Perplexity locked in a massive $750 million AI cloud deal with Microsoft, which basically confirms tech giants are dumping billions into AI infrastructure and expect artificial intelligence to absolutely crush the next decade of technology innovation.

DeepSnitch AI, currently at a discount price, is screaming the best AI crypto coins opportunity with four live AI security agents already protecting traders, while 300% bonus codes turn your $30K into $120K tokens that explode to $32M when Microsoft’s endorsement sends AI crypto parabolic.

Microsoft drops $750M on AI: Blockchain AI tokens about to print

Perplexity securing a $750 million AI cloud infrastructure deal with Microsoft shows tech giants view artificial intelligence as the most critical technology investment for the next decade of digital transformation.

The deal provides Perplexity with massive computing resources from Microsoft Azure to scale AI operations, which signals that AI infrastructure demand is exploding faster than existing capacity can handle and creates opportunities for blockchain AI projects offering decentralized alternatives.

Top high-growth AI tokens for February 2026

1. DeepSnitch AI destroys competition as best AI crypto coin with AI trading tools and 300% multipliers

DeepSnitch AI leads the best AI crypto coins list because it gives traders four operational AI weapons that create asymmetric advantages while your competition trades blind and loses money to scams.

AuditSnitch saves you from losing everything to rug pulls. Scan any contract in seconds before you ape in and watch it catch the honeypot functions, hidden mint capabilities, and malicious code that would have drained your wallet. This tool alone has saved early users millions by flagging scam projects during presale FOMO when emotions override logic

SnitchScan turns you into the whale. Track institutional wallet movements 24/7 across Ethereum, BSC, Solana, Polygon, and every major chain. Get instant alerts when smart money starts accumulating low-cap gems before CT catches on. Copy their entries, ride the momentum pump, exit into their buying pressure.

SnitchFeed makes you the first to know. Breaking news hits your feed in real time before it trends on Twitter. Partnership announcements, exchange listings, regulatory developments. Front-run the narrative, enter before the pump, take profits while retail is still reading the announcement.

SnitchGPT is your personal trading analyst working 24/7. Ask any security question and get instant answers using live blockchain data. “Is this contract safe?” “What’s the holder distribution?” “Are there any suspicious transactions?” Stop wasting hours researching and start making faster, more informed decisions that compound your edge.

The team extended presale after demand crushed projections, giving you exclusive access other traders won’t get. These live AI tools run exclusively for presale participants while everyone else waits. You’re building pattern recognition on whale accumulation zones and contract red flags that becomes your unfair advantage once public launch happens and you’re trading against people without these tools.

DeepSnitch bonus codes turn good entries into generational wealth. When DSNT runs to $10 during the AI security explosion Microsoft just validated with $750M, your $10K position hits $6.65 million.

2. KAITO targets 10x returns through AI search infrastructure

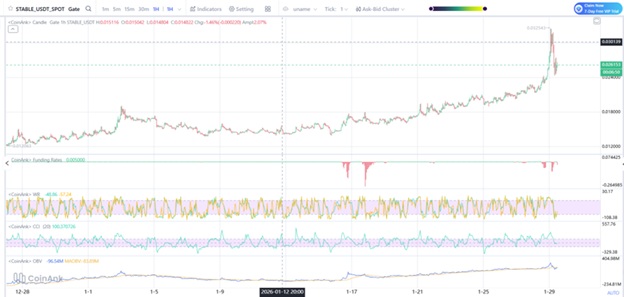

KAITO trades at $0.39 on January 31 as AI-powered search infrastructure gains attention from Microsoft’s $750M deal validating that AI analytics tools represent critical infrastructure for information discovery.

The protocol gives traders AI search and analytics for crypto markets. KAITO could 10x if the AI analytics vs blockchain ecosystem narrative explodes throughout 2026 when institutional capital flows in.

3. VANA builds toward 5x gains through data ownership infrastructure

VANA trades at $2 on January 31, riding the data ownership wave as users realize they’re getting farmed by Microsoft and every AI company for zero compensation on their personal data.

The protocol gives you ownership and monetization of your AI training data contributions. Positioned for 5x when privacy narrative explodes in 2026 and everyone demands control over their data.

VANA’s a safe AI analytics vs blockchain ecosystem bet with working products, but for best AI crypto coins that actually print millionaires, DeepSnitch AI at $0.03755 delivers four live AI security agents today plus 300% presale multipliers instantly quadrupling your stack.

Extended presale lets you master whale tracking and contract analysis before launch, edge that evaporates when public buying starts.

Conclusion: DeepSnitch AI leads AI crypto sector

Microsoft’s $750 million AI infrastructure deal validates unprecedented capital flows toward AI technology, benefiting blockchain projects offering working products at presale pricing.

KAITO and VANA deliver decent 5x to 10x returns as AI infrastructure plays, but the best AI crypto coins printing millionaires is DeepSnitch AI at $0.03755 with working AI security agents today plus 300% presale bonuses that 4x your bag instantly before launch sends prices parabolic and early advantages vanish.

Load $DSNT tokens at the official website before presale closes. Join Telegram and follow X for updates.

Frequently asked questions

What are the best AI crypto coins after Microsoft Perplexity deal?

Best AI crypto coins combine Microsoft validation with working products. KAITO and VANA offer 5x to 10x through AI infrastructure. DeepSnitch AI at $0.03755 delivers 1000x potential with 300% bonuses and live security tools.

Why does AI analytics vs blockchain ecosystem matter?

AI analytics vs blockchain ecosystem represents the intersection where decentralized AI tools solve problems that centralized tech giants cannot address effectively. DeepSnitch AI offers security tools that Microsoft’s centralized approach lacks.

Are KAITO and VANA the best AI crypto coins?

KAITO and VANA represent strong best AI crypto coins for slow gains. However, DeepSnitch AI offers explosive multiplication through working security agents, presale pricing, and 300% bonuses before public launch.