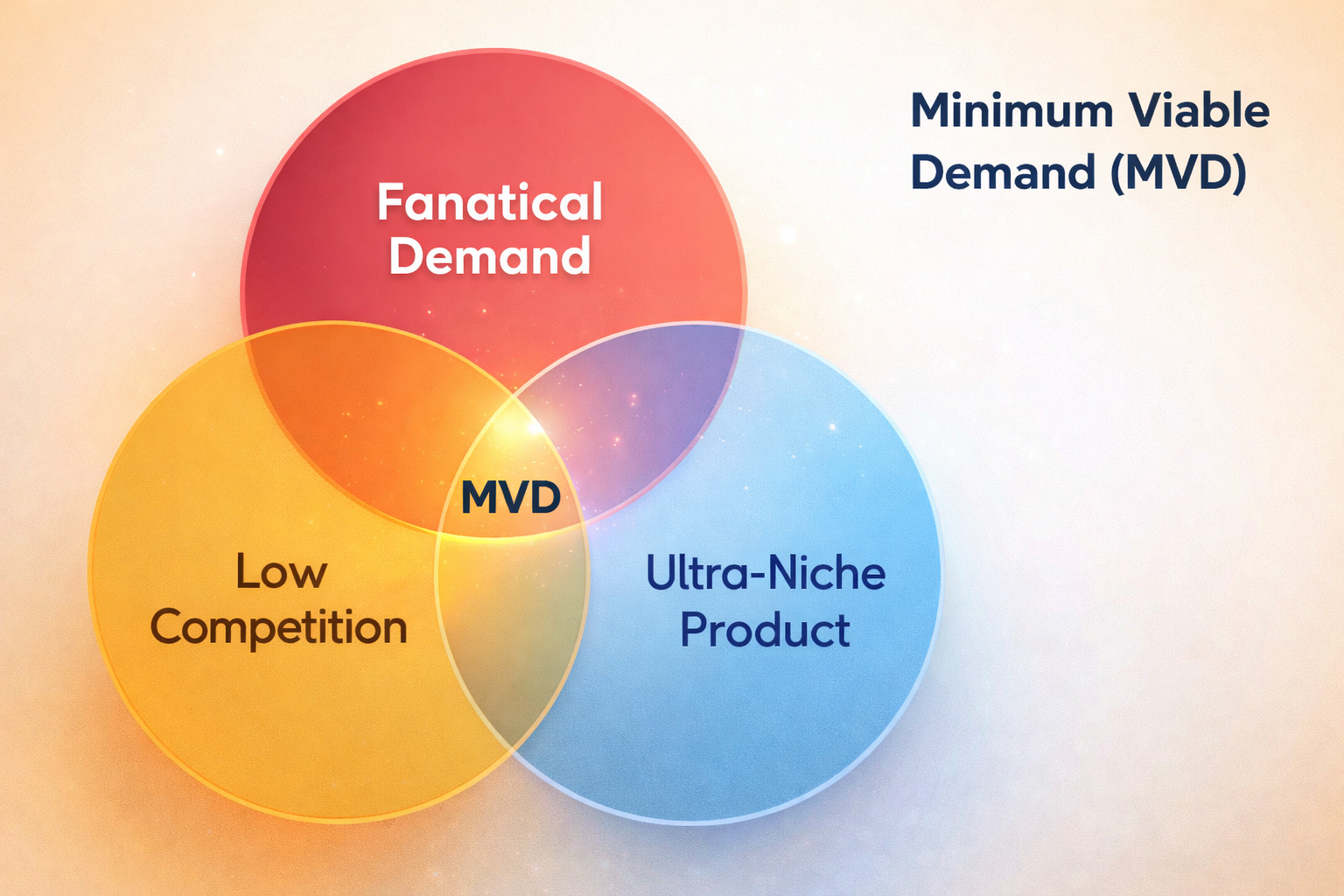

But when you are starting a new venture, the question becomes: where do you begin? Very often, the answer is not by trying to serve everyone. Instead, you focus on creating deeply “passionate” products for a clearly defined, leverageable demand, even if that demand is small at the start. You stand a far better chance of success by winning a small group of believers than by chasing a broad audience and ending up with none.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

I describe this approach as Minimum Viable Demand (MVD). MVD is especially powerful in digital markets, where iteration is fast and scaling is relatively frictionless. The demand may be small, but it is real, committed, and capable of being leveraged.

The essence of MVD is not size, but viability. The demand must be strong enough to sustain the business and flexible enough to scale over time. When done right, MVD delivers higher margins, lower competition, and fanatical early adopters.

It is often better to build for the first 1,000 users who genuinely care than for one million who do not. Once you have won those first 1,000, you can then design a deliberate path to scale, expanding the market while preserving differentiation, pricing power, and product identity.

In many markets, this strategy creates a quiet disruption. Incumbents ignore the small niche, assuming it does not matter. By the time they realize what is happening, the innovator has expanded the territory and reshaped the market. This dynamic sits at the heart of what I have previously explained as the startup incentive construct.

Understanding Startup Incentive Construct, a Framework by Ndubuisi Ekekwe

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube