Between January and April 2025, the digital footprint of an emerging Ponzi scheme, known as CBEX, quietly expanded across Nigeria’s South West region. At first glance, CBEX resembled countless other high-yield investment platforms promising fast returns with minimal risk. But behind the façade was a familiar story: financial desperation, uneven digital literacy, and the illusion of opportunity fueled by social validation and algorithmic reach.

Understanding the CBEX Exposure Curve

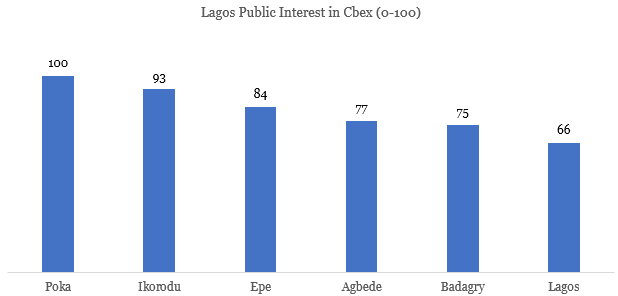

While traditional investigations into such schemes typically emerge after damage has been done, digital behaviour patterns offer a different vantage point. By analysing public interest data sourced from Google Trends, two distinct indicators—general search queries for “CBEX” and login-related searches such as “CBEX login” evolved as critical markers. These search patterns tell a deeper story about how exposure, engagement, and vulnerability vary not only between individuals but also across geographies.

Regional Hotspots: A Data-Driven View

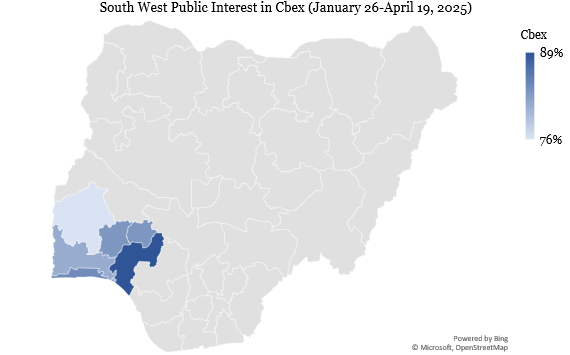

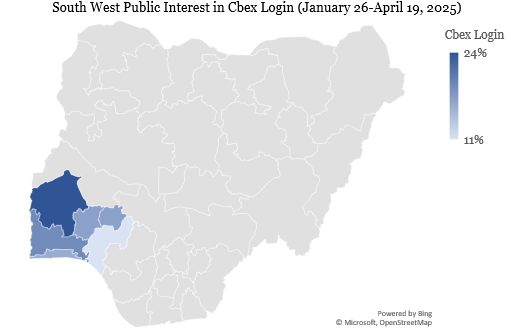

The South West zone of Nigeria, comprising Lagos, Ogun, Oyo, Osun, Ondo, and Ekiti states, offers a unique lens to assess these differences. Lagos, unsurprisingly, ranked highest in both public interest and login-related search activity. Nearly 89% of all CBEX-related searches in the region were concentrated in Lagos, with login-specific searches accounting for 24%. This suggests that, beyond curiosity, a substantial proportion of Lagosians were actively interacting with the platform—either logging in to invest, track returns, or, as typically happens in such schemes, attempting to recover funds after withdrawal problems began.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

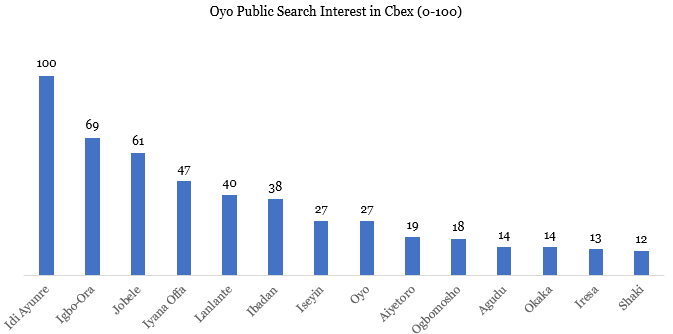

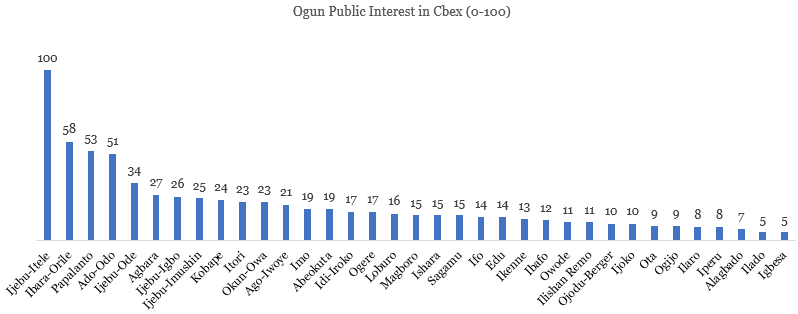

In nearby states such as Ogun and Oyo, the trends remained strong, though slightly less intense. High general interest and moderate-to-high login-related activity imply that these states formed the second layer of the scheme’s diffusion. Social and familial ties, digital connectivity, and migration patterns likely played a role in this regional spread. Such behaviours follow a known model in fraud research: financial schemes often travel fastest along trusted social lines.

Osun, Ondo, and Ekiti, however, present a contrasting narrative. While general awareness of CBEX was present, with search interest ranging around 76%, login-specific queries were markedly lower, fluctuating between 11% and 15%. This may suggest a more skeptical user base or delayed exposure. Alternatively, it could reflect systemic barriers such as limited internet access, lower digital confidence, or stronger informal resistance to non-traditional financial products.

The distinction between public interest and platform engagement is more than academic—it has policy and business implications. General search interest represents attention, curiosity, and early-stage exposure. Login interest, on the other hand, signals interaction and potential financial commitment. When both spike, especially within a compressed time window, the result may be an early warning system for regulators, banks, fintech providers, and consumer protection agencies.

In a digital economy characterised by speed and decentralisation, financial scams no longer require complex infrastructure. All they need is visibility—amplified through search engines, social media algorithms, and word-of-mouth virality. CBEX’s regional spread followed this model precisely. It did not require a physical presence to operate. Instead, it relied on search relevance, referral links, and urgent storytelling—powerful psychological levers that have been tested and perfected in today’s online marketplaces.

Reframing Digital Financial Risk

The implications are significant. Monitoring digital search behaviour in real time can be a powerful fraud detection tool. Much like marketers use search intent to model consumer demand, regulators and financial educators can use it to forecast risk exposure and deploy targeted interventions. Financial literacy efforts need to become hyper-local and behaviour-specific. It’s not enough to run national campaigns; messages must be tailored to the state-level contexts revealed in data.

A broader governance rethink is needed. As Ponzi schemes evolve in sophistication, so too must our mechanisms for protecting the financially vulnerable. That means bringing together digital platforms, local agencies, behavioural scientists, and civil society in co-designing fraud-resistant ecosystems.