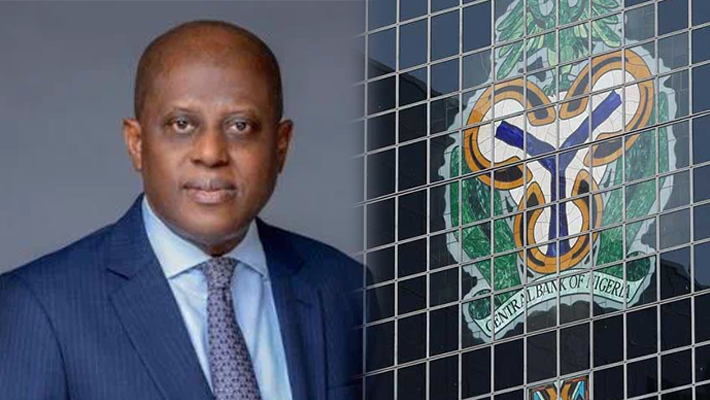

I commend Nigeria’s apex bank governor, Yemi Cardoso, for this new playbook: ‘In a significant shift from previous practices, Cardoso revealed the central bank’s intention to withdraw from direct development financing interventions. He said the CBN aims to transition to more limited advisory roles that align with the government’s economic agenda. There is a need to pull the central bank back from direct development finance interventions into more limited advisory roles that support economic growth,” explained Cardoso.”

This is what I have been advocating for ages. I had noted that part of Nigeria’s problem was the overheating of the economy with Naira via the Ways and Means policy ( Nigerian government borrowing from CBN!) which distorted market equilibrium, and in the process neutralized CBN policies.

Largely, you raise interest rates to slow the economy and control inflation, but the next day, you print billions of Naira and hand it over to the government, canceling out the very policy you are architecting to control inflation. Under that regime, Nigeria has struggled to tame inflation!

Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) opens registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

But with this new policy, there is hope. Of course, everything depends on Cardoso’s capacity to hold his ground as the government comes with a debit card for more money, knowing that the CBN can load the ATM with cash!

I call on the apex bank to also do something new: instead of raising rates to lower inflation in Nigeria, lower interest rates to boost production and supply. I guarantee you that if you lower interest rates in Nigeria, you will improve the Supply side in the market, and if that happens, inflation will drop. Our inflation is driven by low supply, and when we raise rates, we reduce supply [higher productive cost depresses supply] even though the policy has no impact on Demand since our consumer lending is largely nonexistent.

If you cannot try it across Nigeria, use Ovim, and you will see how inflation will drop in Oriendu Market, Ovim, Abia State.

Following growing public outcry over the nation’s current economic situation and mounting pressure from stakeholders to turn the fortune around, the CBN has been caught in the mix. The apex bank’s attempts for years to change the economic trajectory with varying monetary policies failed.

In a speech delivered via email on Tuesday, as reported by Reuters, Cardoso highlighted the pressing issues of a depreciating naira, double-digit inflation projected to reach 30% in the near term, and a staggering N87 trillion debt.

Comment On Feed

Comment 1: I have always held the opinion that until we go back to supply side economics, the whole monetary and fiscal policies of Nigeria will not yield 100% return. The supply side is the key. Let us have enough food supply with reliable road infrastructure that ensures prompt delivery at reduced cost anywhere in the country, consumer price index will go down which will directly impact inflation rate.

Let Govt provide infrastructure that supports surplus supply of food, clothing and shelter and see how cpi and inflation goes down.

Comment 2: Interesting positions. However, when the supply side is boosted and consumer lending remains non-existent, as the erudite Ndubuisi Ekekwe pointed out, there’s still a problem.

My Response: The problem is that prices will drop due to “Oversupply” assuming no change in Demand. That is a good problem to have in Nigeria right now and especially in Oriendu Market Ovim.

Comment 3: Thank you Prof. Ndubuisi Ekekwe for this economic analysis that I strongly align with. We do not tackle poverty and lack by mitigating or ameliorating it. Instead, we should focus on creating/catalyzing prosperity, so that scarcity, poverty and inflation are indirectly tackled too.

This is why I posit that for Africa to thrive economically under the clean energy transition, affordable (low-cost) energy must be made available in large quantities to boost local productivity. This will also protect our local markets from cheaper imported alternatives.

While we must commend what is being done in Africa now in replacing fossil-fuel generators with solar PV energy, our vision should be bigger: large-scale production of “cheap” sustainable energy for high-value agricultural value-chain, manufacturing and AI/data-science technological competitiveness.

You can please see details on this from my recent writing for The London School of Economics and Political Science (LSE) here: https://blogs.lse.ac.uk/africaatlse/2023/10/02/locally-generated-electricity-might-not-be-the-most-efficient-route-for-african-energy-transition/

---

Register for Tekedia Mini-MBA (Feb 10 - May 3, 2025), and join Prof Ndubuisi Ekekwe and our global faculty; click here.

The last CBN regime did not just do Ways and Means, it also gave away around a trillion naira in the name of anchor borrowers and its constituents, the money missed its way, and the artificial farmers who benefited also used it to purchase dollars, you got the gist? That’s how twisted and distorted many things are in Nigeria.

On this one, we will observe, commending announcements is not for some of us, until practical action follows.

I’m lost at what you’re trying to communicate here. What has the CBN doing away with GBOGBONISE (a Yoruba word for medicine that cures all diseases) got to do with ways and means? What the CBN is doing away with is the direct/indirect funding of development projects which some would call development financing but this has nothing to do with ways and means which as I write today is still in operation. The argument for and against ways and means is a different conversation. Several investors like me prefer investing in CBN instruments because aside from safety, they offer more returns when compared to what the Banks are offering in the form of deposits or even discounting instruments though you can say it is still below the inflation rate! For me and judging by the level of oversubscription of the NTB, Sukuk bond, and the 2053 bond just issued, I think the federal government should just do away with USD-denominated foreign loans and source 100% locally. It is the absence of market-friendly instruments like the NTB, Sukuk, Savings bonds, and other bonds that are making PONZI SCHEMES still thrive in the land. Well some might talk about crowding out of the private sector but the truth is that money is not cheap and therefore the private sector needs to offer more to attract funds from discerning investors like me!

All good as long as CBN remains only as an independent non commercial Bank- coordinating public policies and in light of national development and financial stability of the economy.

CBN should revisit the eNaira policy of the last administration. Implementing eNaira will help Nigeria to overcoming forex problems, public corruption, cash shortages, transparency and others…

Nigeria‘s burden is about those who hold important positions not being strong enough holding their ground because of self interests and their understanding of public service!

I concur with the investor ade kehinde that CBN’s direct dev.t intervention is different from ways & means, the F.G would always have its palm rubbed inasmuch the job of the cbn gov. is at the prerogative of the president, sincerity of purpose must also come from the gov.t to provide adequate infrastructures in boosting the economy, encourage exports & make the business environment attractive for foreign investment in such a way to also protect the interests of local entrepreneurs, surely there’ll be positive changes

I want to comment on the author’s advocacy for reducing of interest rates and hence borrowing rate (hopefully). While it may sound good to reduce interest rate to one digit, it is instructive to look at the other side of the coin – the entities that bring in the money to the banks or entities that patronize NTB, bonds etc. The question is “will very low interest rates encourage these entities to choose to invest into these instruments among alternatives”? The past administration tinkered with the idea of reducing interest rate for depositors to virtually zero. Infact account balances in current accounts were being heavily charged monthly while savings accounts balances were earning virtually nothing. The economic strategy behind this policy was I suppose to encourage Nigerians to invest their funds in productive economic activities such as agriculture, manufacturing, trade etc. The policy wanted to turn every Nigerian to an entrepreneur by fire and by force. What this policy failed to consider was that it is not every body that is meant to be in agriculture, manufacturing, trade etc. Some folks are not cut out for the intricacies of agriculture, manufacturing, trade etc. Some folks will rather earn from the more predictable investment in fixed deposits, money market investments such as national treasury bills (NTBs), bonds etc. When the past government reduced interest rate on these instruments to virtually zero, the Nigerian citizens were forced into handy alternative investments such as crypto currency, ponzi schemes and the like. This led to much loss of funds to Nigerians. The government intention to nudge Nigerians into investing in economic activities like agriculture, manufacturing, trade etc, did not come to pass because not all people are cut out for those economic activities. It is not every one that will be a farmer, agriculturist, manufacturer etc. Monetary policies should be balanced so that those who believe in earning through investing in bonds, treasury bills, bank term deposits and other money market instruments, can do so and those who have the calling and proficiency to venture into agriculture, manufacturing, trade etc can do those. It is from the pool of the fund from the depositors and similar investors that the banks can pool fund to lend to the entrepreneurs who are venturing into agriculture, manufacturing, trade etc. To stifle money market activities through very low interest rate to investors in this space while expecting to hand out low interest rate loans to entrepreneurs will create a backlash because fund owners will look the other way for more beneficial use of their funds. A balance is required in this intertwined monetary space