Curve Finance, launched their stablecoin whitepaper recently, called the Lending-Liquidating AMM Algorithm [LLAMMA]. Been thinking about how lending markets are linked to fickle dex liquidity, LTV params are similar to option pricing. The problem with current CDP (collateral-debt position) stablecoins is that they have to liquidate undercollateralized positions to keep the peg. Partial liquidations help, but they have two problems: Expose CDPs to bad debt and Users get penalized for liquidations.

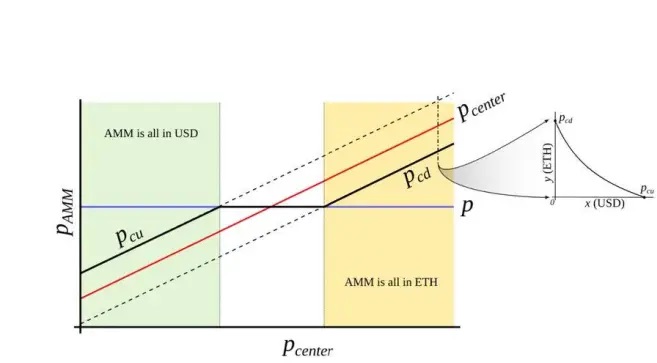

The core idea of Curve- Stable coin [CRV] is an AMM for continuous liquidation or de-liquidation. This Lending-Liquidating AMM converts between collateral (ETH) and a stable-coin. So when collateral price is high, user deposits all in ETH, but when prices goes down, ETH is converted to USD.

Thus, Pcenter is the price at which liquidity is formed. When ETH price reaches Pcu, AMM collateral is converted to USD. Once ETH price goes up and reaches Pcd, the AMM collateral is converted to all in ETH. Foobar, Tweeted on the limitation of AMM on Defi lending markets. Lending is inextricably dependent on AMM liquidity, but these AMMs are external, LPs can withdraw at any time, most protocols require active governance to approve or deny new token listings, or to modify LTV ratios in risky times.

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025): registration continues.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

https://twitter.com/0xfoobar/status/1595085744980529154?s=46&t=u6hFBiusXEjTZ1Zo5MWOvA

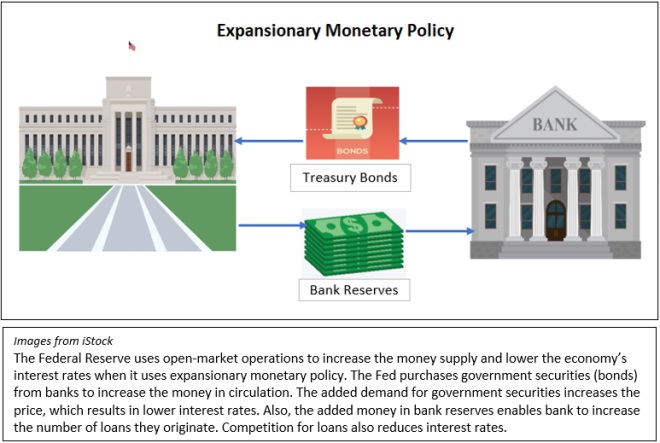

However, the biggest innovation in DeFi stable-coins is the Automated Market Operations. You see, the Fed engages in “Open Market Operations” by minting $USD to buy securities, lend to banks etc. This way it influences the money supply and manipulates interest rates.

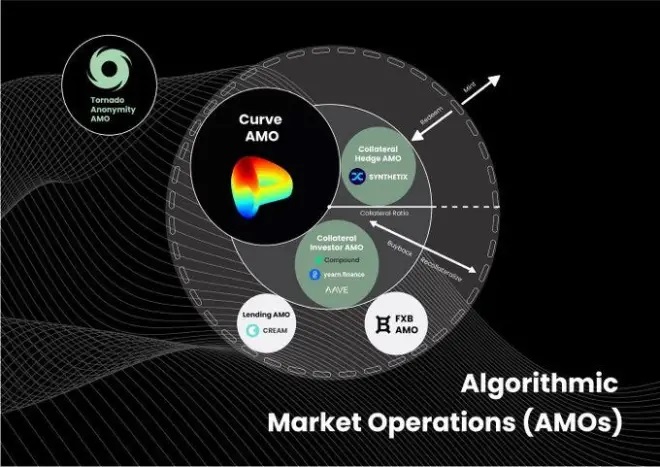

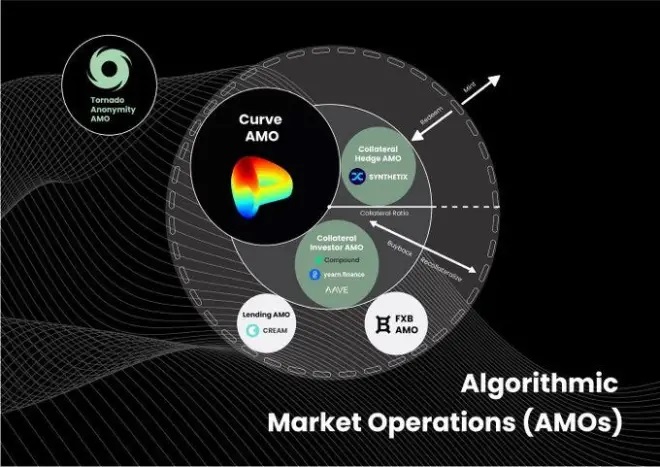

Several stablecoins learnt well from the FED, Frax’s v2 monetary policy can issue new $FRAX as long as it does not change the FRAX price off its peg. Protocols can algorithmically mint FRAX and deposit it to Curve, Aave or anywhere else that the DAO deems beneficial.

Curve’s LLAMMA, solves this by making internalizing the AMM, making the collateral token be Liquidity Pool share, in the example of ETH collateralizing a USD stablecoin, the user would deposit ETH as collateral, but this gets transformed into an ETH/USD LP position as ETH price goes down, the LP position gradually sells some ETH and buys some USD, the token basically represents the reverse strategy of a market maker. Sure it’s going to lose a bit when markets are flat, but the whole point is that you’re paying a bit to take out the loan which spreads out liquidation risk.