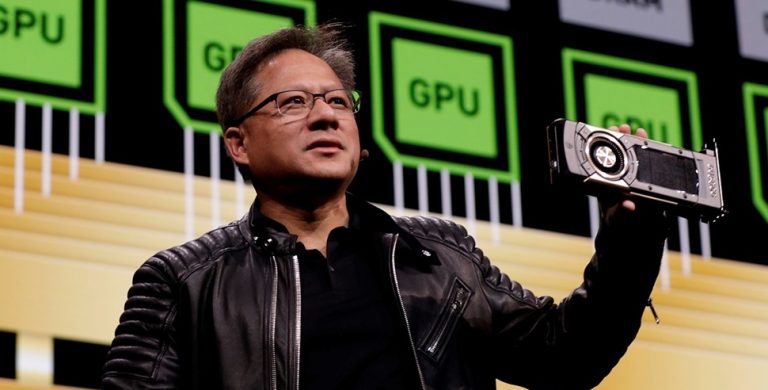

NVIDIA’s recent earnings report for Q1 fiscal 2025, released after market close on May 28, 2025, surpassed Wall Street expectations, driving a 7% stock price increase in after-hours trading. The company reported adjusted earnings per share (EPS) of $0.96, beating the consensus estimate of $0.93, and revenue of $44.06 billion, exceeding the expected $43.31 billion, marking a 73% year-over-year sales growth. The data center segment, fueled by AI chip demand, generated $39.1 billion, up 73% from the previous year.

However, export restrictions on NVIDIA’s H20 chips to China led to an $8 billion revenue shortfall, though strong demand for Blackwell GPUs helped offset this impact. Despite the beat, some analysts noted the results were not as overwhelmingly positive as in prior quarters, citing the China-related write-off and a projected Q2 revenue guidance of $45 billion, slightly below the $45.66 billion consensus. Posts on X reflected mixed sentiment, with some highlighting the earnings beat and others noting the guidance miss due to China restrictions. The stock’s after-hours gain aligns with options traders’ expectations of a 6-7% move.

NVIDIA’s Q1 fiscal 2025 earnings beat, with a 7% stock price surge in after-hours trading on May 28, 2025, reinforces its dominance in the AI chip market. The 73% year-over-year revenue growth, driven by $39.1 billion in data center sales, signals robust demand for AI infrastructure. This could buoy investor confidence in AI-related stocks, potentially lifting companies like AMD, Intel, or TSMC, though the broader market may remain cautious due to NVIDIA’s high valuation (P/E ratio ~70x forward earnings).

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The $8 billion revenue hit from U.S. export restrictions on NVIDIA’s H20 chips to China highlights escalating U.S.-China tech tensions. This could pressure other chipmakers with China exposure and accelerate efforts by Chinese firms to develop domestic alternatives, potentially reshaping the global semiconductor landscape. NVIDIA’s Q2 revenue guidance of $45 billion, slightly below the $45.66 billion consensus, suggests potential supply chain constraints or softening demand in non-AI segments. While the Blackwell GPU ramp-up is a positive, any perceived slowdown could temper investor enthusiasm, especially given NVIDIA’s significant weighting in major indices like the S&P 500.

Strong data center demand reflects continued enterprise investment in AI, but the stock’s muted post-earnings reaction compared to prior quarters (e.g., 10-15% jumps) may indicate market saturation or profit-taking. Rising interest rates or macroeconomic uncertainty could further cap upside. Optimists, including retail investors on X, emphasize NVIDIA’s earnings beat ($0.96 EPS vs. $0.93 expected) and AI-driven growth. They view the 7% stock gain as validation of NVIDIA’s leadership in AI and its ability to navigate export restrictions. Some argue the Blackwell GPU’s strong demand signals future upside, with analysts like those from Goldman Sachs maintaining a “Buy” rating and a $150+ price target.

Skeptics point to the $8 billion China revenue shortfall and slightly below-consensus Q2 guidance as red flags. Posts on X highlight concerns about NVIDIA’s reliance on AI hype, high valuation, and potential margin compression if supply chain issues persist. Some analysts, like those at Bernstein, suggest the stock’s risk-reward is less favorable after its 200%+ run since 2023, with export controls posing ongoing risks.

NVIDIA’s earnings underscore its AI market strength but also expose vulnerabilities to geopolitical and supply chain challenges. The 7% stock gain reflects cautious optimism, but the divide in sentiment suggests volatility ahead. Investors should monitor AI adoption trends, U.S.-China relations, and NVIDIA’s ability to sustain margins amid export curbs.