November 8th, FTX froze withdrawals due to a lack of collateral. What was one of the titans of the industry less than a month before the fall, seemingly overnight turned into a headline for one of the largest cases of fraud and financial mismanagement in over a decade.

After the FTX, Alameda Research and BlockFi bankruptcy, Proof of Reserves has emerged as a potential solution to regain investors’ trust.

How do we explain FTX’s $10 Billion in losses?

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

Where did the $2 Bn in venture funds go?

My working hypothesis is that FTX was a fraud even prior to recent events and as far back as 2021. SBF will go down in history as a fraud larger than Bernie Madoff. Alameda Research was indispensable to FTX, crucial for this analysis.

FTX must inventory customer funds 1:1. How then to match buy & sell orders? Both orders would have to arrive at the exact same time, the exact same size, and agree on the exact same price. That never happens. Alameda fixes this problem by serving as the Designated Market Maker (DMM). Under US securities law, the DMM is obligated to make a market under any market conditions.

The DMM stands ready to offer their own inventory of securities to the market, and stands ready to buy. FTX is a gift for Alameda. FTX is gathering and attracting tons of uninformed retail order flow for Alameda to monetize by trading against. Similar to PFOF

Alameda is a gift for FTX. Alameda offers valuable liquidity to customers. Otherwise, the exchange would have no volume. That exclusive FTX/Alameda relationship conferred a major advantage to Alameda.

Alameda could make a market with limited competition against uninformed retail order flow. Alameda would simply take the other side of random buy & sell orders and make money.

A good DMM or HFT can make money nearly every day. You are constantly turning over the portfolio. You make more money in volatile markets. It requires little capital. It’s a great business. That business attracts competition.

Mango Markets utilized a margin trading protocol allowing cross-margin between a basket of different crypto assets as collateral. They used an oracle which fed them spot prices of these assets from several major exchanges to determine the value of the collateral on the Exchange.

One of the assets that was allowed to be used for collateral was MNGO, the exchange’s native token. MNGO was extremely illiquid, and Avi realized that it would be relatively easy to manipulate the price of MNGO on the centralized exchanges that fed data into the oracle.

Sam Bankman Fried took large positions on MM at the same time using MNGO as collateral, was able to withdraw various forms of collateral from the exchange while the position was in profit, & by the time MNGO crashed back to fair market value, the exchange was left w/ a large sum of bad debt.

SBF wrote a great Twitter thread detailing the mechanics of this move less than a month before FTX’s collapse – & once we’re done peering through it – I think you’ll realize the mechanics between the MNGO exploit and the explanation for the FTX balance sheet hole are eerily similar.

1) When it comes to oracles,

you just have to make up your own damn mind pic.twitter.com/7kZATSLpQM

— SBF (@SBF_FTX) October 12, 2022

His fictional asset for the sake of this example is XYZ – which is supposed to represent MNGO. Now, I’m getting a bit ahead of myself here, but I also want you to start picturing XYZ as tokens such as FTT or SRM that were used as forms of collateral by Alameda on FTX.

Here’s where things start to go wrong.

Imagine the Alameda is the House. The house has a slight ‘edge’ – a slight positive expectancy. Over time, the skillful poker players start to show up. Jump, Wintermute, and smaller shops. The HFT game rewards whomever has the lowest latency and fastest data.

FTX’s competitors invest in hardware: co-located servers, ultra-fast flexible gate programming arrays (FPGAs), and data. They compile in C.

FTX spent millions on AWS. They code in Python. Too slow… Great HFT firms will invest up to billions in proprietary high-speed data links such as microwave technology.

The mere curvature of a fiber optic cable creates a disadvantage for an HFT firm. The bending of the speed of light is unacceptable. Speed is everything.

FTX and Alameda now flip from a slight positive expectancy to a slight negative expectancy. They are the sucker at the poker table. They start to bleed. They lose a small amount of money per trade – on millions of trades.

At the same time, they are growing customers. Why?

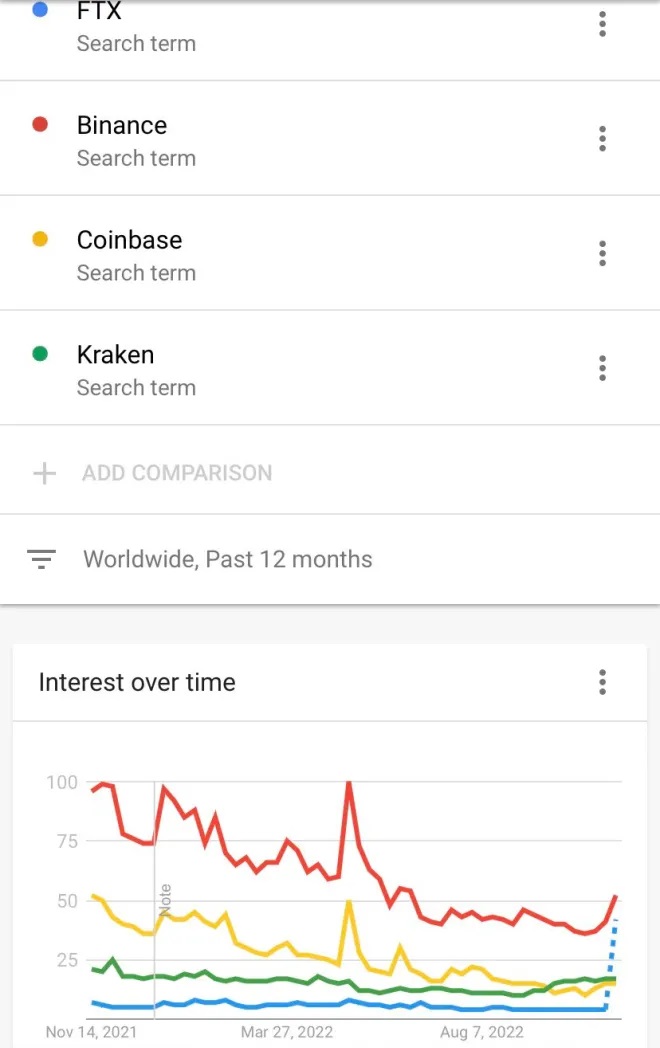

The same trading strategy that might not work profitably at at Coinbase would make profit at FTX Global. It’s was known known that FTX Global had the best ‘vig’ in town if you were an HFT. A lot of people assume FTX achieved major retail penetration. But search indicates near zero organic engagement for an exchange its size.

FTX seemed dominated by prosumers and trading firms. And if they made a killing in 2021, and there was no soft retail flow, who was losing?

At its core, the quotation service that FTX offered was broken. It was quoting stale prices. That exposes FTX Global to getting ‘picked off’ by faster traders with lower latency. ‘Picked off’ means an informed traders spot the mis-quotation and profit at Alameda’s cost.

William Clemente, Cofounder of ReflexivityRes Tweeted apparently, Many crimes have an intent component where a prosecutors must prove at least circumstantially that there was intent by the person.

It’s very clear, @SBF_FTX is hand selecting interviews with people who have little knowledge of how margin exchanges work so that he can carefully craft a narrative of “criminal negligence” instead of fraud. It’s disgusting.

— Will Clemente (@WClementeIII) December 3, 2022

However, intent for the action underlying the crime is all that’s needed, Not intent to commit the crime nor knowledge it was a crime.

On his recent interview on Good Morning America, SBF explained what transpired on FTX leading to Implosion. 2:33 is where my confirmation of his guilt was solidified. The way he avoids that question… it’s a simple question dude… Yes or No. He danced around that answer… and continued to dance through the Alameda/FTX relationship questions.

Disgraced FTX founder Sam Bankman-Fried appears to be employing the “bad businessman strategy” to avoid facing jail time over the missing billions from the crypto platform, says CNBC. The shock collapse of FTX, valued just months ago at $32 billion, came after the company used customer deposits to fund bets made by its affiliated trading firm Alameda Research — with the effects rippling through the industry. While no charges have yet been filed, legal experts told CNBC the fallen crypto star should be “very concerned about prison time;” both the Securities and Exchange Commission and Justice Department are reported to be investigating the matter. Bankman-Fried has so far denied fraud. (LinkedIn News)