The recent controversy surrounding the $300 billion OpenAI deal between Oracle and Microsoft highlights a paradox within the AI economy: despite the tech industry’s massive investment in computing infrastructure, the financial risks and structural weaknesses may be building up even faster than the promised gains.

Oracle’s significant investment in OpenAI — through its Stargate data center partnership — has led to strong market skepticism. The credit rating agency, Moody’s, deemed that deal especially risky and has pointed out the “significant counterparty risk”. The main reason is Oracle’s heavy reliance on just a few companies to generate the majority of its future revenue.

According to Bloomberg, Oracle is assisting OpenAI in circumventing the export restrictions imposed on AI chips, thereby strategically positioning itself as a “one-stop shop” for OpenAI’s global expansion and assuming a crucial supplier role in its development.

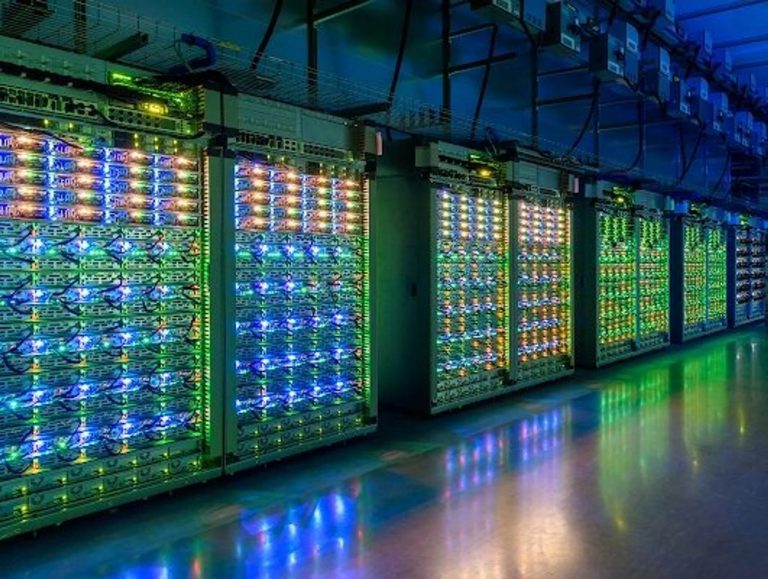

Such a situation is indicative of a larger trend: debt is the primary source of funding in the AI infrastructure boom. According to The Economic Times, the amount of debt for data centers in 2025 has increased by 112% and surpassed the $25 billion mark. Quite a few of these projects depend on risky financing, asset-backed securities (ABS), and intricate arrangements that predict continual demand.

According to JPMorgan, global data center and AI infrastructure spending is expected to exceed $5 trillion in five years, driven by “astronomical” demand for computing power. McKinsey, on the other hand, projects that AI workloads will drive a $6.7 trillion investment in data centers by 2030, with most of the new demand coming from generative AI.

However, the enormous amount of capital being utilized raises significant doubts. A large part of the infrastructure investments would face the capital expenditure-to-revenue mismatch issue: today’s construction of 10 GW+ computing power will only be profitable if AI companies can convert that capacity into revenue for an extended period and provide the expected value to investors, potentially achieving the status of high dividend stocks. Market analysis reveals that some of the largest AI companies are still incurring losses at a level significantly higher than their current revenue.

One more critical weakness is the concentration risk. The AI Now Institute’s landscape report predicts that only four cloud providers — Google, Microsoft, Amazon, and Meta — will cover 60 to 65 percent of all AI workloads by 2030, resulting in these companies having extraordinary power over the entire computing infrastructure stack. This may also significantly impact the performance of the SPX chart, as the companies represent some of the most prominent players.

Furthermore, research from the ground warns that such a concentration around computers, data, talent, capital, and energy may engender systemic fragility in the AI value chain. Additionally, power is coming up as a major limitation. The use of large GPU clusters consumes a significant amount of energy, and the associated costs may ultimately lead to very slim margins.

Regions with low electricity costs have been identified by analysts as particularly appealing for the location of data centers; however, grid limitations, rising electricity prices, or regulatory developments (such as carbon pricing and usage restrictions) may compromise the economic viability of AI infrastructure.