Bitfarms Ltd, a major North American Bitcoin mining company, revealed plans to wind down its Bitcoin mining operations over the next two years (2026–2027) and redirect its energy infrastructure toward artificial intelligence (AI) and high-performance computing (HPC) data centers.

This marks Bitfarms as the first large-cap Bitcoin miner to commit to fully exiting its core crypto mining business, driven by shrinking profit margins in mining amid the 2024 Bitcoin halving and volatile token prices.

Mining activities will phase out gradually through 2027, with full conversion of facilities to AI/HPC by the end of that period. The company’s 2.1 GW energy portfolio across North America—clustered in power- and fiber-rich regions—positions it well for this shift.

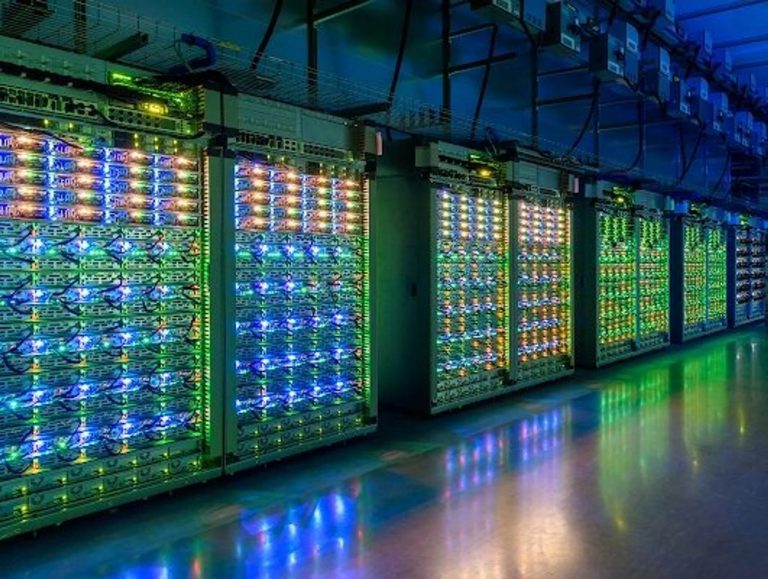

The 18 MW facility in Washington State will be the initial focus, retrofitted with Nvidia GB300 GPUs and advanced liquid cooling. This site, representing less than 1% of Bitfarms’ developable capacity, is expected to be operational for AI workloads by December 2026.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Bitfarms has secured a $128 million fully funded supply agreement with a major U.S. data center partner for equipment and materials. CEO Ben Gagnon stated that GPU-as-a-Service (GPUaaS) at the Washington site alone could generate more net operating income than Bitfarms has ever achieved from Bitcoin mining, providing a “strong cashflow foundation” to cover operations, debt, and further expansions.

Bitfarms’ Q3 2025 earnings, released alongside the announcement, highlighted the pressures prompting this pivot: Net Loss: $46 million, nearly double the $24 million loss from Q3 2024. $69 million, up 156% year-over-year but missing analyst expectations by 16%.

520 BTC mined at an average direct cost of $48,200 per BTC. 1,827 BTC as of November 13, 2025. The decision reflects broader industry challenges: post-halving block rewards dropped to 3.125 BTC, network hashrate has surged, and Bitcoin’s price volatility trading below $96,000 on November 14 has eroded margins.

In contrast, AI compute demand offers stable, long-term contracts with higher margins and fewer regulatory hurdles.Market ReactionStock Impact: Shares plunged 18% to $2.60 on November 14, extending a 51% monthly decline amid broader crypto market weakness. After-hours trading saw further dips.

While some view the pivot as forward-thinking—leveraging existing infrastructure for the AI boom—others expressed concern over near-term revenue uncertainty during the transition.

Bitfarms joins a wave of miners diversifying into AI/HPC:Similar Moves: Marathon Digital (MARA) expanded AI services alongside record revenues; Core Scientific (CORZ) partnered with CoreWeave for AI cloud computing; Cipher Mining and TeraWulf have deals with SoftBank and Google, projecting billions in AI revenue.

Miners’ access to cheap, scalable power gives them a competitive edge over traditional data center builders. AI’s explosive growth—fueled by models like those from OpenAI and enterprises needing GPU power—promises steadier cash flows than crypto’s cycles.

Short-term pain, potential long-term gain, 2026–2027 will be a revenue trough. Mining will wind down gradually, but AI revenue won’t fully replace it until late 2026 or 2027. Expect negative free cash flow, possible equity dilution, and continued stock pressure.

The market will stop valuing Bitfarms as a Bitcoin miner (BTC holdings + hashrate) and start valuing it as an AI/HPC infrastructure play (power capacity × $/kW-month + GPU utilization). This re-rating is already underway — the stock is trading near book value of power assets rather than mining multiples.

Retrofitting mining sheds for liquid-cooled Nvidia GB300s, securing long-term GPUaaS or colocation contracts, and hitting the December 2026 deadline are all non-trivial. One major delay or failed contract could be catastrophic.

This strategic overhaul could redefine Bitfarms’ identity, but execution risks remain high: retrofitting costs, securing clients, and navigating energy demands for AI. For now, it’s a bold bet on compute over crypto.