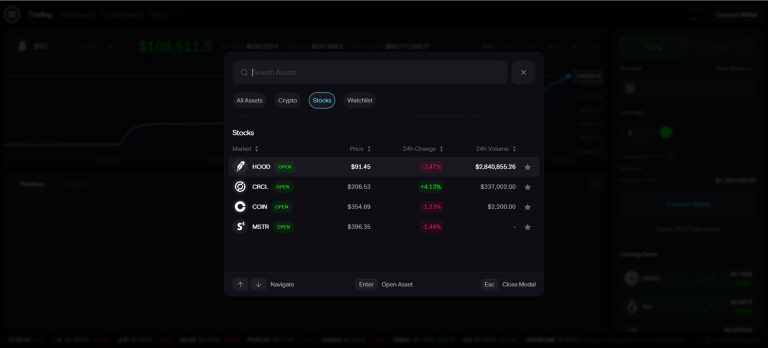

Aevo, a decentralized derivatives exchange built on a custom Ethereum Layer 2, launched a platform called Aevo Degen, offering up to 1000x leverage on tokenized stock derivatives for select equities, including Coinbase (COIN), Robinhood (HOOD), MicroStrategy (MSTR), and Circle (CRCL), with plans to add more stocks. The platform operates during U.S. stock market hours, with all positions automatically closed at the end of each trading day.

These tokenized derivatives track stock prices via oracles without representing direct ownership, allowing trading within the crypto ecosystem without a traditional brokerage. Traders can control large positions with minimal capital (e.g., $100 controls a $100,000 position), but a 0.1% adverse price move can wipe out the entire position.

Fees are only charged as a share of profits, not on unprofitable trades. Trades are executed at market price with no slippage. Early users (first 100-200) can receive a 1:1 deposit match up to $50. However, the high leverage carries significant risks, as small price swings can lead to rapid, substantial losses. Aevo emphasizes robust technical infrastructure, but users are cautioned to manage risks carefully due to the volatile nature of such trading.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The launch aligns with trends toward tokenizing traditional financial assets, though it raises concerns about regulation and risk management. The launch of Aevo’s Degen platform with 1000x leverage trading on tokenized equities has significant implications across financial, regulatory, and market dynamics. Tokenized equities on a crypto platform lower barriers to entry, allowing retail traders to engage in high-leverage trading without traditional brokerage accounts.

This could attract a new wave of crypto-native traders to equity markets. 1000x leverage magnifies price movements, potentially increasing volatility in the underlying tokenized assets, especially for volatile stocks like Coinbase or MicroStrategy. Small market moves could trigger large liquidations, impacting price stability. A 0.1% adverse price move can wipe out a trader’s position, posing extreme risks, especially for inexperienced retail traders drawn to the platform’s high-leverage allure.

Mass liquidations during market downturns could strain the platform’s infrastructure or lead to cascading effects in the broader crypto market, given the interconnectedness of tokenized assets and crypto exchanges. Tokenized equities operating outside traditional stock exchanges may fall into regulatory gray zones, especially in jurisdictions like the U.S., where the SEC closely monitors securities. Aevo’s use of oracles to track prices without direct ownership may not exempt it from securities laws, potentially attracting regulatory action.

As a decentralized platform, Aevo may face varying regulatory challenges across jurisdictions, complicating compliance and user access. The platform accelerates the trend of tokenizing real-world assets (RWAs), bridging traditional finance and DeFi. This could pave the way for broader adoption of tokenized securities but also raises questions about market integrity and investor protections.

By offering zero-fee trading and high leverage, Aevo challenges traditional brokers, potentially pressuring them to innovate or lower costs. The “Degen” branding and 1000x leverage may attract speculative traders, potentially leading to irrational market behavior or “gamification” of trading, similar to past retail-driven events (e.g., GameStop 2021). The complexity and risk of high-leverage derivatives necessitate robust user education to prevent widespread losses, which Aevo must address to maintain credibility.

The platform’s reliance on oracles for price feeds introduces risks of manipulation or technical failures, which could disrupt trading or lead to unfair liquidations. As a new platform, Aevo Degen’s ability to handle high trading volumes and maintain liquidity during volatile periods remains untested. While Aevo’s platform offers innovative access to high-leverage equity trading, it introduces substantial risks for users and potential regulatory challenges. It could reshape how retail traders engage with equities in the crypto ecosystem but requires careful risk management and regulatory clarity to avoid adverse outcomes.

GameSquare Holdings Received Board Approval For $100M Ethereum Investments

GameSquare Holdings, Inc. (Nasdaq: GAME), a media and entertainment company, has received board approval for a phased investment of up to $100 million in Ethereum (ETH) as part of a new treasury strategy. This initiative marks a significant pivot toward decentralized finance (DeFi) and blockchain-based financial management.

The company announced on July 8, 2025, that it priced an underwritten public offering of 8,421,054 shares at $0.95 each, raising approximately $8 million to kickstart this Ethereum-based treasury vehicle. The strategy is supported by a partnership with Dialectic, a crypto investment firm, utilizing its Medici platform to target on-chain yields of 8–14%, significantly higher than typical ETH staking returns of 3–4%.

The investment will be deployed in stages to maintain sufficient capital for ongoing operations, with plans to explore additional yield-generating opportunities within the Ethereum ecosystem, such as stablecoins and NFTs. Following the announcement, GameSquare’s stock surged 58.76% on July 8, 2025, closing at $1.54, with trading volume exceeding $40 million, reflecting strong investor enthusiasm.

The move aligns with a broader trend of institutional adoption of cryptocurrencies, though it carries risks due to Ethereum’s price volatility and potential regulatory challenges. The implications of GameSquare’s (Nasdaq: GAME) board approving a phased $100 million investment in Ethereum are multifaceted, affecting the company, its stakeholders, and the broader market.

By allocating up to $100 million to Ethereum, GameSquare is diversifying its treasury away from traditional assets like cash or bonds. The targeted 8–14% yield through Dialectic’s Medici platform could significantly outperform conventional treasury returns, boosting financial efficiency. Ethereum’s price volatility (e.g., 15–20% daily swings in 2025) introduces risk. A sharp decline in ETH value could impair GameSquare’s balance sheet, impacting liquidity for operational needs.

As a media and entertainment company with esports and gaming ties, investing in Ethereum aligns with blockchain trends like NFTs and Web3 gaming, potentially opening new revenue streams or partnerships. Evolving crypto regulations, especially in the U.S., could complicate compliance or impose restrictions on GameSquare’s ability to hold or liquidate ETH, particularly if Ethereum is classified as a security.

The 58.76% stock surge on July 8, 2025, reflects investor optimism about GameSquare’s crypto pivot. However, sustained gains depend on Ethereum’s performance and effective execution of the treasury strategy. Investors gain exposure to high-yield DeFi opportunities but face increased risk from crypto market fluctuations. Conservative shareholders may view this as a departure from GameSquare’s core business.

The move positions GameSquare as a forward-thinking company, potentially attracting tech-savvy investors but alienating those wary of crypto’s speculative nature. GameSquare’s investment reinforces Ethereum’s credibility as a corporate treasury asset, following the likes of MicroStrategy and Tesla with Bitcoin. This could encourage other public companies to explore crypto allocations.

Partnering with Dialectic to leverage DeFi protocols highlights the growing maturity of Ethereum’s ecosystem, promoting broader adoption of yield-generating strategies. A $100 million ETH purchase, even if phased, could contribute to bullish price momentum for Ethereum, especially in a market sensitive to institutional flows. GameSquare’s move signals deeper integration of blockchain in gaming, potentially accelerating trends like play-to-earn models, NFT-based in-game assets, or decentralized esports platforms.

Competitors in the media and gaming sectors may feel pressured to explore similar crypto strategies to remain financially competitive or relevant in Web3 spaces. The investment reflects confidence in Ethereum’s long-term value and DeFi’s stability, but it also underscores reliance on high-risk assets amid inflationary or uncertain economic conditions.

A bear market or significant ETH price drop could erode GameSquare’s treasury value. Smart contract vulnerabilities or platform failures in Dialectic’s Medici could lead to losses. If the strategy underperforms, activist investors or shareholders may push for a reversal. Interest rate hikes or stricter crypto regulations could dampen the strategy’s viability.

GameSquare’s Ethereum investment is a bold bet on blockchain’s future, with potential to enhance returns and industry positioning but accompanied by significant financial and regulatory risks. The success of this strategy will hinge on Ethereum’s market performance, DeFi execution, and GameSquare’s ability to balance innovation with operational stability.