In my youth, I had two homes, depending on when… Ireland and Trinidad.

I had two interesting observation points from where I could see the beginning of the dominance of Japanese vehicles in the marketplace. Dominant brands of the masses in Europe were British Leyland (different sub marques), Chrysler-Hillman, Citroen, Fiat, Ford, Opel, Renault, SAAB, Vauxhall, Volkswagen and Volvo.

Lots of people said bad things about the Japanese cars, but over a decade, they dominated the car markets, (particularly Toyota), while many of the indigenous brands, especially in the UK, were either bought or died out.

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025): registration continues.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

I can remember a time in Nigeria when the only bleach folks would buy was ‘JiK’. Nobody would put their hands in dish washing if it was not ‘Morning Fresh’. Those that drunk vodka would only drink Smirnoff and the word ‘stout’ wasn’t even in the lexicon, only Guinness. If it wasn’t Lipton, it wasn’t tea, and elders in villages still spoke of ‘Quaker Oats’.

These days people are a lot less brand-loyal even in the most brand persistent of geos.

Arguments in favour of Cryptocurrencies are often variations of two types:

- Freedom from external control of, and sovereign border problems with personal assets

- A store of value that is less inflationary than FIAT.

The reality of Cryptocurrencies is that 1. Every ‘Cryptographic Network’ with a corporate or individual owner, has a control prerogative, and this may work out more risky than if the control were by a sovereign entity. We need to liberate ourselves from this naïve perception of Crypto-Corporates as being any more humane than Oil Giants or Big Pharma. The only options that truly offer this is where the network builders divested themselves of ownership (as with Bitcoin and Handshake).

- Only ‘Nakamoto Consensus’ Proof of Work (PoW) Blockchains offer true non-inflationary value (again, Bitcoin and Handshake are examples). BTC max circulation is 21m units, while HNS is 2.04 bn units.

But there is a third inflationary pressure in the Cryptocurrency asset class which nobody ever talks about. There are currently 193 countries acknowledged by the UN, which means there is a limit of 193 FIATs. Nobody can declare the existence of a nation in the morning and expect ascendancy to the UN with open arms, and enjoy the knock on benefits, such as being able to issue a national currency that its citizens will accept, and the world will acknowledge.

Any individual, group or company however, can randomly decide to create an ecosystem with its own cryptocurrency. ‘Nakamoto Consensus’ Proof of Work (PoW) Blockchains are at the high end, with ERC 20 tokens at the ‘sh$tcoin’ end, but ultimately, increasing network numbers renders the Asset Class as a whole, inflationary.

No brand in the asset class is ‘untouchable’ or ‘sacrosanct’.

There is no proprietary hold on the technology, so there is scope for even ‘Nakamoto Consensus to be duplicated, or even improved upon.

Just as ‘Morning Fresh’ ran out of freshness in Nigeria, the Cryptocurrency Asset Class needs to understand, just because you don’t hear the knocking, doesn’t mean there isn’t a Toyota just outside the door.

When a product becomes surrounded by many technical equals or even superiors, brand is subjective, and its dominance is vulnerable, even the Bitcoin ‘brand’.

An article on LinkedIn earlier today by Sriram Ananthakrishnan acknowledges the meteoric rise of gold price, but nobody in my online reach is paying much attention to it.

Much is in play, and all Asset Classes are being heavily promoted by the Investment and Trading professionals linked to them.

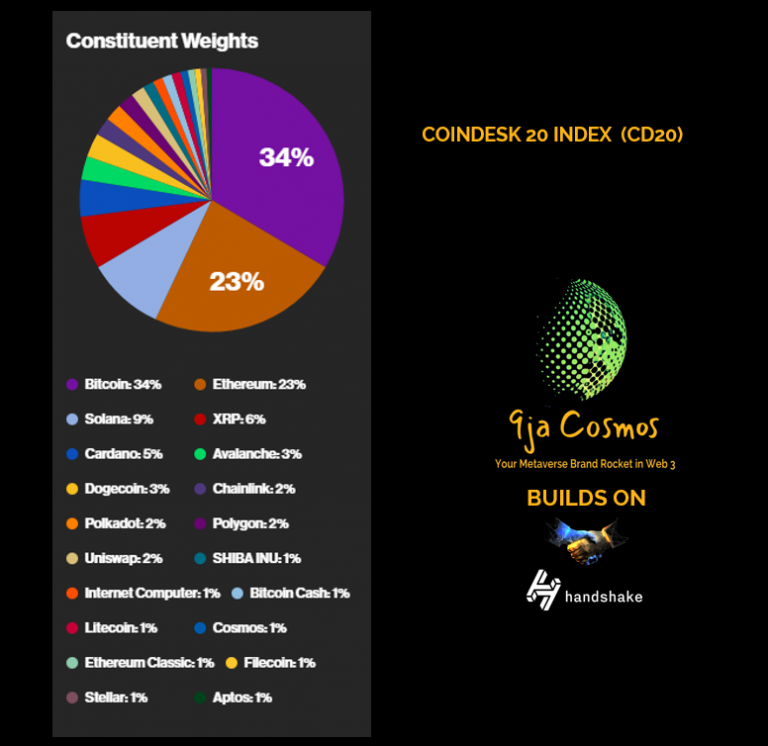

This finally brings us to the reason why the Coindesk 20 (CD 20) is so important.

Throughout economic history, we have seen different asset classes enjoy strong sentiment at different times. Equities, Commodities, Real Estate, Bonds, Trusts, FIATs, and over the last few years, Cryptocurrencies have entered the market, chasing investment.

Different global events have made different instruments or asset classes attractive. This has often meant the disposal of other assets, and consequently, a depression of other asset classes through no inherent fault of their own, as folks liquidated to chase the latest bandwagon.

In the dot com boom more than 20 years ago, many flash-in-the-pan equities enjoyed meteoric rises only to completely disintegrate later. Greed drove people to liquidate shares of old established companies who were deemed ‘safe’ but whose shares didn’t rise with any degree of urgency.

The US for example, has the Dow Jones Industrial Average, the Standard & Poor’s 500, and the Nasdaq Composite. These indices are particularly useful in a time of investment famine or abandonment, because they show endurance of particular stocks, against their class average.

Among FIATs we have the IMF Reserve, also called the SDR (Special Drawing Rights) Basket, whose ‘constituent weights’ are:

| USD 43.38% | EUR 29.31% | CNY 12.28% | JPN 7.59% | GBP 7.44% |

This is a fairer index on which to bench the performance of any FIAT, because it shields it from irrational analytics influenced by volatile swings in a single currency, such as the $USD when it is swinging on sentiment while awaiting a decision of Congress to raise the Debt Ceiling.

The CD20 offers a new mechanism within which to objectively look at what is happening with the subjective value of different Cryptocurrencies. It is a young index, and it won’t be perfect right away. It will probably include a few ERC 20 tokens, which can bring periodic instability to the index, but over time it will improve.

As sovereign equity indices emerged representing different sub classes, so too, we hope the future of Cryptocurrency indices will reflect different sub classes, such as whether coin or token, consensus construct and tokenomics, and whether the ecosystem supports diverse building, or is offering ‘store of value’ only.

This would help investors and builders further differentiate currency performance, without undue reliance on assets in other classes, which might be a flawed approach.

9ja Cosmos is here…

Get your .9jacom and .9javerse Web 3 domains for $2 at:

Visit 9ja Cosmos LinkedIn Page

Preview our Sino Amazon/Sinosignia releases