The Department of Justice (DOJ) has finalized a court order declaring the United States government the titleholder of seized cryptocurrencies and digital assets associated with Helix’s operations from 2014 to 2017.

This development comes as DeepSnitch AI overshadows major cryptocurrencies, with its price surging 150% amid its ongoing presale. The rally propelled the price to $0.03755 as the project raised $1.41 million.

Many now say DeepSnitch AI may be on the verge of soaring one hundred-fold as they anticipate its exchange debut. As a result, DeepSnitch AI could be the next crypto to buy now.

DOJ concludes $400M seizure in Helix case

According to a report on January 29, the US Department of Justice closed the case against the Bitcoin-era darknet mixing service provider Helix, sanctioning the forfeiture of over $400 million in cryptocurrencies and digital assets.

The assets were seized from Helix operator Larry Harmon between 2014 and 2017. Helix was developed to hide Bitcoin transactions on darknet markets.

On January 21, the US District Court for the District of Columbia issued an order that formally transferred ownership of the seized assets to the government. Henceforth, all assets previously owned by Helix have become properties of the United States.

Which of the trending coins this week can rise 100x in 2026?

1. DeepSnitch AI poised as the next crypto to 100x as demand jumps

DeepSnitch AI is taking a systematic approach to reduce guesswork in trading and investing and replace it with actionable, data-driven execution.

By leveraging five AI agents that gather real-time intelligence across several chains, DeepSnitch AI can help retail investors make well-informed investment decisions based on market sentiment and institutional demand.

SnitchScan, SnitchGPT, SnitchCast, SnitchFeed, and AuditSnitch are the five AI agents DeepSnitch AI creators built, and each has been integrated into a live dashboard that allows them to function simultaneously.

To access them, you have to be a DSNT holder. DSNT is currently in stage four of its presale, selling for $0.03755, with over $1.41 million raised.

Recently, DeepSnitch AI launched a bonus program for presale investors, allowing them to increase their holdings up to 3x right after purchase. This bonus is one of the reasons DeepSnitch AI is among the trending coins this week.

2. Hyperliquid price prediction: Commodity market explosion drives 24% rally

Following an explosion in commodity trading on Hyperliquid, HYPE surged 37.3% to $31.20. Silver became the most traded asset on the exchange during the Asian session.

Around the same time, Bitcoin and Ethereum recorded the highest trading volume among cryptocurrencies on Hyperliquid. This surge in activity prompted a response from the exchange’s CEO, Jeff Yan.

Also, the co-founder of Hyperliquid, Jeff, noted that Hyperliquid had become the most liquid market for crypto price discovery. Due to this momentum across the board, HYPE is expected to keep increasing in market value.

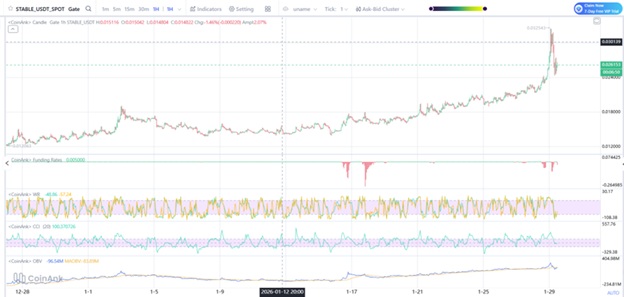

3. Stable price prediction: Why is the asset pumping?

Stable is one of the trending coins this week and possibly one of the top cryptocurrencies to buy today. Over the past seven days, Stable has gained 30% in value, hitting $0.025.

This upswing has been attributed to a confirmed imminent network upgrade and short liquidation in the Stable perpetual market.

The Stable team announced that the v1.2.0 mainnet upgrade is scheduled for February 4, switching gas fees to USDT0 and eliminating extra wrap and unwrap steps on the network.

With these improvements, Stable could surge even higher, probably touching $0.030 in the coming days.

The bottom line

Despite the positive performance of HYPE and STABLE, DeepSnitch AI outperformed both altcoins, posting a 150% gain while still in its presale stage. This performance has stoked forecasts that it could be the next crypto to 100x.

DeepSnitch AI’s native token currently costs $0.03755, but not for long, as demand continues to accelerate. Also, the recent bonus structure, which allows investors to use the codes DSNTVIP150 or DSNTVIP300 to claim 150% and 300% bonuses on purchases above $10k and $30k, respectively, further adds to the allure.

Visit the official website for more information, and join X and Telegram for community updates.

FAQs

1. What is the best crypto to buy now?

The best crypto to buy now, based on market preference, is DeepSnitch AI, a presale token with potential to be the next crypto to 100x.

2. What are the top cryptocurrencies to buy today?

Based on the last seven days’ performance metrics, DeepSnitch AI, Stable, and HYPE would be the top cryptocurrencies to buy today due to their resilience amid the marketwide drawdown.

3. Which of the trending coins this week can soar 100x?

Given its low-cap status, growing retail attention and adoption, and clear utility, many predict DeepSnitch AI could rise 100x before this year ends.