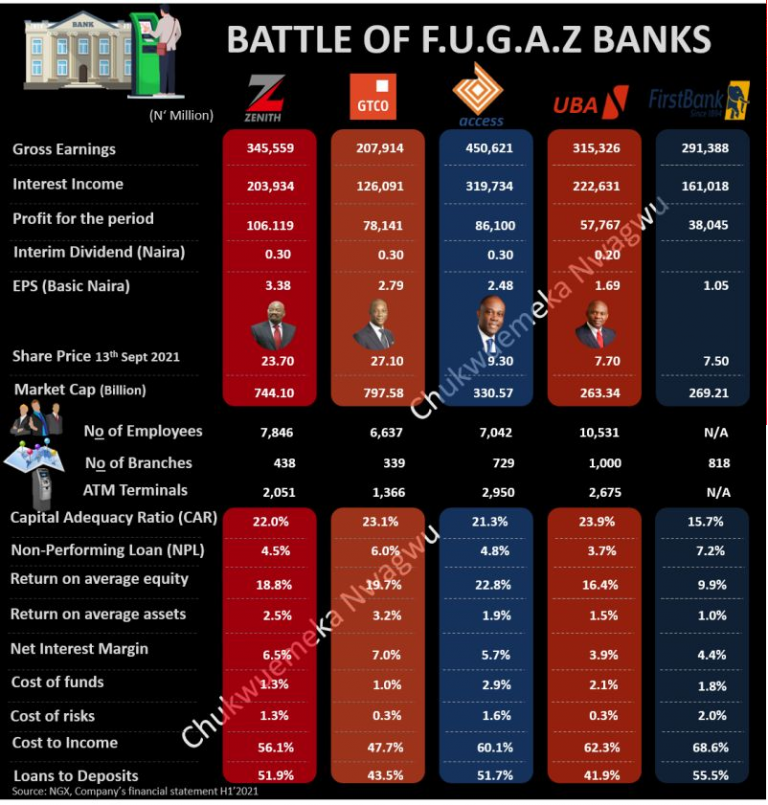

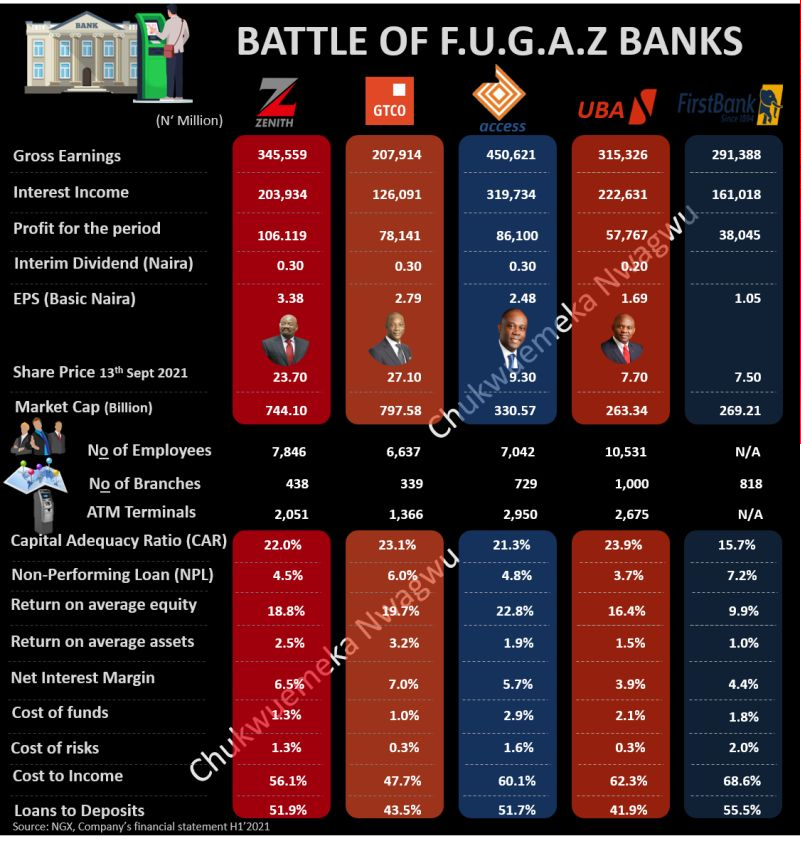

What is happening to GTBank (yes, GTCO)? It is losing steam across the board. Begin with the cost-to-income ratio which used to be industry leading at sub-40%. Now, it has jacked it up to 47% (I guess the holdco setup could have caused that). From gross earnings to profitability, Access and Zenith are there. Access is becoming a critical banking institution; look at the interest income.

There is a pattern I am seeing: improved marginal cost is a solid competitive advantage and being big will work for these relatively big and geographically positioned institutions, as the new era of African commerce begins. Nigerian banking will be totally different in 5 years.

Access and Zenith are on to something; GTBank has to watch itself well.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

Indeed. Access Holding as a whole keeps expanding, if one follows, you would see all the acquiring here and there, then you know that they are serious about growth.

As I said, I still expect their Insurance.